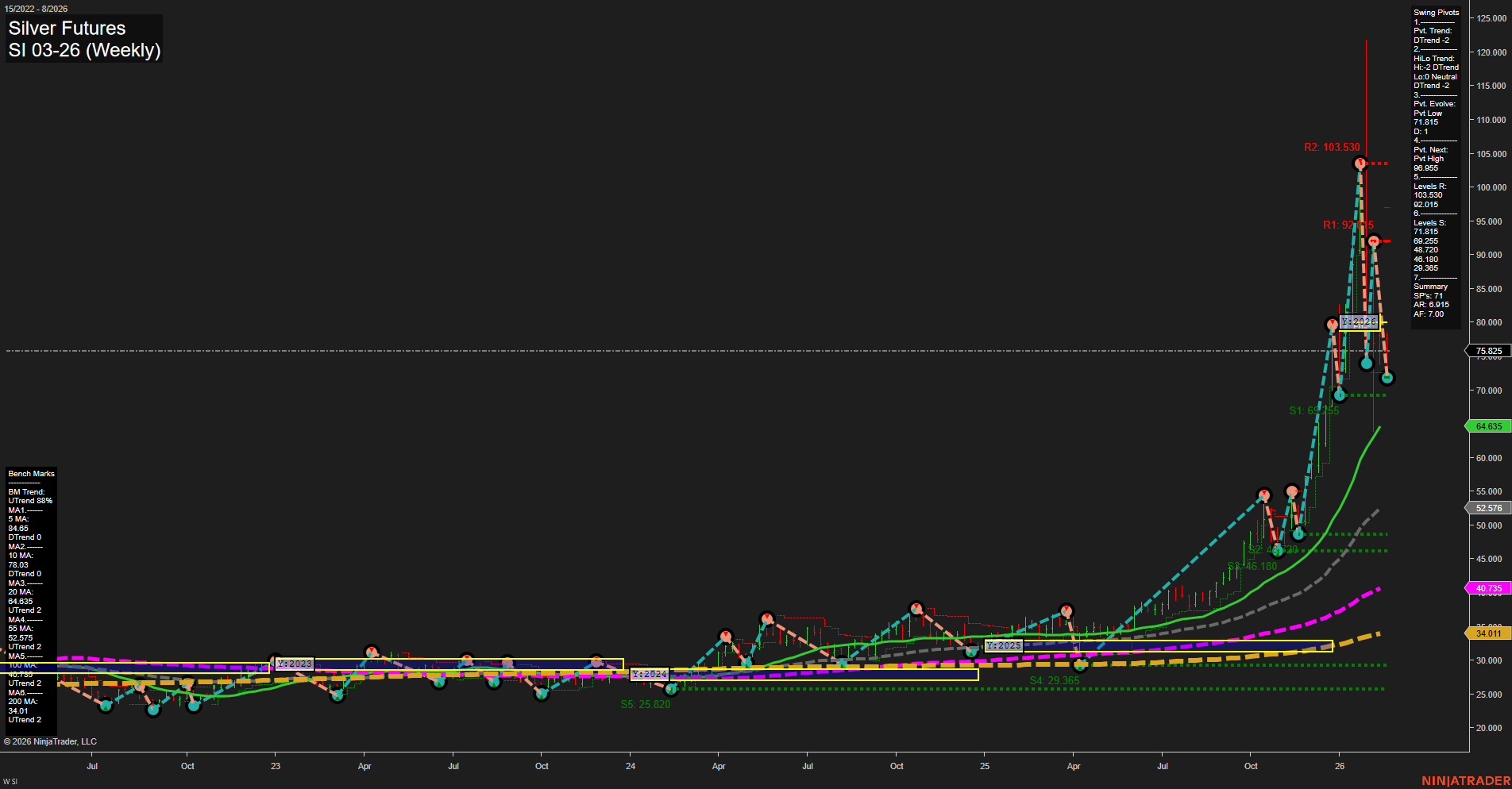

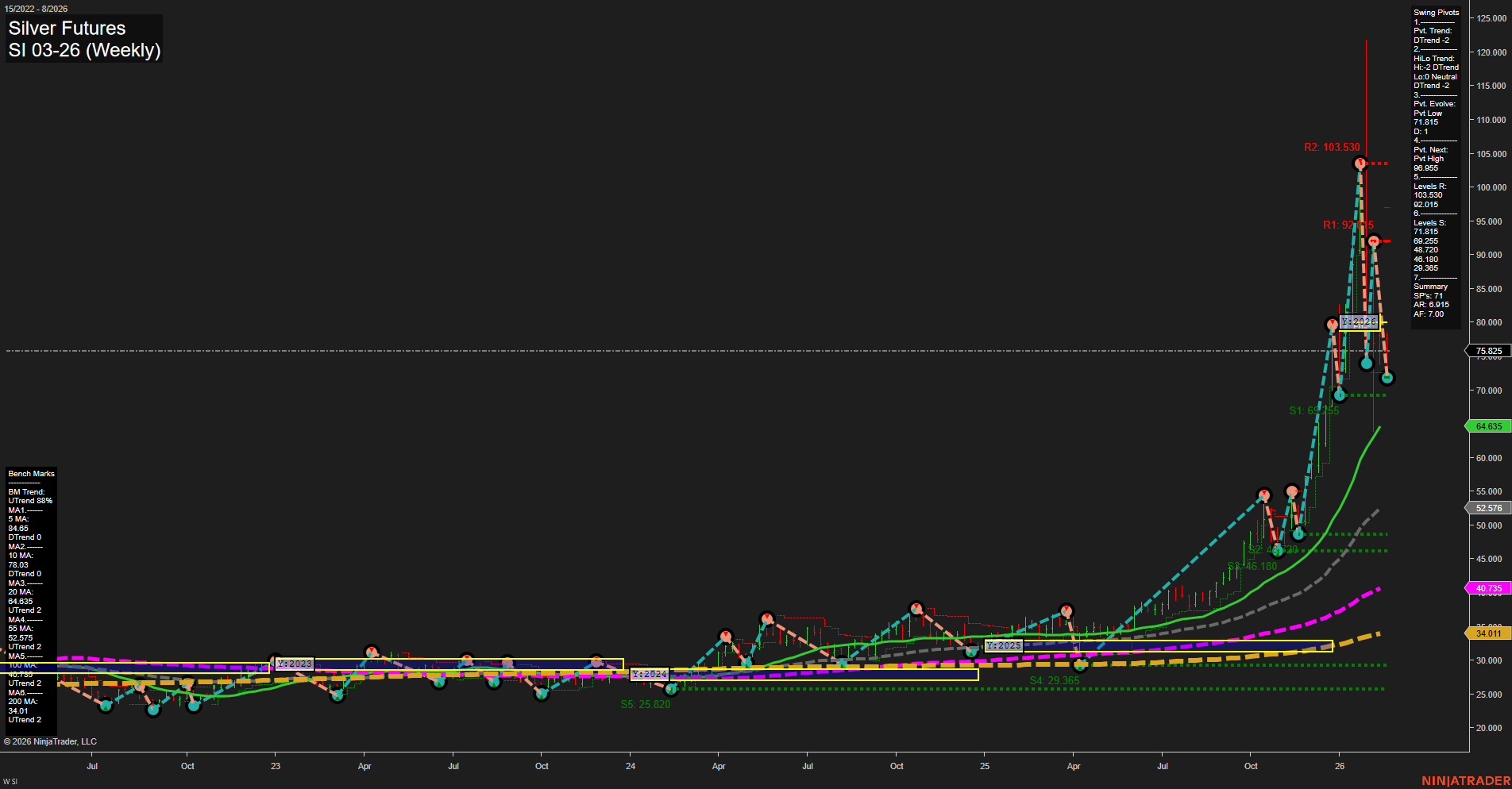

SI Silver Futures Weekly Chart Analysis: 2026-Feb-18 07:21 CT

Price Action

- Last: 75.825,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -29%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -35%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 66.180,

- 4. Pvt. Next: Pvt low 64.635,

- 5. Levels R: 103.530, 92.715, 90.985, 80.785, 48.180, 40.285,

- 6. Levels S: 66.180, 64.635, 52.576, 34.011, 29.365, 25.820.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 84.665 Down Trend,

- (Intermediate-Term) 10 Week: 78.703 Down Trend,

- (Long-Term) 20 Week: 64.635 Up Trend,

- (Long-Term) 55 Week: 52.575 Up Trend,

- (Long-Term) 100 Week: 40.735 Up Trend,

- (Long-Term) 200 Week: 34.011 Up Trend.

Recent Trade Signals

- 17 Feb 2026: Short SI 03-26 @ 73.765 Signals.USAR-WSFG

- 13 Feb 2026: Short SI 03-26 @ 77.5 Signals.USAR-MSFG

- 12 Feb 2026: Short SI 03-26 @ 76.035 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

Silver futures have experienced a dramatic surge, with recent price action showing large, fast-moving bars indicative of heightened volatility and a sharp pullback from recent highs. All short- and intermediate-term metrics, including the WSFG and MSFG, are trending down, with price currently below key NTZ/F0% levels, confirming a corrective phase after a parabolic rally. Swing pivot analysis shows a dominant downtrend in both short- and intermediate-term trends, with the next support levels at 66.180 and 64.635, while resistance remains far above at 92.715 and 103.530, reflecting the recent blow-off top. Weekly benchmarks reveal that while short- and intermediate-term moving averages have turned down, the long-term trend remains up, supported by the 20, 55, 100, and 200 week MAs. Recent trade signals have all triggered short entries, aligning with the current corrective move. Overall, the market is in a short- and intermediate-term bearish correction within a still intact long-term bullish structure, suggesting a significant retracement phase after an extended rally, with volatility and potential for further downside tests before any stabilization or renewed uptrend.

Chart Analysis ATS AI Generated: 2026-02-18 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.