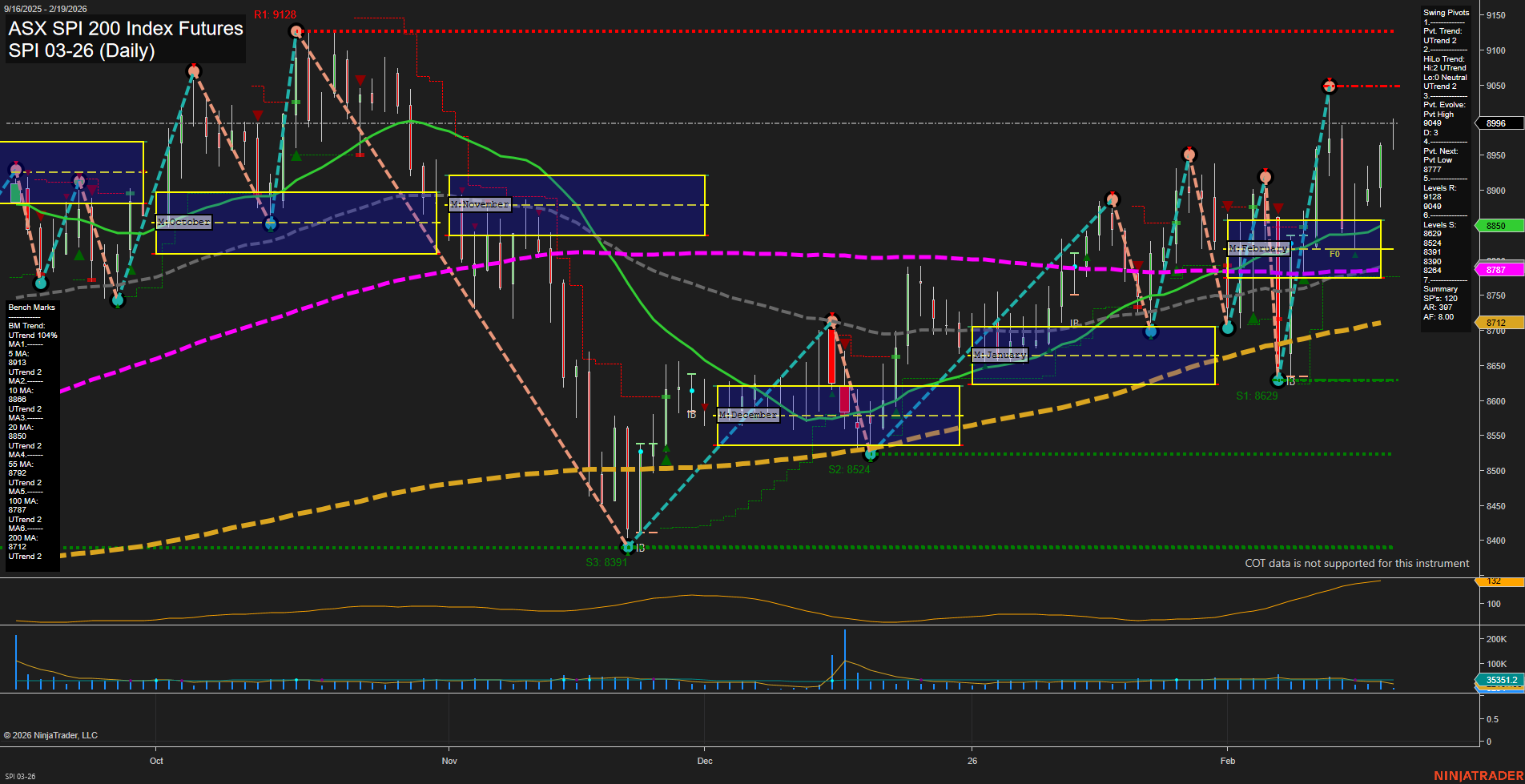

The SPI 200 futures daily chart is showing a strong bullish structure across all timeframes. Price action has been characterized by medium-sized bars and average momentum, indicating steady participation without excessive volatility. The swing pivot analysis confirms a short-term and intermediate-term uptrend, with the most recent pivot high at 9049 and the next key support at 8777. Resistance levels are set at 9128 and 9049, while support is well-defined at 8629, 8524, and 8391, suggesting a solid base below current prices. All benchmark moving averages (from 5-day to 200-day) are trending upward, reinforcing the prevailing bullish sentiment. The ATR value of 96 points to moderate volatility, and the VOLMA at 33,551.2 suggests healthy trading activity. The neutral readings on the session fib grids (weekly, monthly, yearly) indicate that price is not currently at an extreme relative to recent ranges, supporting the idea of a stable uptrend rather than an overextended move. Overall, the market is in a clear uptrend with higher highs and higher lows, supported by both price action and moving averages. There is no immediate sign of reversal or exhaustion, and the structure suggests that any pullbacks may be viewed as part of a broader bullish cycle. The environment is constructive for trend-following strategies, with well-defined levels for monitoring potential reversals or continuation.