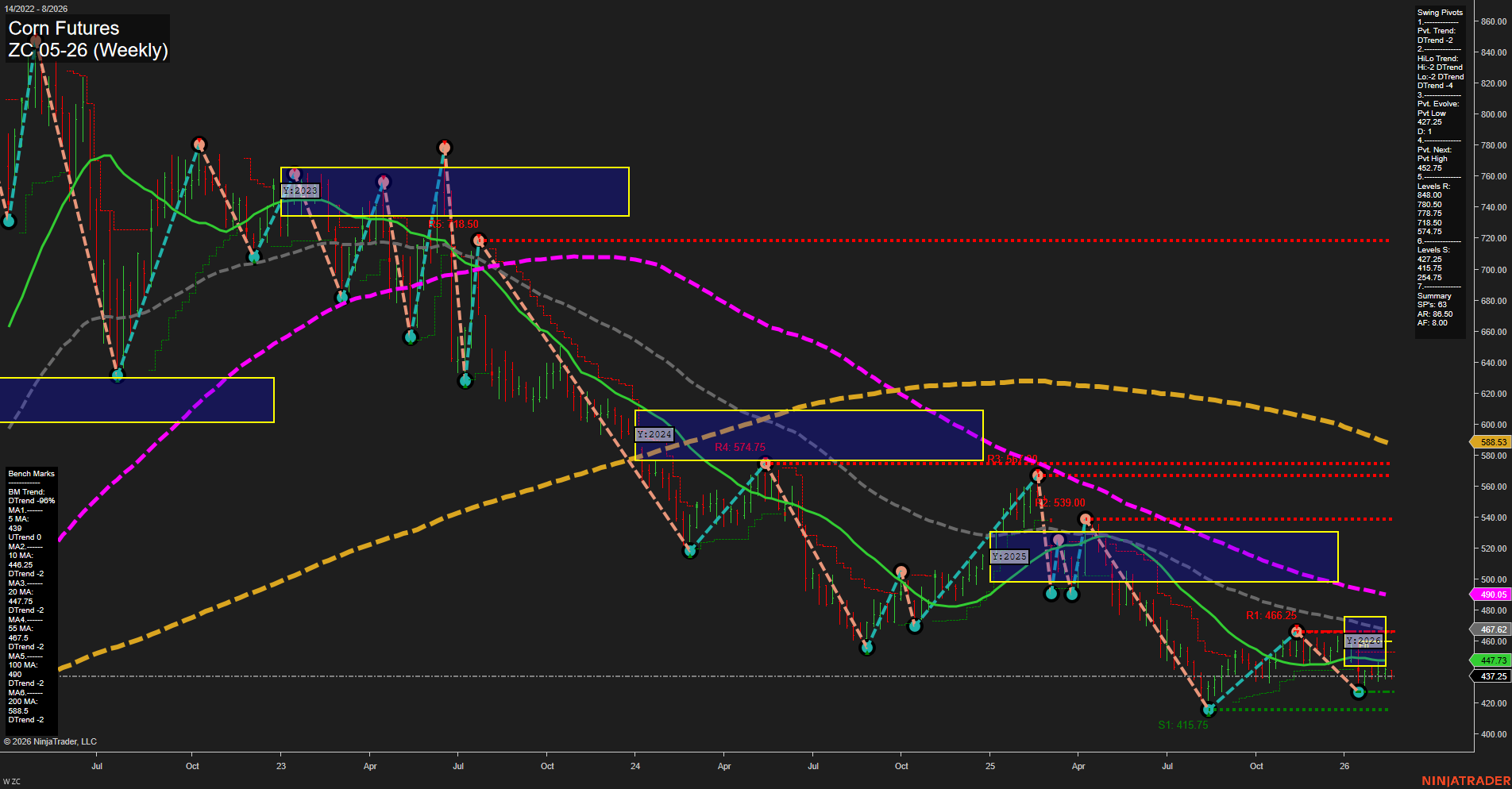

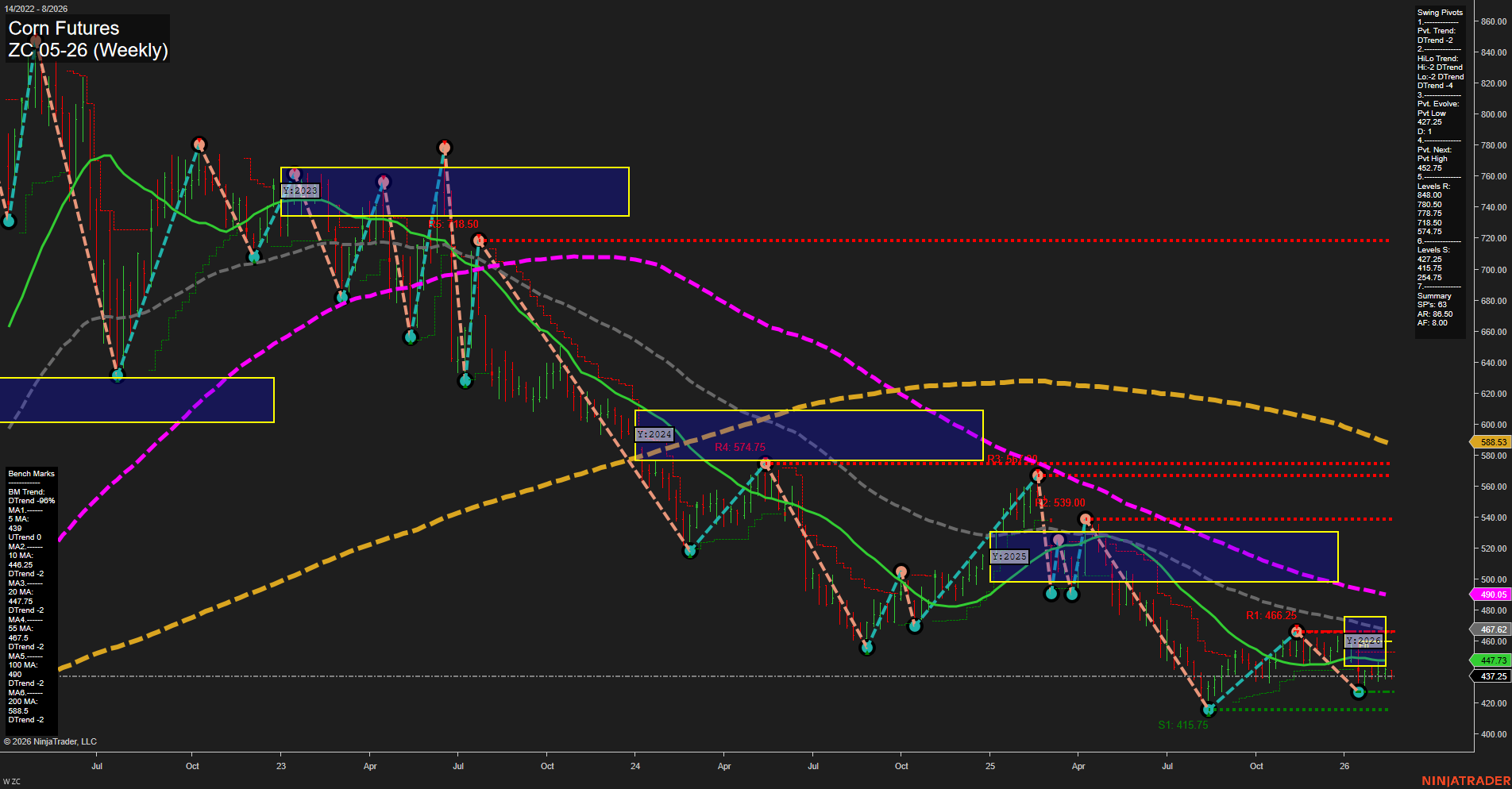

ZC Corn Futures Weekly Chart Analysis: 2026-Feb-18 07:26 CT

Price Action

- Last: 437.33,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -14%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 427.25,

- 4. Pvt. Next: Pvt high 462.75,

- 5. Levels R: 846.00, 788.50, 718.50, 574.75, 539.00, 466.25,

- 6. Levels S: 427.25, 415.75, 244.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 447.25 Down Trend,

- (Intermediate-Term) 10 Week: 446.25 Down Trend,

- (Long-Term) 20 Week: 457.75 Down Trend,

- (Long-Term) 55 Week: 490.00 Down Trend,

- (Long-Term) 100 Week: 588.53 Down Trend,

- (Long-Term) 200 Week: 800.00 Down Trend.

Recent Trade Signals

- 17 Feb 2026: Short ZC 03-26 @ 429.5 Signals.USAR-WSFG

- 12 Feb 2026: Long ZC 03-26 @ 431 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures continue to exhibit a persistent downtrend across all timeframes, as confirmed by the alignment of the WSFG, MSFG, and YSFG session fib grid trends, all showing price below their respective NTZ/F0% levels. The swing pivot structure reinforces this bearish sentiment, with both short-term and intermediate-term trends pointing down and the most recent pivot evolving at a new low (427.25). Resistance levels remain well above current price, while support is clustered just below, suggesting limited downside before a potential test of key support zones. All benchmark moving averages are trending lower, with price trading beneath every major weekly average, highlighting sustained selling pressure and a lack of bullish momentum. Recent trade signals reflect this environment, with a short signal dominating the short-term and only a brief long attempt in the intermediate-term. The market is currently consolidating near recent lows with small bars and slow momentum, indicating a pause within the broader downtrend rather than a reversal. Overall, the technical landscape remains decisively bearish, with no clear signs of a trend change or significant recovery at this stage.

Chart Analysis ATS AI Generated: 2026-02-18 07:27 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.