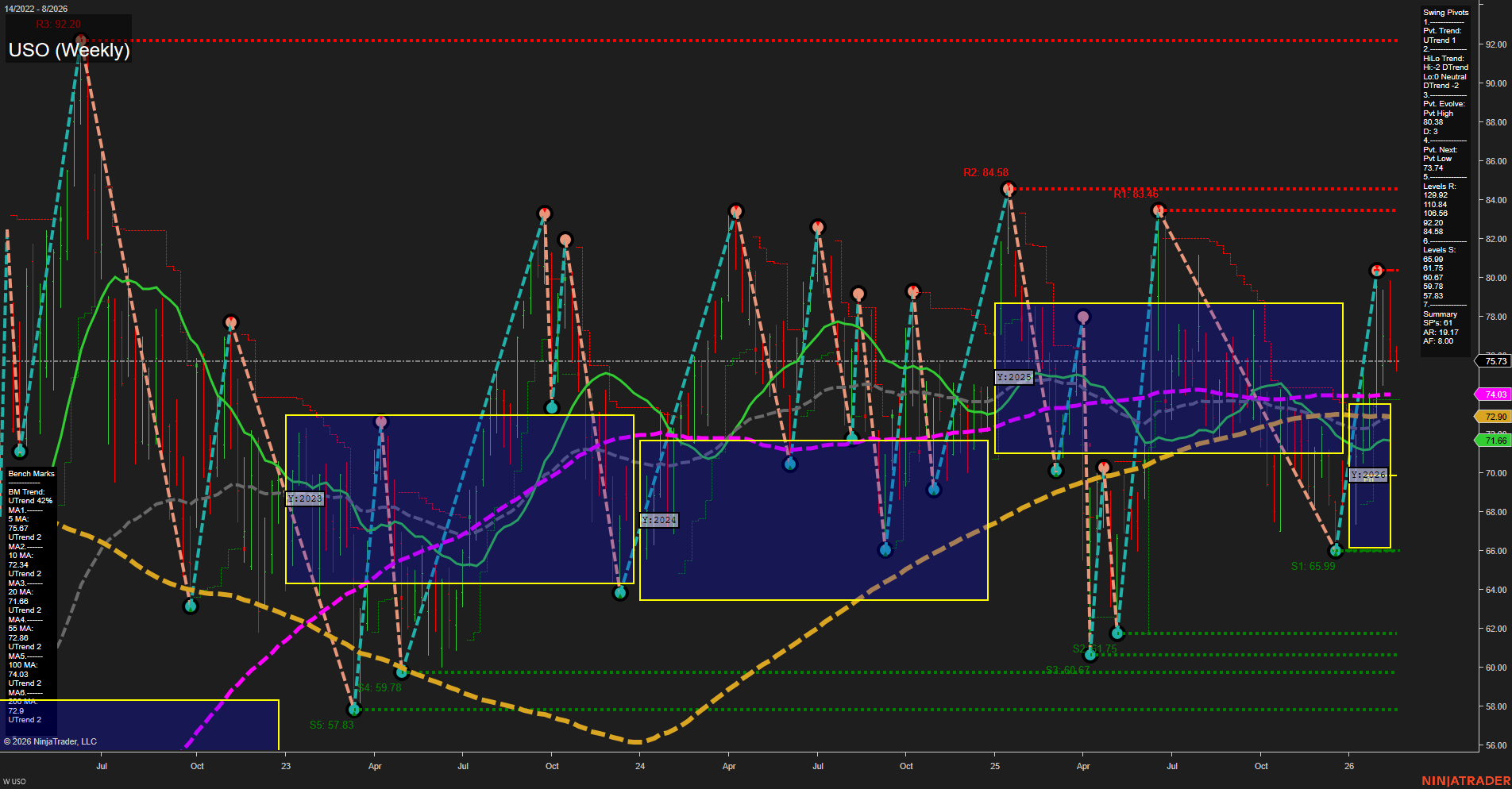

The USO weekly chart reflects a market in transition, with price currently at 75.73 and medium-sized bars indicating steady but not aggressive movement. Momentum is average, suggesting neither strong buying nor selling pressure dominates. The short-term (WSFG) and intermediate-term (MSFG) Fib grid trends are neutral, with price consolidating within the NTZ zones, and no clear directional bias. Swing pivots show a short-term uptrend, but the intermediate-term HiLo trend remains down, highlighting a recent pivot high at 83.36 and a next potential pivot low at 57.83. Resistance levels cluster above 80, while support is layered from 66 down to 57. The moving averages across all timeframes are in uptrends, with price above key benchmarks, supporting a bullish long-term structure. However, the intermediate-term trend is still bearish, likely reflecting the recent sequence of lower highs and lower lows. Overall, the market is consolidating after a period of volatility, with the potential for a longer-term bullish continuation if price can sustain above the 72-74 zone and break through resistance. The chart suggests a choppy environment, with both trend and counter-trend opportunities, and a need to watch for breakout or rejection patterns at key levels.