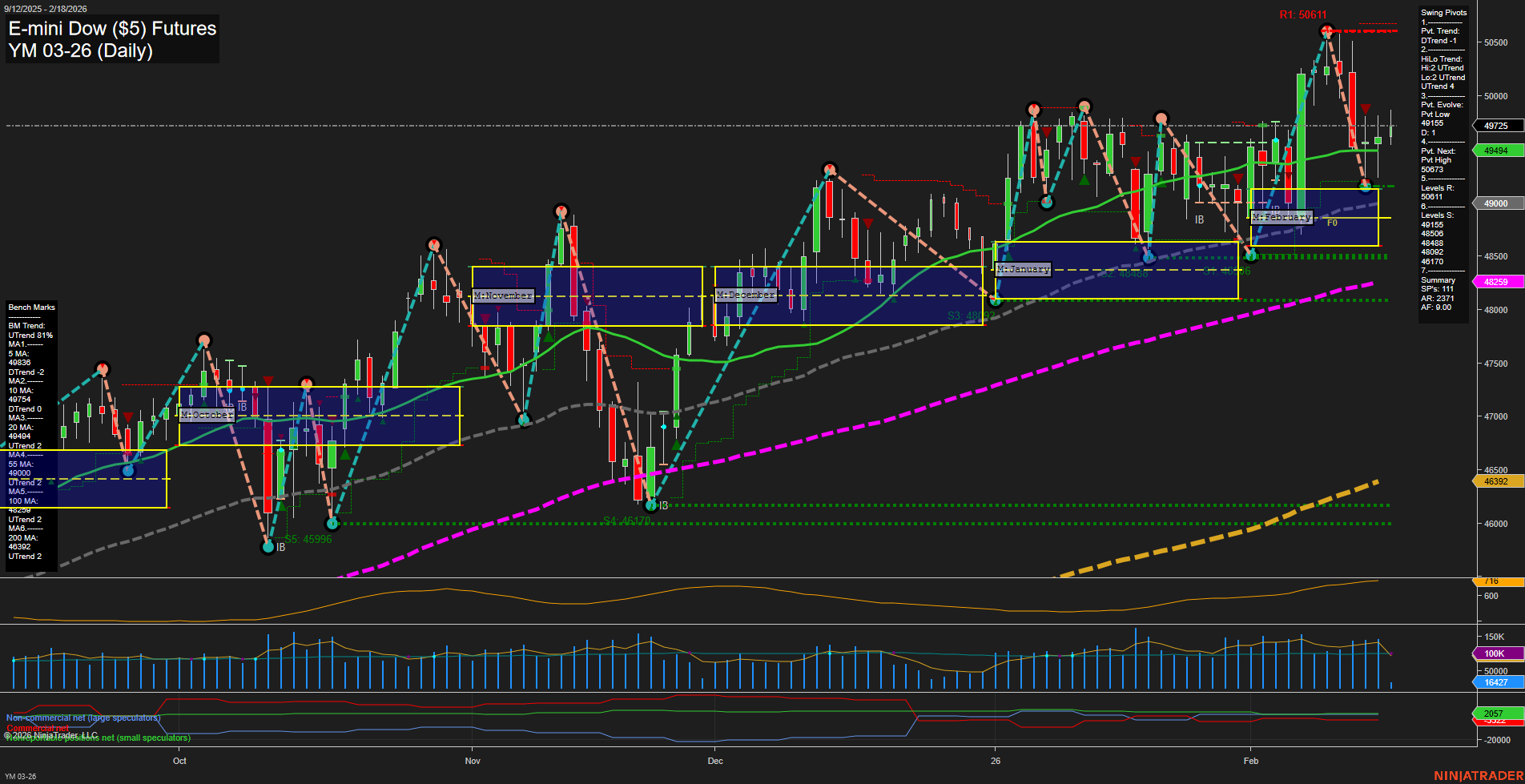

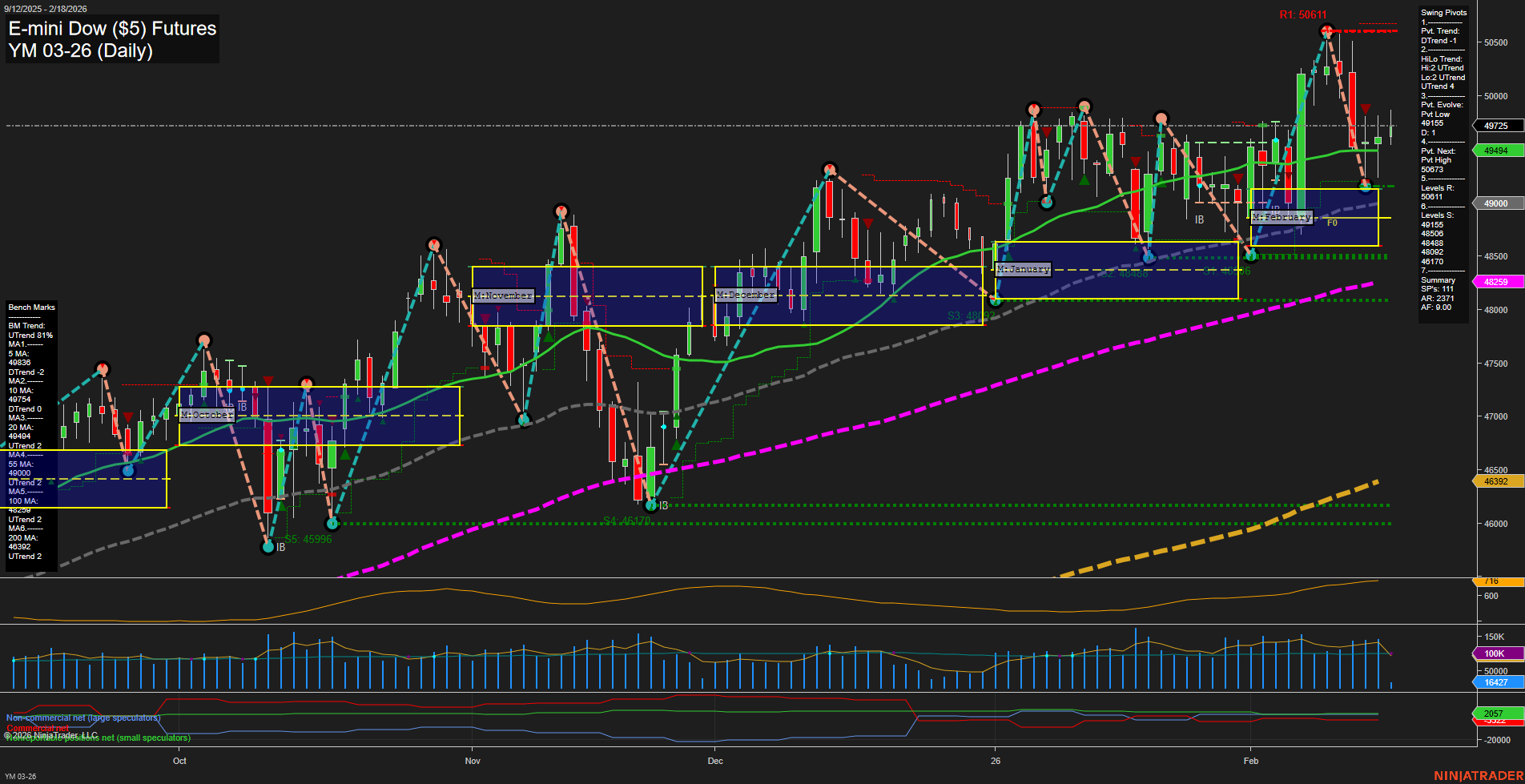

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2026-Feb-18 07:24 CT

Price Action

- Last: 49,745,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 41%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 49,745,

- 4. Pvt. Next: Pvt High 50,673,

- 5. Levels R: 50,611, 50,673,

- 6. Levels S: 48,668, 48,486, 48,084, 45,996.

Daily Benchmarks

- (Short-Term) 5 Day: 49,836 Up Trend,

- (Short-Term) 10 Day: 49,744 Down Trend,

- (Intermediate-Term) 20 Day: 49,494 Up Trend,

- (Intermediate-Term) 55 Day: 48,259 Up Trend,

- (Long-Term) 100 Day: 47,084 Up Trend,

- (Long-Term) 200 Day: 46,392 Up Trend.

Additional Metrics

- ATR: 512,

- VOLMA: 108,292.

Recent Trade Signals

- 18 Feb 2026: Long YM 03-26 @ 49,862 Signals.USAR.TR120

- 18 Feb 2026: Long YM 03-26 @ 49,812 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures daily chart shows a market in a broad uptrend across all major timeframes, with price action currently consolidating after a recent pullback. The short-term swing pivot trend has shifted to a downtrend, but the intermediate and long-term trends remain firmly up, as confirmed by the majority of moving averages and the position of price above key session fib grid levels. The most recent swing low at 49,745 is being tested, with resistance overhead at 50,611 and 50,673. Volatility is moderate, and volume remains healthy. The recent long trade signals suggest renewed bullish interest, but the short-term trend is mixed, indicating a possible period of sideways or choppy action before a decisive breakout. The overall structure favors the bulls, with higher lows and strong support levels, but short-term traders should be mindful of potential resistance and the need for confirmation of a new swing high.

Chart Analysis ATS AI Generated: 2026-02-18 07:25 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.