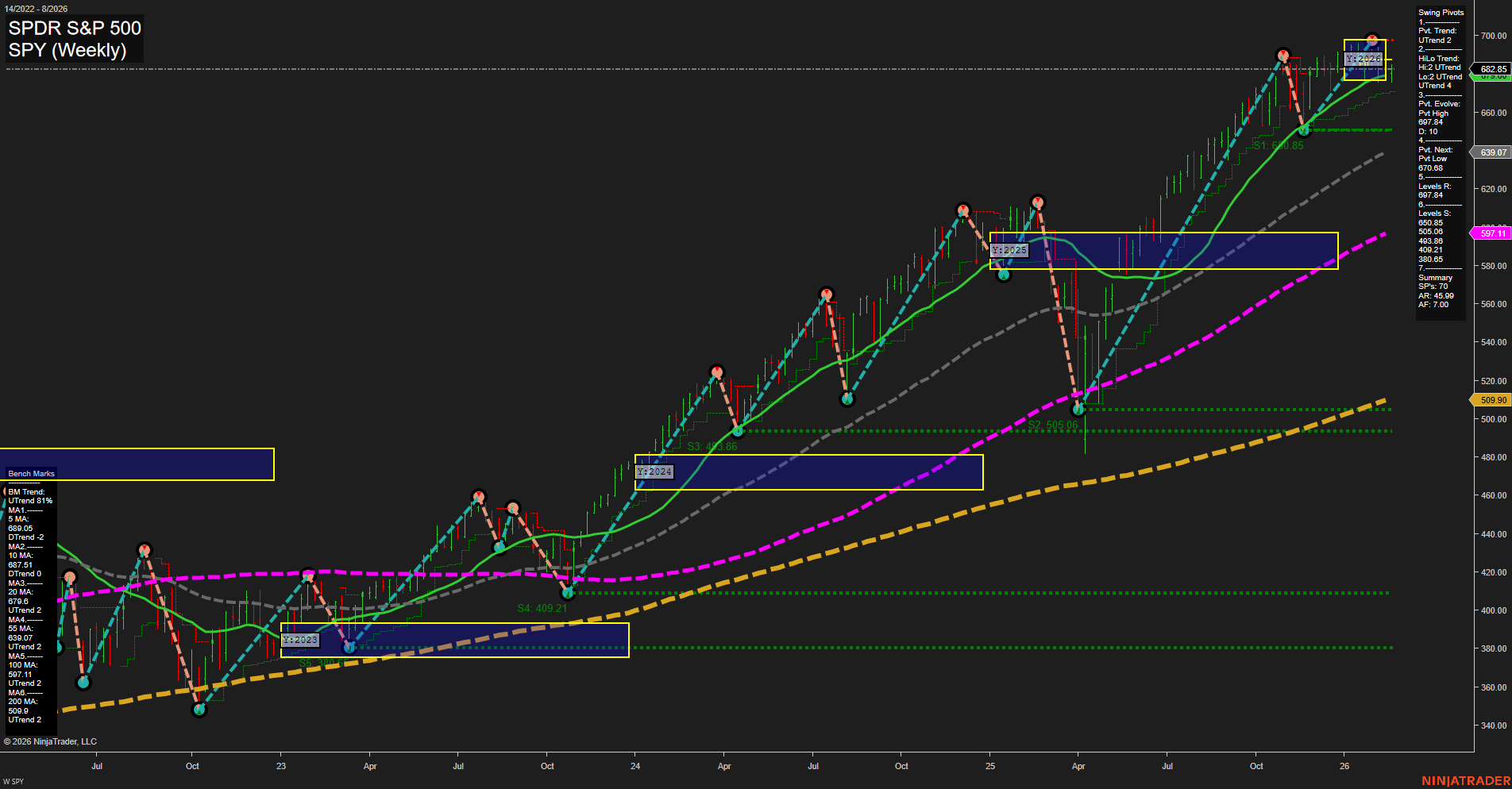

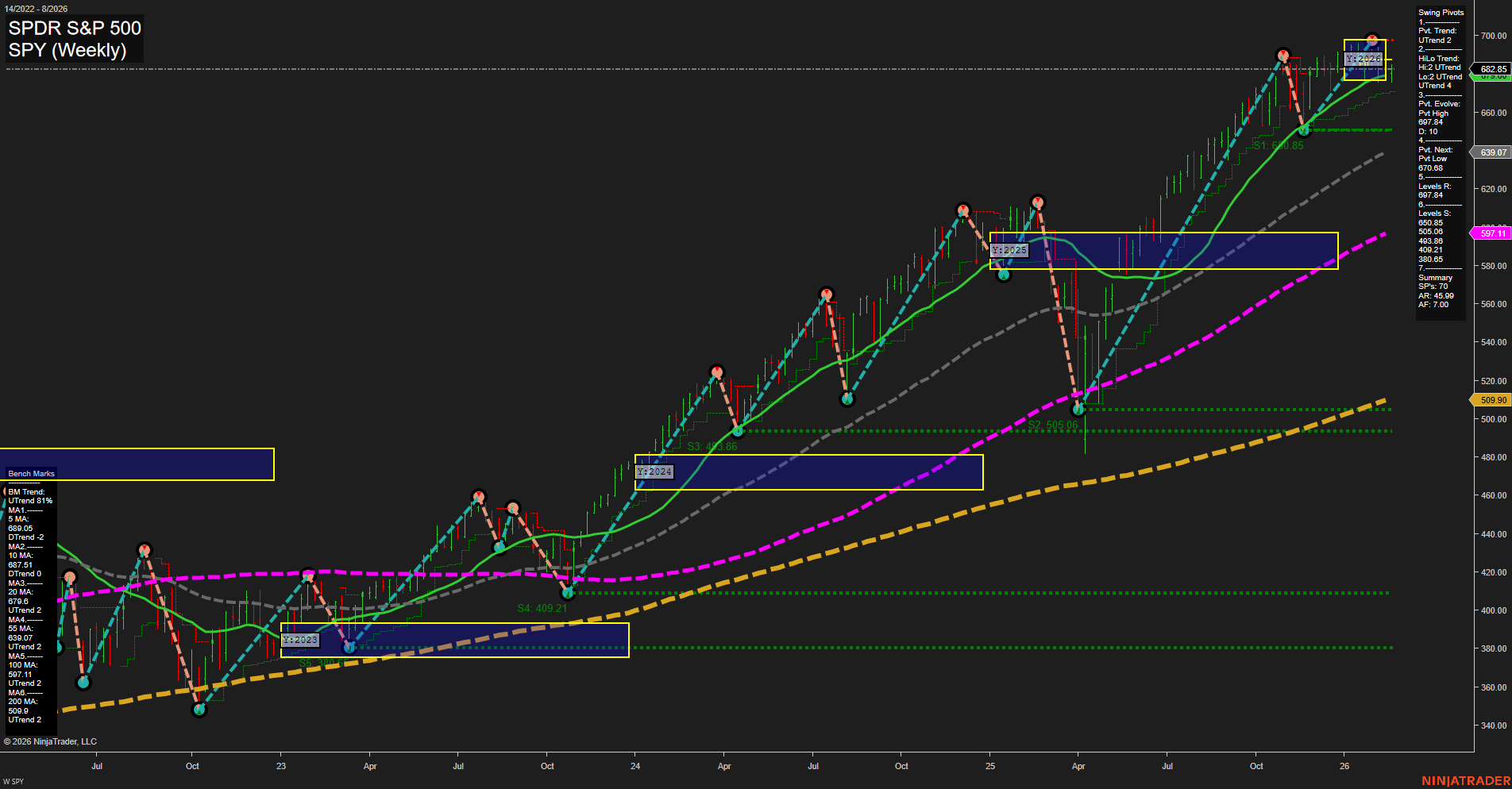

SPY SPDR S&P 500 Weekly Chart Analysis: 2026-Feb-18 07:22 CT

Price Action

- Last: 682.85,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 682.85,

- 4. Pvt. Next: Pvt low 591.11,

- 5. Levels R: 682.85, 650.85, 630.97,

- 6. Levels S: 591.11, 505.99, 409.21.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 663.06 Up Trend,

- (Intermediate-Term) 10 Week: 647.63 Up Trend,

- (Long-Term) 20 Week: 630.97 Up Trend,

- (Long-Term) 55 Week: 591.11 Up Trend,

- (Long-Term) 100 Week: 509.99 Up Trend,

- (Long-Term) 200 Week: 409.21 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY weekly chart shows a strong and persistent uptrend across all major timeframes, with price action making new highs and all benchmark moving averages trending upward. Swing pivots confirm the bullish structure, with the most recent pivot high at 682.85 and the next significant support at 591.11. The market has shown resilience, with higher lows and higher highs, and no major signs of reversal or exhaustion. The neutral bias in the session fib grids suggests a pause or consolidation phase, but the underlying trend remains intact. Volatility appears moderate, and the absence of sharp pullbacks or breakdowns supports the continuation of the current trend. Futures swing traders would note the clear trend alignment, strong support levels, and the potential for trend continuation, while being mindful of any emerging consolidation or retracement patterns.

Chart Analysis ATS AI Generated: 2026-02-18 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.