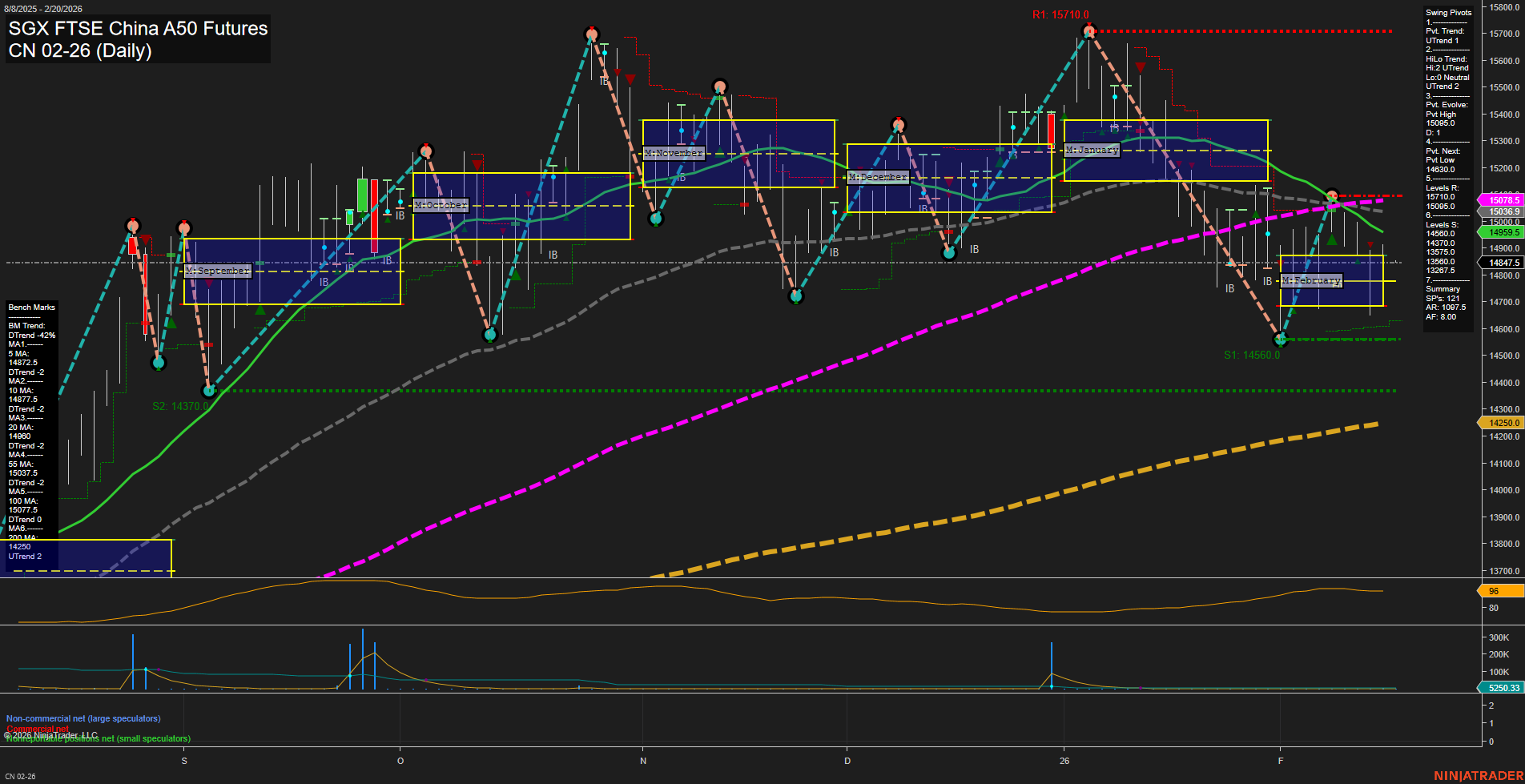

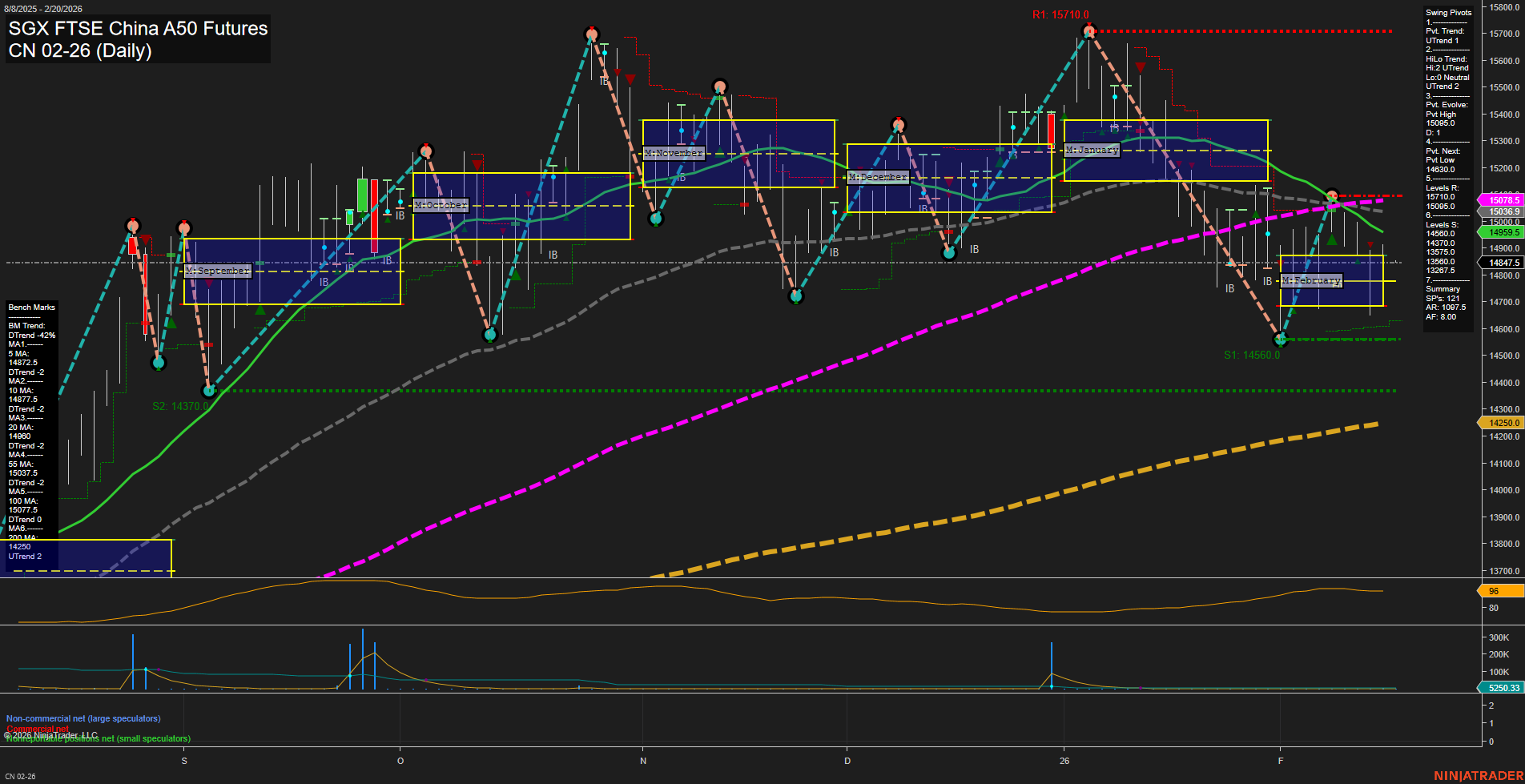

CN SGX FTSE China A50 Futures Daily Chart Analysis: 2026-Feb-18 07:06 CT

Price Action

- Last: 14909.5,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 14560.0,

- 4. Pvt. Next: Pvt high 15005.0,

- 5. Levels R: 15710.0, 15005.0,

- 6. Levels S: 14560.0, 14370.0, 13257.5.

Daily Benchmarks

- (Short-Term) 5 Day: 14877.5 Down Trend,

- (Short-Term) 10 Day: 14909.5 Down Trend,

- (Intermediate-Term) 20 Day: 15037.5 Down Trend,

- (Intermediate-Term) 55 Day: 14990.0 Down Trend,

- (Long-Term) 100 Day: 15077.5 Down Trend,

- (Long-Term) 200 Day: 14260.0 UTrend.

Additional Metrics

- ATR: 87.5,

- VOLMA: 261842.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The CN SGX FTSE China A50 Futures daily chart currently reflects a market in consolidation, with price action showing medium-sized bars and slow momentum. The swing pivot structure has shifted to an uptrend in both short- and intermediate-term metrics, with the most recent pivot low at 14560.0 and the next potential pivot high at 15005.0. However, all benchmark moving averages from short to long term (except the 200-day) are trending down, indicating that the broader trend remains under pressure despite the recent swing low bounce. The price is currently trading below most key moving averages, suggesting resistance overhead, particularly at 15005.0 and 15710.0. Support is established at 14560.0 and 14370.0, with a deeper level at 13257.5. Volatility, as measured by ATR, is moderate, and volume metrics are stable. Overall, the market is in a neutral phase across all timeframes, with no clear directional bias emerging from the session fib grids or moving averages. The chart suggests a period of indecision, with the potential for range-bound trading as the market digests recent moves and awaits a catalyst for a sustained breakout or breakdown.

Chart Analysis ATS AI Generated: 2026-02-18 07:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.