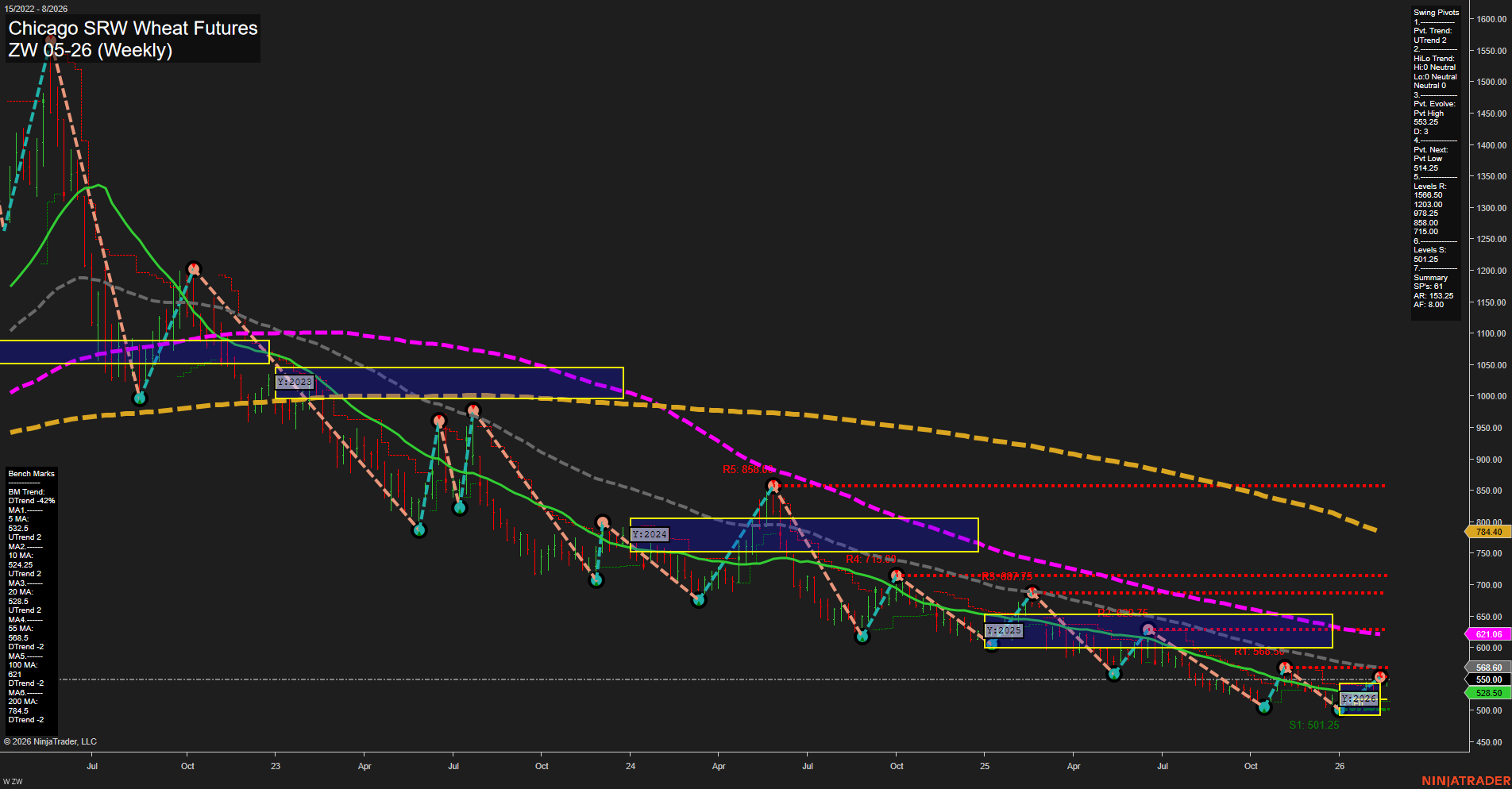

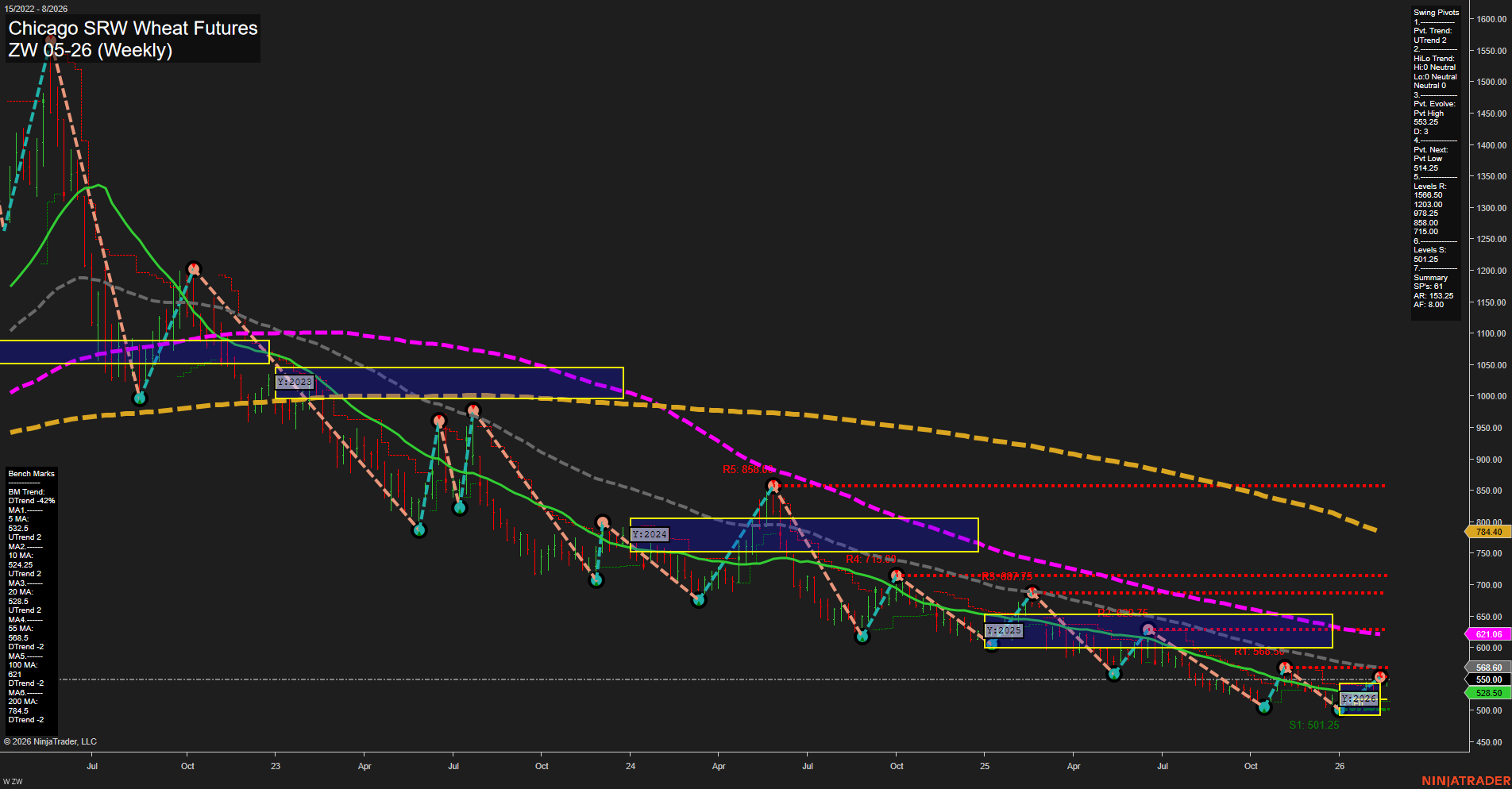

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2026-Feb-18 07:28 CT

Price Action

- Last: 528.50,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 22%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 543.25,

- 4. Pvt. Next: Pvt Low 514.25,

- 5. Levels R: 856.00, 823.00, 788.00, 715.00,

- 6. Levels S: 514.25, 501.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 532.0 Down Trend,

- (Intermediate-Term) 10 Week: 523.25 Down Trend,

- (Long-Term) 20 Week: 558.5 Down Trend,

- (Long-Term) 55 Week: 621.0 Down Trend,

- (Long-Term) 100 Week: 701.0 Down Trend,

- (Long-Term) 200 Week: 784.4 Down Trend.

Recent Trade Signals

- 17 Feb 2026: Short ZW 03-26 @ 541 Signals.USAR.TR120

- 13 Feb 2026: Long ZW 03-26 @ 548.75 Signals.USAR-MSFG

- 11 Feb 2026: Long ZW 03-26 @ 534.75 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures weekly chart shows a market in a prolonged downtrend, with all major long-term moving averages (20, 55, 100, 200 week) trending lower and well above current price, confirming persistent bearish pressure. Short-term and intermediate-term Fib grid trends (WSFG, MSFG) have recently turned up, with price holding above their respective NTZ/F0% levels, suggesting a possible attempt at a short-term base or bounce. However, swing pivot structure remains weak, with the most recent pivot trend still down and resistance levels stacked far above. Momentum is slow and bars are small, indicating a lack of strong conviction from either buyers or sellers. Recent trade signals show mixed direction, with both short and long entries triggered in the past week, reflecting choppy, indecisive price action. Overall, the market is attempting to stabilize after a significant decline, but the dominant long-term trend remains bearish, and any rallies are likely to face strong resistance overhead. The environment is characterized by consolidation and potential for further volatility as the market tests support and resistance zones.

Chart Analysis ATS AI Generated: 2026-02-18 07:28 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.