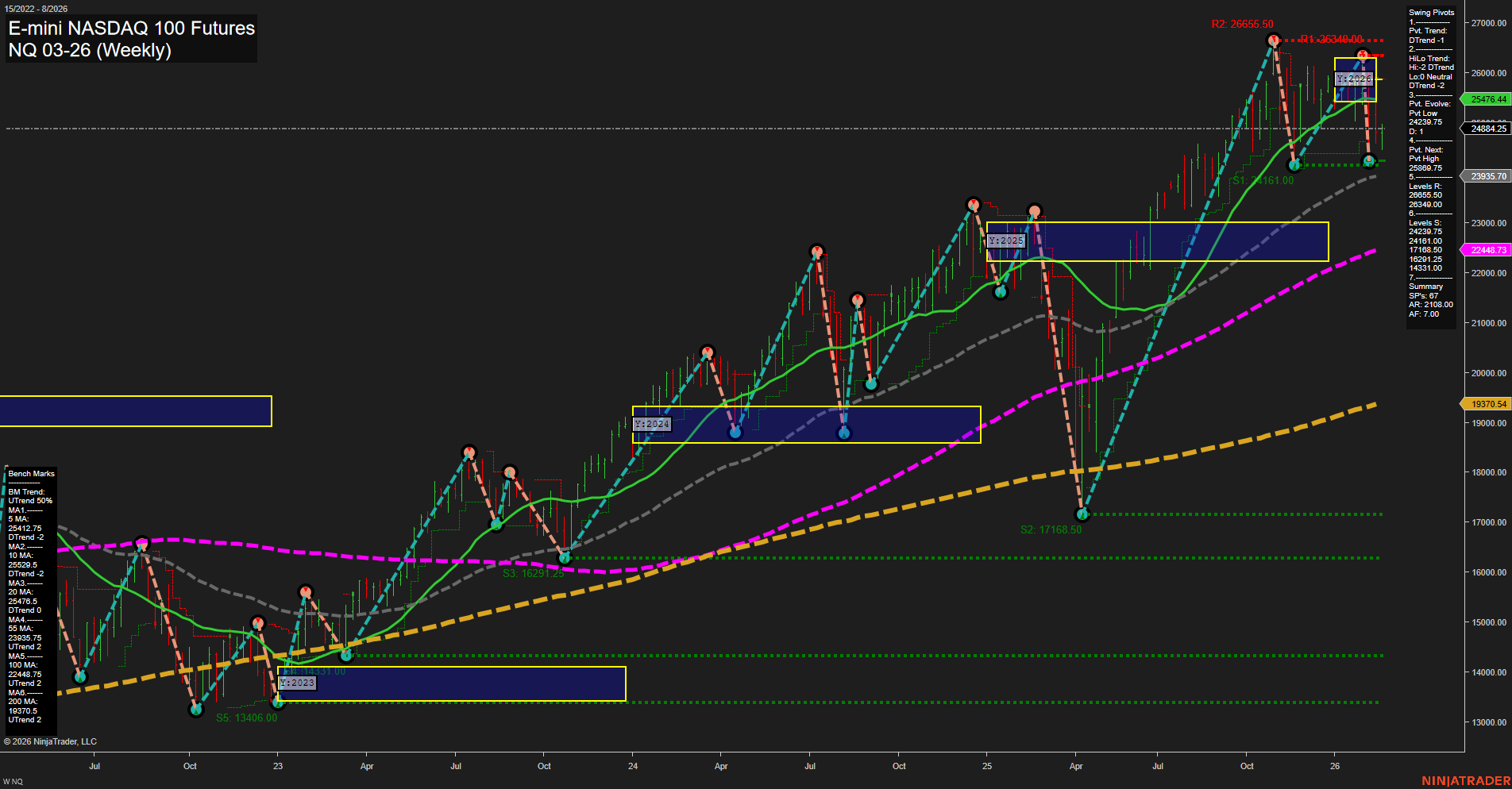

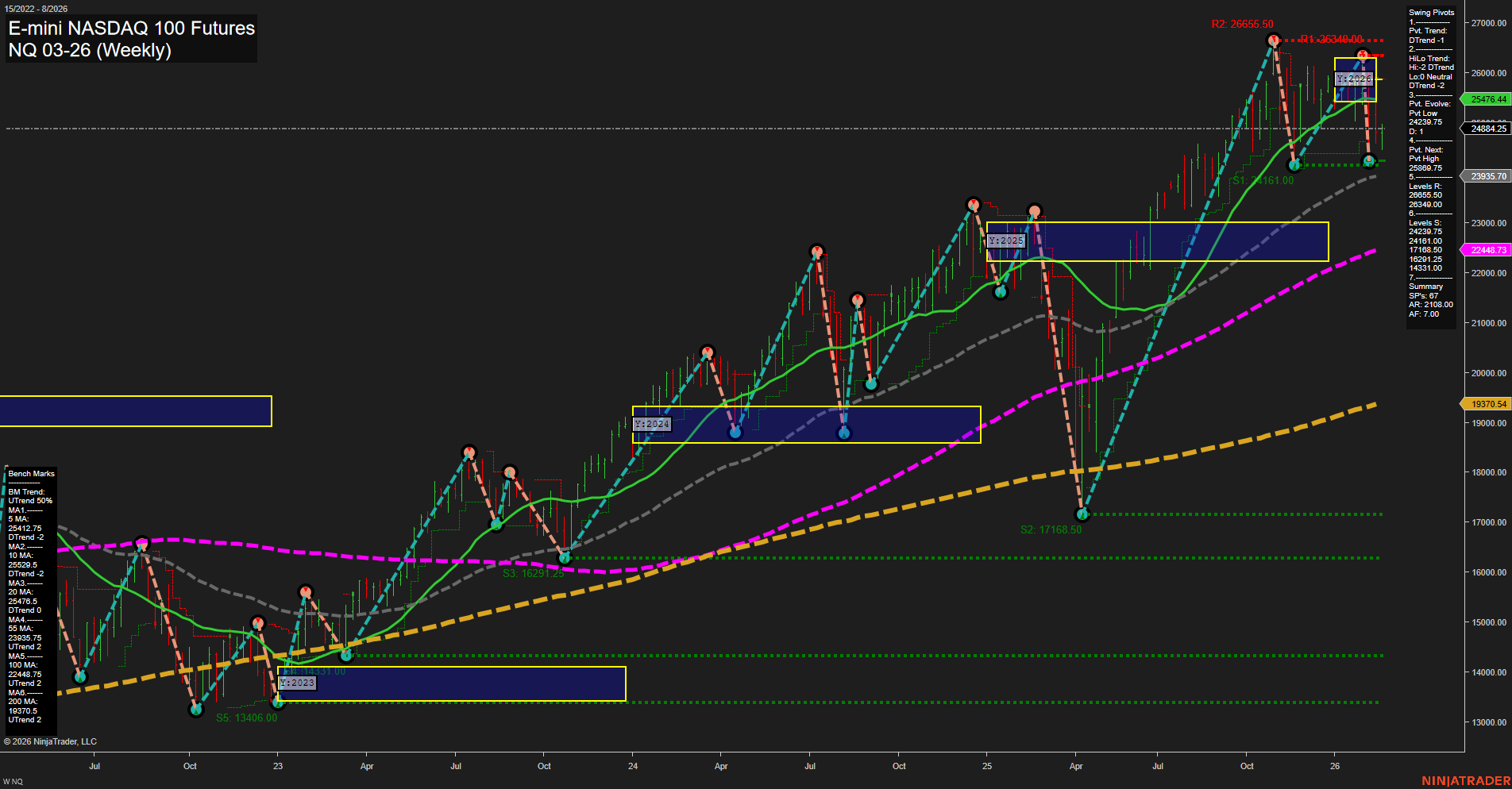

NQ E-mini NASDAQ 100 Futures Weekly Chart Analysis: 2026-Feb-18 07:17 CT

Price Action

- Last: 25476.44,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -38%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -22%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 24379.25,

- 4. Pvt. Next: Pvt high 26340.00,

- 5. Levels R: 26655.50, 26340.00,

- 6. Levels S: 24379.25, 23935.75, 23488.25, 23048.00, 22161.00, 21615.00, 17168.50, 16295.25, 14331.00.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 25174.25 Up Trend,

- (Intermediate-Term) 10 Week: 24718.75 Up Trend,

- (Long-Term) 20 Week: 23935.75 Up Trend,

- (Long-Term) 55 Week: 22414.75 Up Trend,

- (Long-Term) 100 Week: 21000.00 Up Trend,

- (Long-Term) 200 Week: 19370.54 Up Trend.

Recent Trade Signals

- 18 Feb 2026: Long NQ 03-26 @ 24903.25 Signals.USAR.TR120

- 18 Feb 2026: Long NQ 03-26 @ 24903.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures weekly chart shows a market in transition. Price action is consolidating after a strong rally, with medium-sized bars and slow momentum indicating a pause or potential inflection. Short-term (WSFG) trend remains up, supported by recent long trade signals, but the swing pivot trend has shifted to down, suggesting a possible short-term pullback or correction. Intermediate-term (MSFG) and swing HiLo trends are both down, reflecting a retracement phase after recent highs, with price below the monthly and yearly NTZ/F0% levels. However, all major long-term moving averages (20, 55, 100, 200 week) are trending up, and price remains well above these benchmarks, confirming the underlying bullish structure. Key resistance is at 26340.00 and 26655.50, while support is layered below at 24379.25 and 23935.75. The overall structure suggests a market digesting gains, with short-term neutrality, intermediate-term weakness, but a strong long-term uptrend still intact. This environment often precedes either a deeper pullback or a resumption of the primary uptrend, depending on how price reacts at key support and resistance levels.

Chart Analysis ATS AI Generated: 2026-02-18 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.