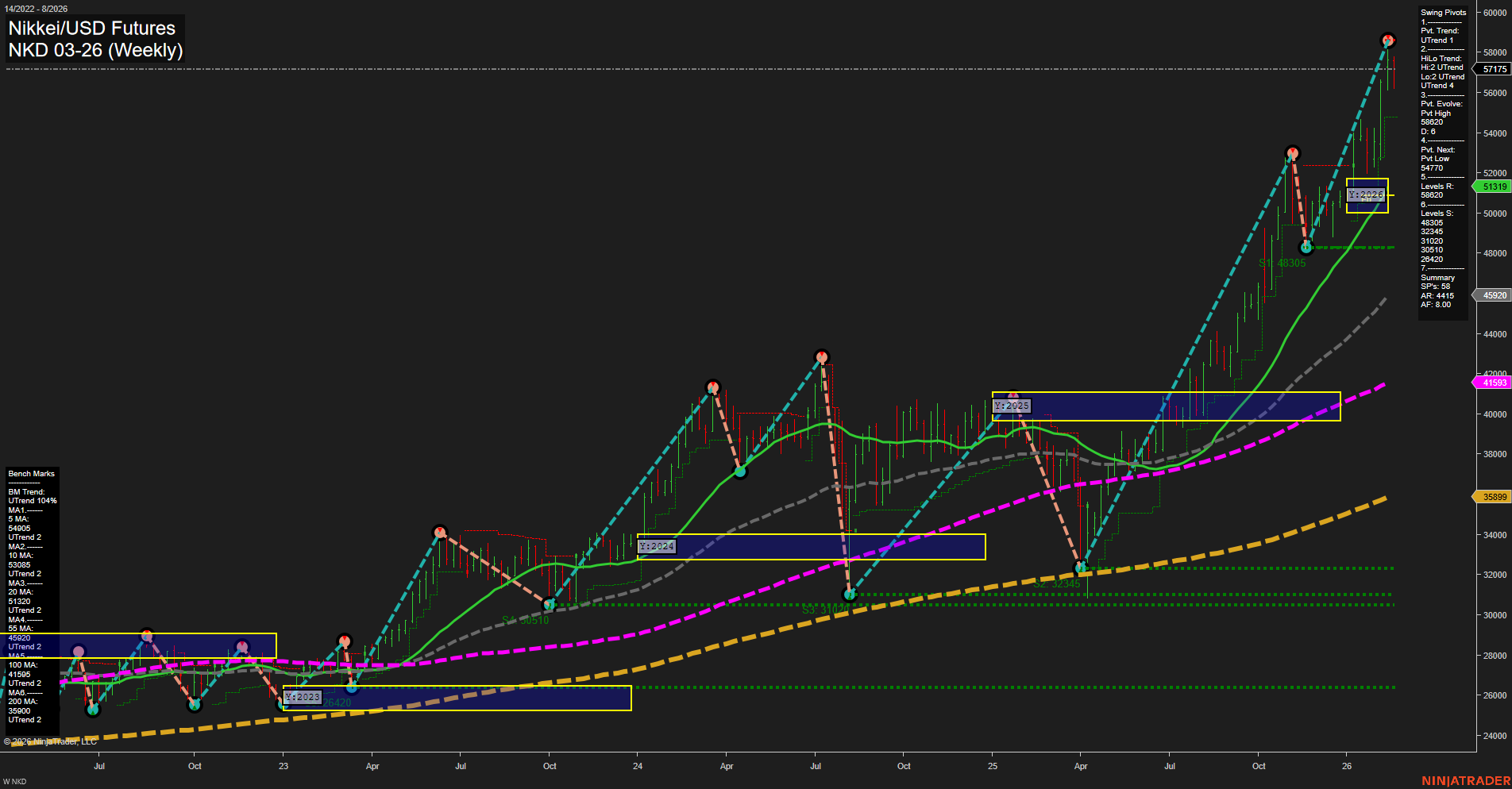

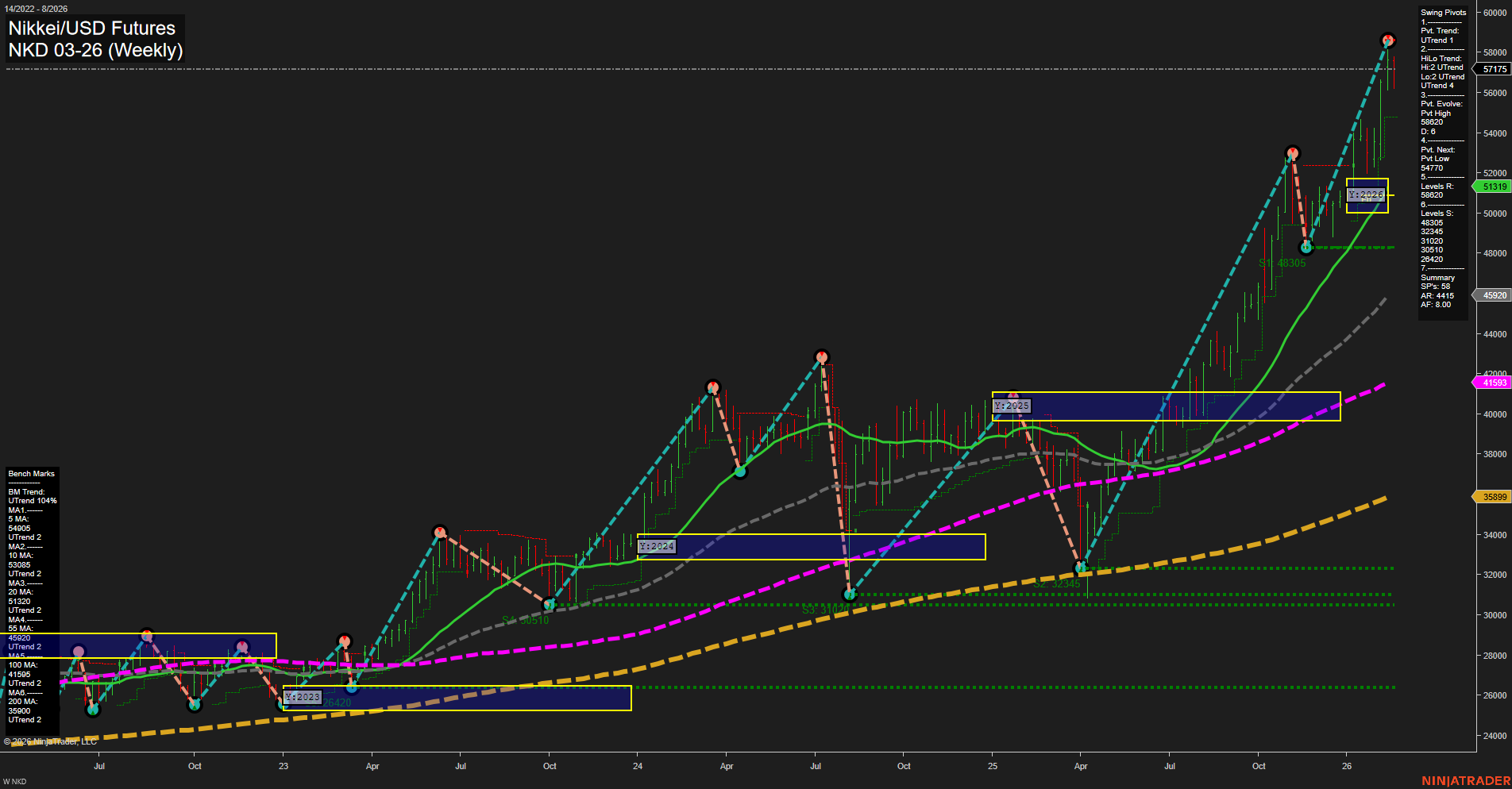

NKD Nikkei/USD Futures Weekly Chart Analysis: 2026-Feb-18 07:16 CT

Price Action

- Last: 57,175,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -15%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 100%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 79%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 57,175,

- 4. Pvt. Next: Pvt low 51,319,

- 5. Levels R: 57,175,

- 6. Levels S: 51,319, 43,305, 39,420, 36,420, 33,405, 32,405.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 54,063 Up Trend,

- (Intermediate-Term) 10 Week: 51,320 Up Trend,

- (Long-Term) 20 Week: 45,920 Up Trend,

- (Long-Term) 55 Week: 41,593 Up Trend,

- (Long-Term) 100 Week: 41,156 Up Trend,

- (Long-Term) 200 Week: 35,899 Up Trend.

Recent Trade Signals

- 18 Feb 2026: Long NKD 03-26 @ 57,410 Signals.USAR.TR120

- 13 Feb 2026: Long NKD 03-26 @ 57,625 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD Futures weekly chart is displaying a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating aggressive buying and a possible breakout environment. The short-term WSFG trend is down, but this appears to be a minor pullback within a much larger uptrend, as both the intermediate and long-term Fib grid trends (MSFG and YSFG) are firmly up with price well above their respective NTZ/F0% levels. Swing pivots confirm the uptrend, with the most recent pivot high at 57,175 and the next significant support at 51,319, followed by a series of higher support levels, reflecting a stair-step pattern typical of strong trends. All benchmark moving averages from 5-week to 200-week are trending up, reinforcing the underlying bullish momentum. Recent trade signals are long, aligning with the prevailing trend. Overall, the market is in a robust uptrend, with any short-term weakness likely to be viewed as a retracement within a dominant bullish cycle. The technical landscape suggests continued strength, with higher lows and higher highs, and no immediate signs of reversal or exhaustion.

Chart Analysis ATS AI Generated: 2026-02-18 07:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.