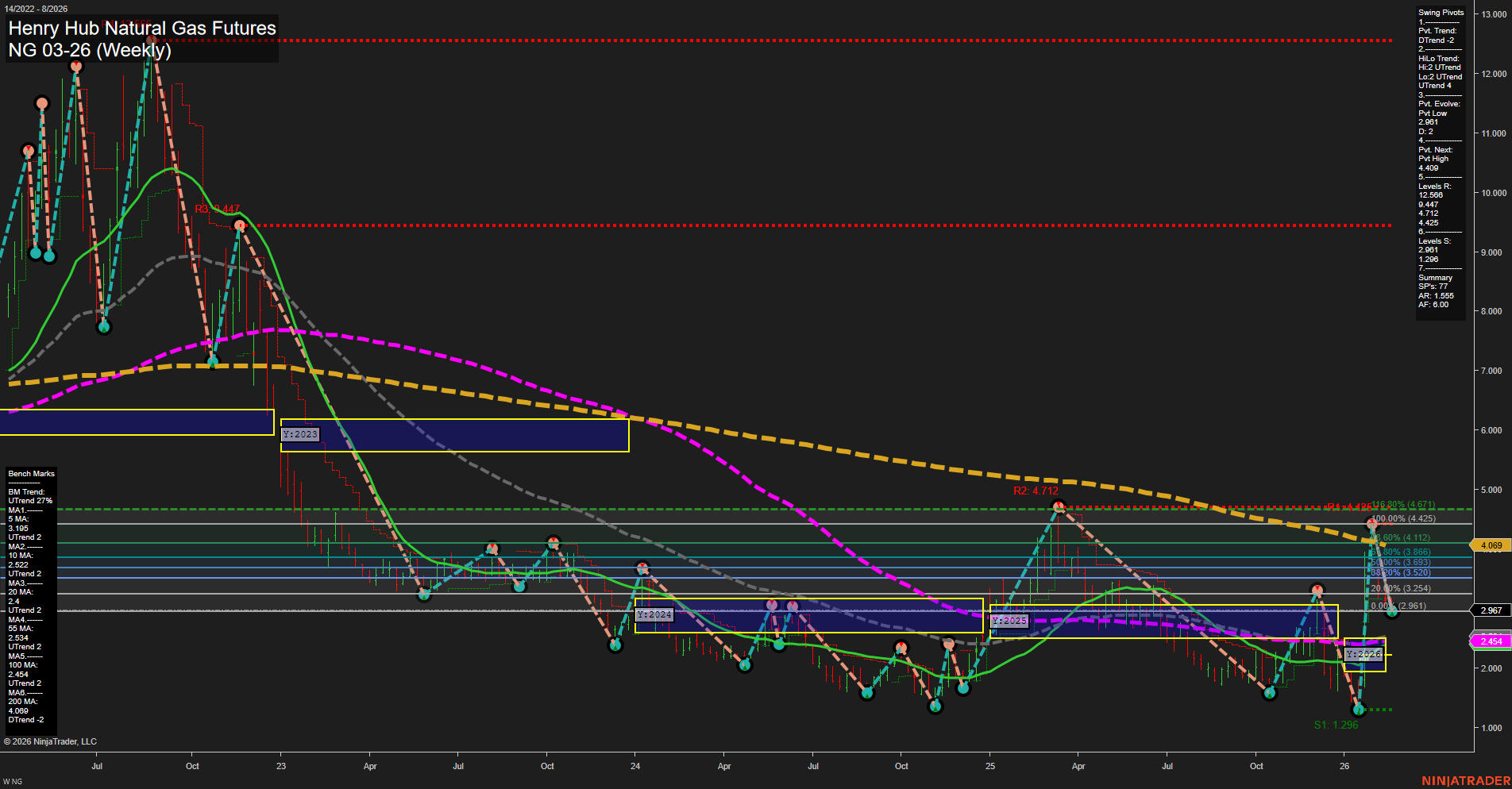

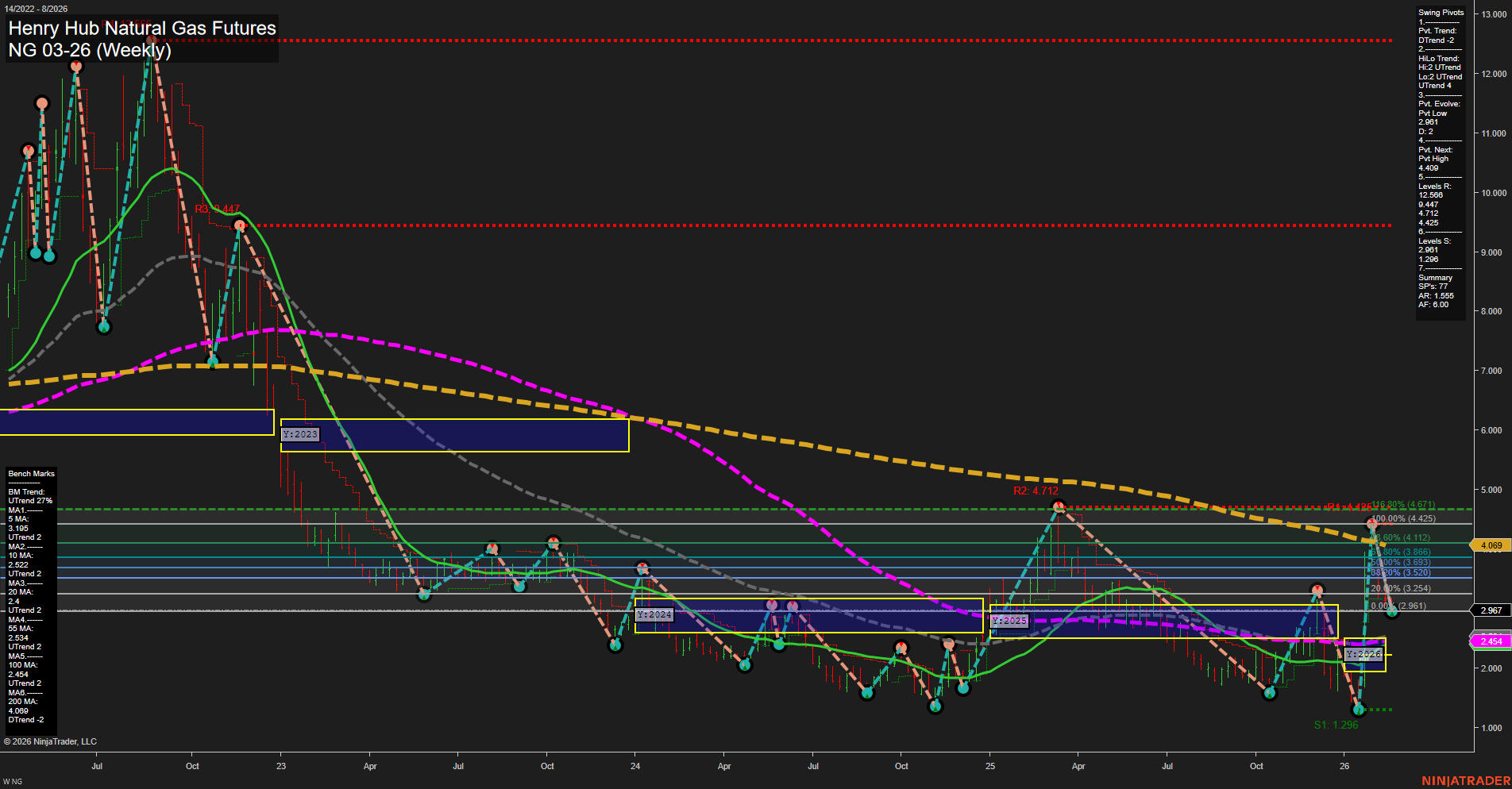

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2026-Feb-18 07:15 CT

Price Action

- Last: 2.967,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -37%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2.21,

- 4. Pvt. Next: Pvt high 4.50,

- 5. Levels R: 12.09, 9.447, 4.712, 4.425,

- 6. Levels S: 2.081, 1.296.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.105 Down Trend,

- (Intermediate-Term) 10 Week: 3.524 Down Trend,

- (Long-Term) 20 Week: 2.954 Up Trend,

- (Long-Term) 55 Week: 4.164 Down Trend,

- (Long-Term) 100 Week: 4.669 Down Trend,

- (Long-Term) 200 Week: 4.425 Down Trend.

Recent Trade Signals

- 16 Feb 2026: Short NG 03-26 @ 3.018 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Natural Gas futures remain under pressure in the short and intermediate term, with both the weekly and monthly session fib grids showing price below their respective NTZ centers and clear downtrends. The most recent swing pivot trend is down, and both the 5- and 10-week moving averages confirm this with ongoing downtrends. However, the intermediate-term HiLo trend has shifted to up, suggesting some underlying support or a potential for a countertrend bounce, but this is not yet confirmed by price action or momentum, which remains slow. The long-term yearly fib grid is still up, with price above the yearly NTZ center, and the 20-week MA has turned up, indicating some stabilization or base-building at these levels. Major resistance remains overhead at 4.425–4.712, while support is seen at 2.081 and 1.296. The recent short signal aligns with the prevailing bearish structure. Overall, the market is in a corrective or consolidative phase after a prolonged decline, with volatility compressing and no clear evidence yet of a sustained reversal. Swing traders should note the potential for further tests of support before any significant trend change develops.

Chart Analysis ATS AI Generated: 2026-02-18 07:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.