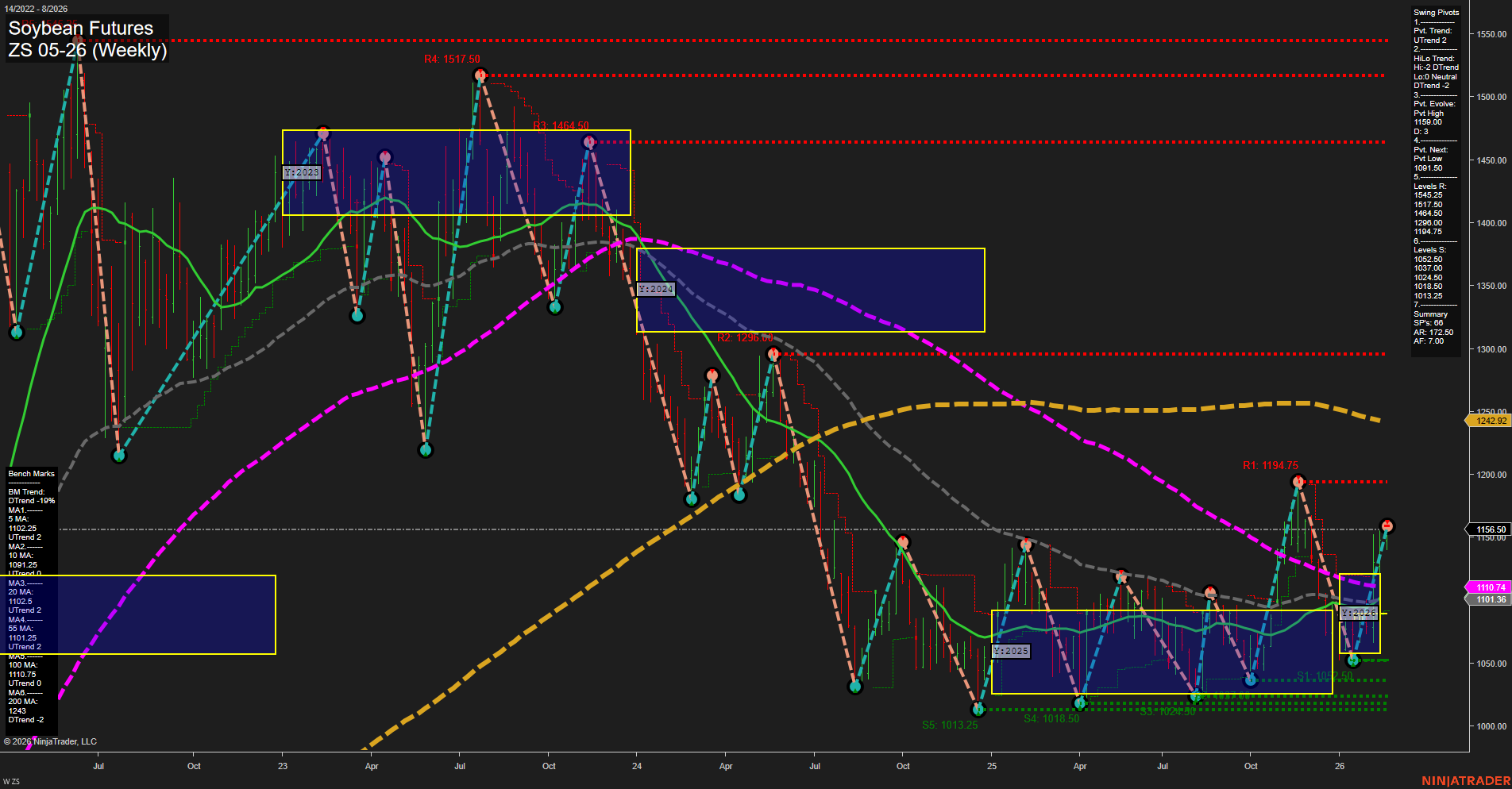

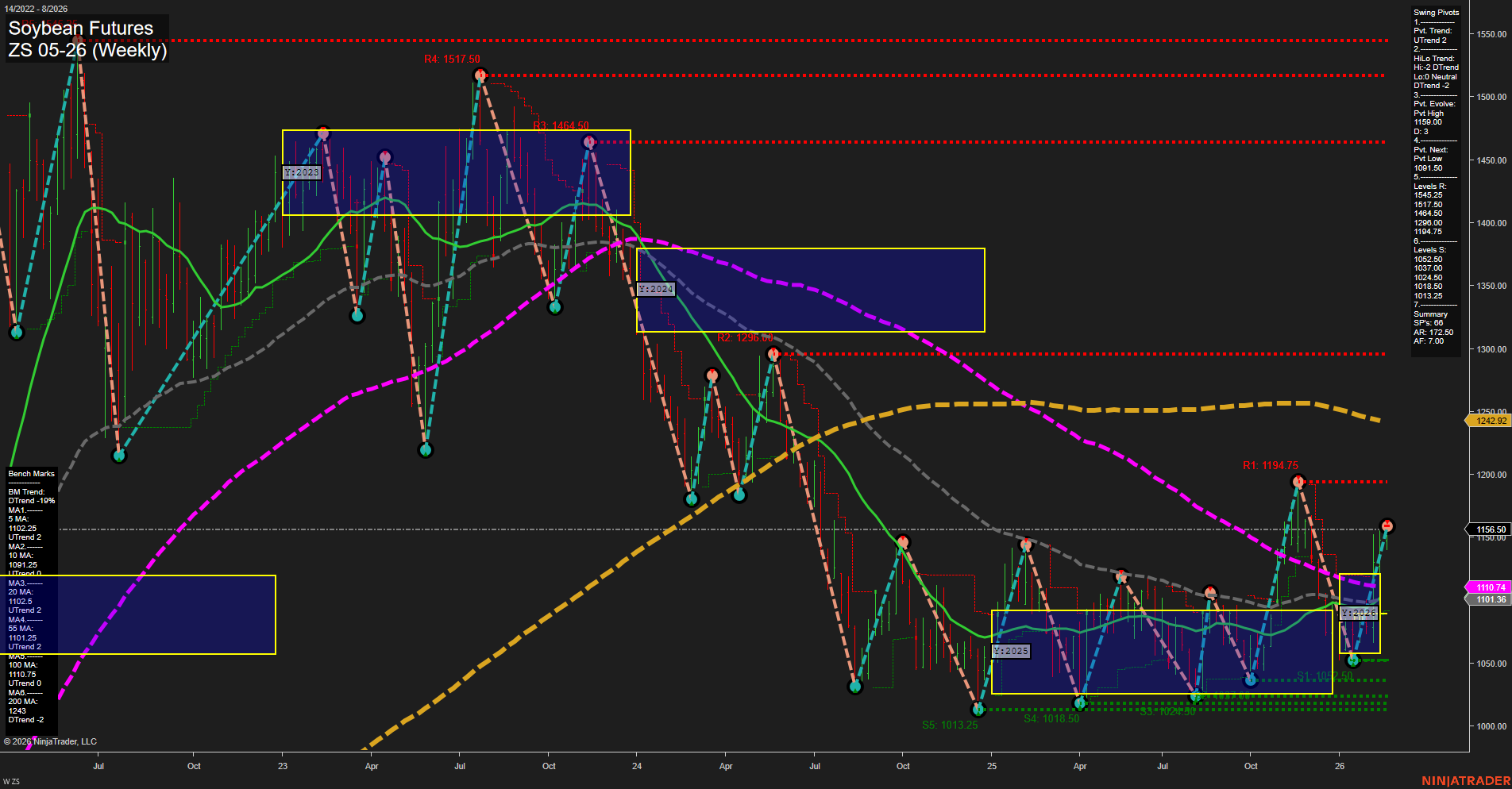

ZS Soybean Futures Weekly Chart Analysis: 2026-Feb-18 07:27 CT

Price Action

- Last: 1242.92,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 56%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 101%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1156.00,

- 4. Pvt. Next: Pvt low 1013.25,

- 5. Levels R: 1545.25, 1517.50, 1464.50, 1360.00, 1286.75, 1194.75,

- 6. Levels S: 1073.00, 1024.50, 1018.50, 1013.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1120.25 Up Trend,

- (Intermediate-Term) 10 Week: 1102.25 Up Trend,

- (Long-Term) 20 Week: 1110.25 Up Trend,

- (Long-Term) 55 Week: 1101.25 Up Trend,

- (Long-Term) 100 Week: 1110.75 Down Trend,

- (Long-Term) 200 Week: 1243.00 Down Trend.

Recent Trade Signals

- 18 Feb 2026: Long ZS 03-26 @ 1141 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures have shifted into a bullish phase on both short- and intermediate-term timeframes, as evidenced by the upward trends in the WSFG and MSFG grids, as well as the swing pivot structure showing higher highs and higher lows. Price has broken above the NTZ center and is trading above key moving averages (5, 10, 20, 55 week), confirming positive momentum. The recent long signal at 1141 aligns with this trend shift. However, the long-term picture remains neutral, with the 100- and 200-week moving averages still in a downtrend, suggesting that while a recovery is underway, the market is still contending with overhead resistance from prior cycles. Key resistance levels are stacked above, and support is well-defined below, indicating a potential for continued volatility as the market tests these zones. The current setup favors trend continuation, but the long-term context warrants monitoring for sustained follow-through or possible consolidation.

Chart Analysis ATS AI Generated: 2026-02-18 07:27 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.