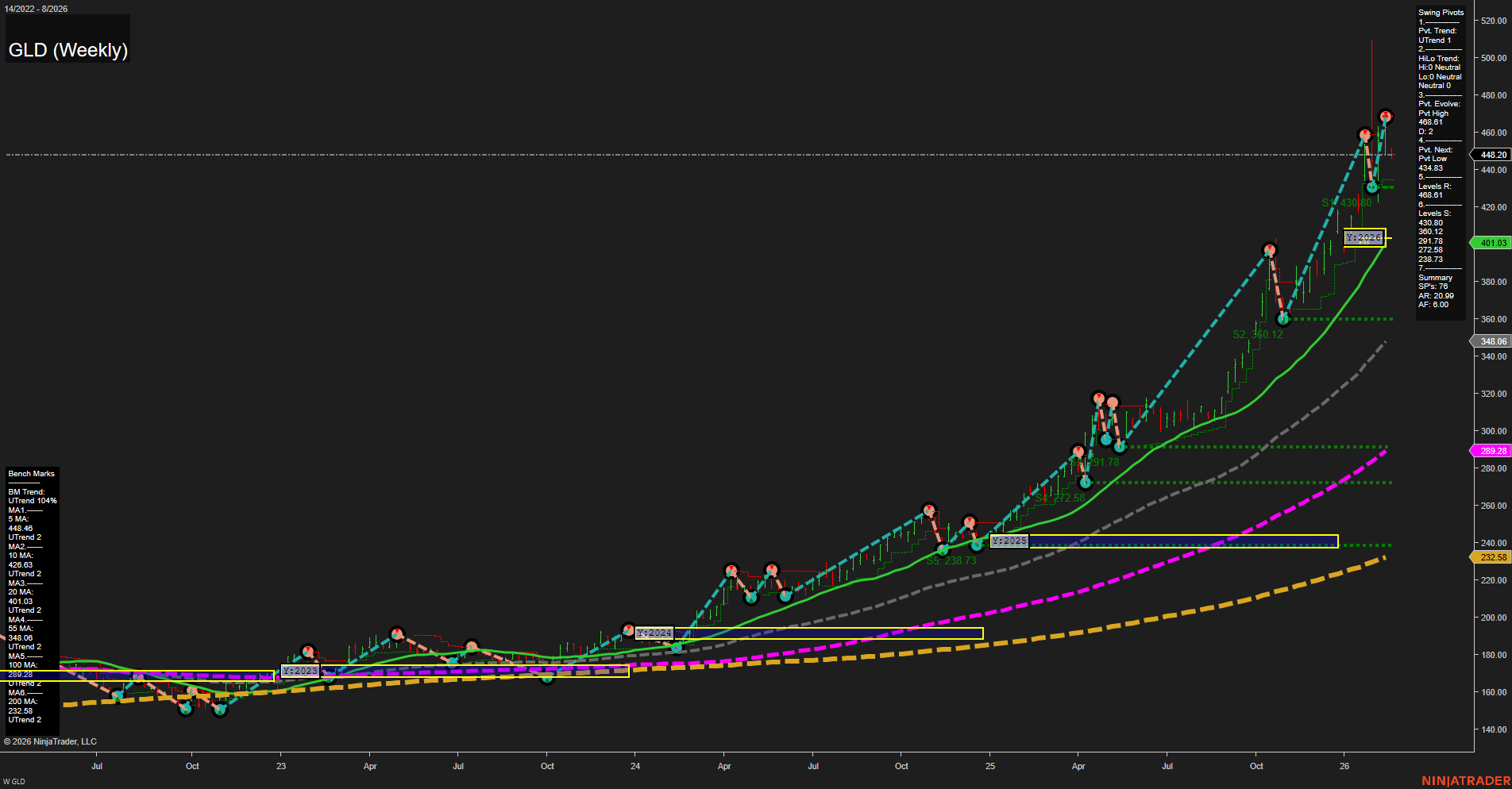

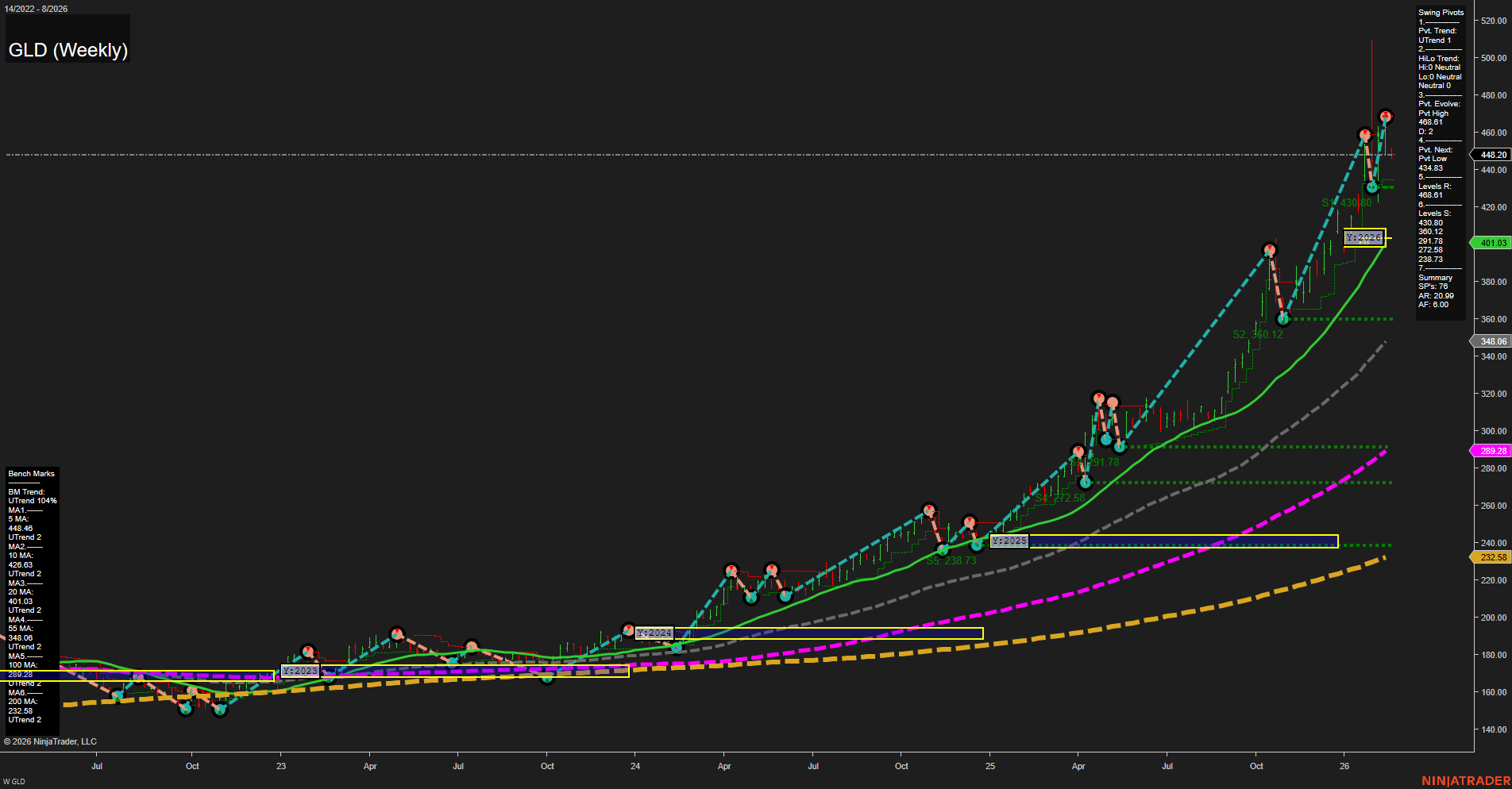

GLD SPDR Gold Shares Weekly Chart Analysis: 2026-Feb-18 07:14 CT

Price Action

- Last: 448.29,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt high 468.91,

- 4. Pvt. Next: Pvt low 439.43,

- 5. Levels R: 480.82, 430.80,

- 6. Levels S: 360.12, 291.78, 238.73.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 448.46 Up Trend,

- (Intermediate-Term) 10 Week: 424.63 Up Trend,

- (Long-Term) 20 Week: 401.03 Up Trend,

- (Long-Term) 55 Week: 346.06 Up Trend,

- (Long-Term) 100 Week: 299.28 Up Trend,

- (Long-Term) 200 Week: 232.58 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

GLD has experienced a strong and rapid advance, as evidenced by large weekly bars and fast momentum, pushing price to new highs above 448. The short-term swing pivot trend remains up, with the most recent pivot high at 468.91 and the next key support at 439.43. Resistance is now seen at 480.82 and 430.80, while support levels are well below current price, indicating a significant move away from prior consolidation zones. All major moving averages (5, 10, 20, 55, 100, 200 week) are trending upward, confirming a robust long-term uptrend. However, the intermediate-term HiLo trend is neutral, suggesting some consolidation or pause in the trend after the recent surge. The price is currently neutral relative to the NTZ/Fib grid, indicating a potential for either further consolidation or a setup for the next directional move. Overall, the chart reflects a strong bullish bias in the long-term, with short-term momentum still favoring the upside, but with some caution warranted in the intermediate-term as the market digests recent gains and volatility remains elevated.

Chart Analysis ATS AI Generated: 2026-02-18 07:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.