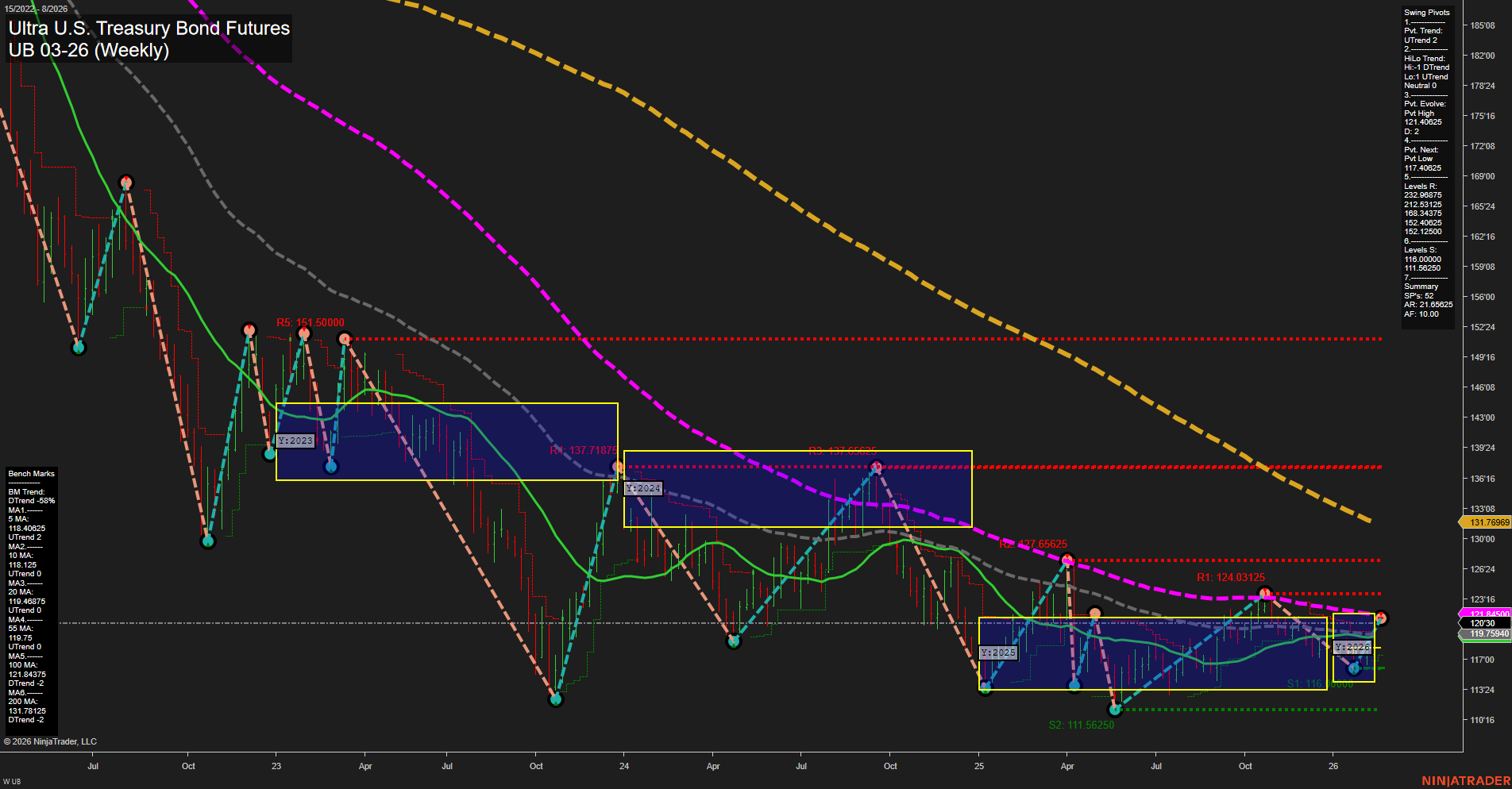

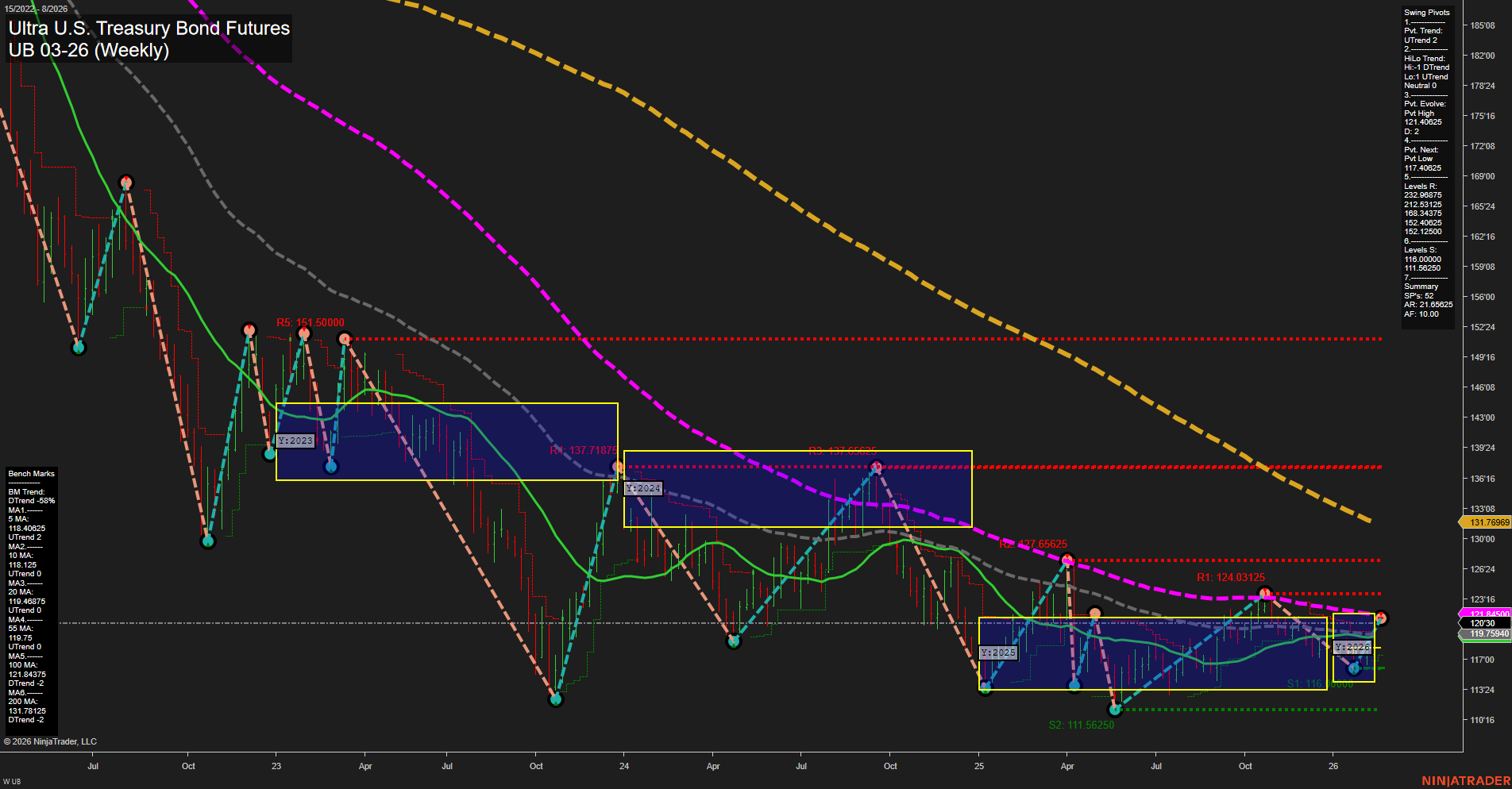

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2026-Feb-18 07:23 CT

Price Action

- Last: 121.09375,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 96%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 121.40625,

- 4. Pvt. Next: Pvt low 117.40625,

- 5. Levels R: 151.50000, 137.71875, 137.65625, 124.03125, 121.40625, 119.12500,

- 6. Levels S: 111.56250, 111.06250.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 120.46875 Up Trend,

- (Intermediate-Term) 10 Week: 119.46875 Up Trend,

- (Long-Term) 20 Week: 120.84375 Up Trend,

- (Long-Term) 55 Week: 124.78437 Down Trend,

- (Long-Term) 100 Week: 131.76699 Down Trend,

- (Long-Term) 200 Week: 133.90625 Down Trend.

Recent Trade Signals

- 17 Feb 2026: Long UB 03-26 @ 121.15625 Signals.USAR-WSFG

- 12 Feb 2026: Long UB 03-26 @ 120.09375 Signals.USAR.TR120

- 10 Feb 2026: Long UB 03-26 @ 119.09375 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart is showing a notable shift in momentum, with price action currently above key NTZ (neutral trading zone) levels across short, intermediate, and long-term session fib grids. The recent swing pivot structure confirms an uptrend in both short- and intermediate-term metrics, with the most recent pivots forming higher highs and higher lows. Weekly benchmarks for the 5, 10, and 20-week moving averages are all trending upward, supporting the bullish tone in the short and intermediate timeframes, while the longer-term 55, 100, and 200-week averages remain in a downtrend, indicating that the broader trend is still neutral to bearish but potentially stabilizing. Recent trade signals have all been to the long side, reflecting the current upward momentum. Resistance levels are clustered well above current price, while support is established at lower levels, suggesting room for further upside if momentum persists. The chart reflects a market in the early stages of a potential trend reversal, with price consolidating above key moving averages and showing signs of a possible breakout from a prolonged base. Volatility appears moderate, and the market is transitioning from a choppy, range-bound environment toward a more directional move.

Chart Analysis ATS AI Generated: 2026-02-18 07:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.