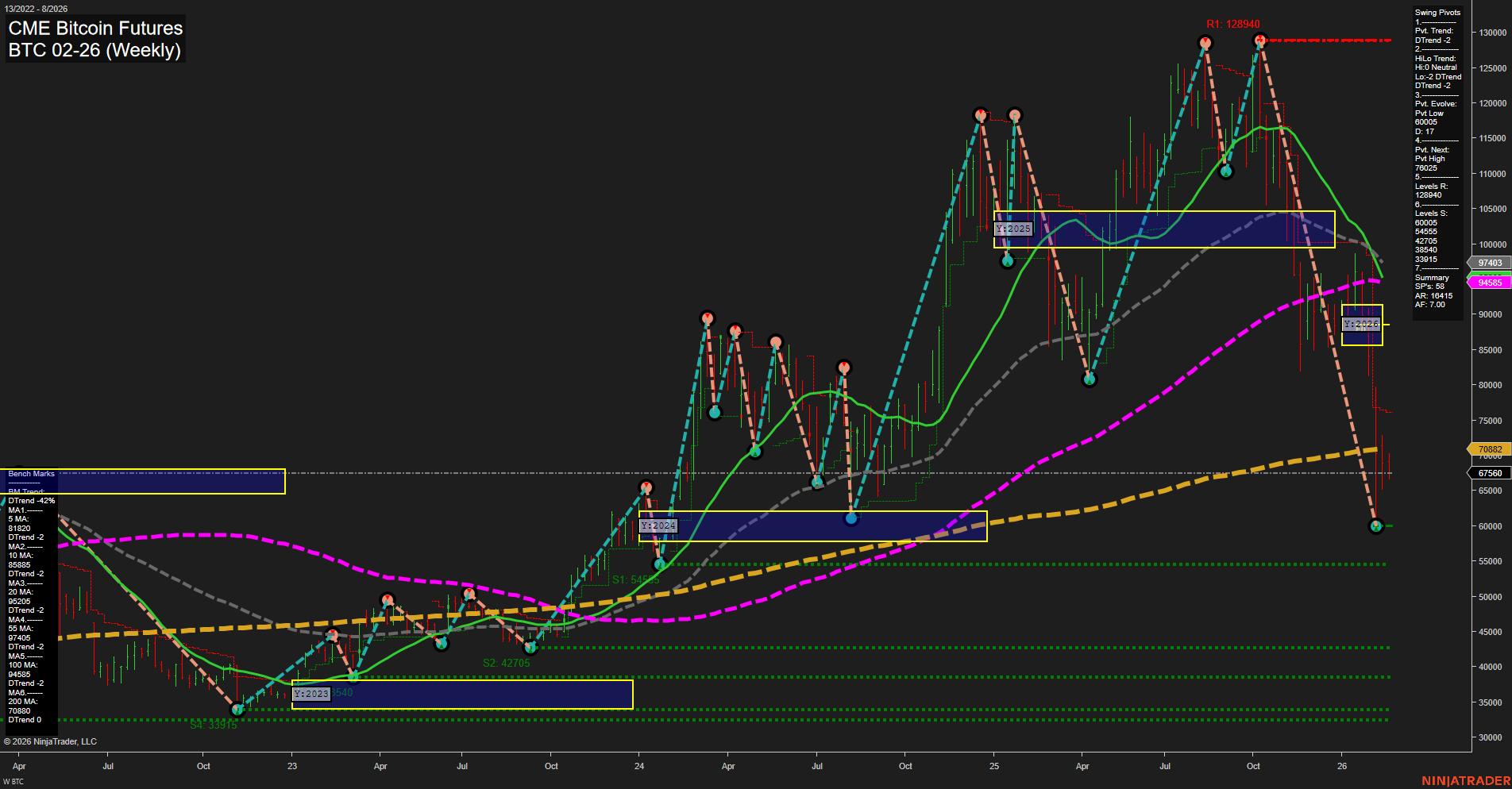

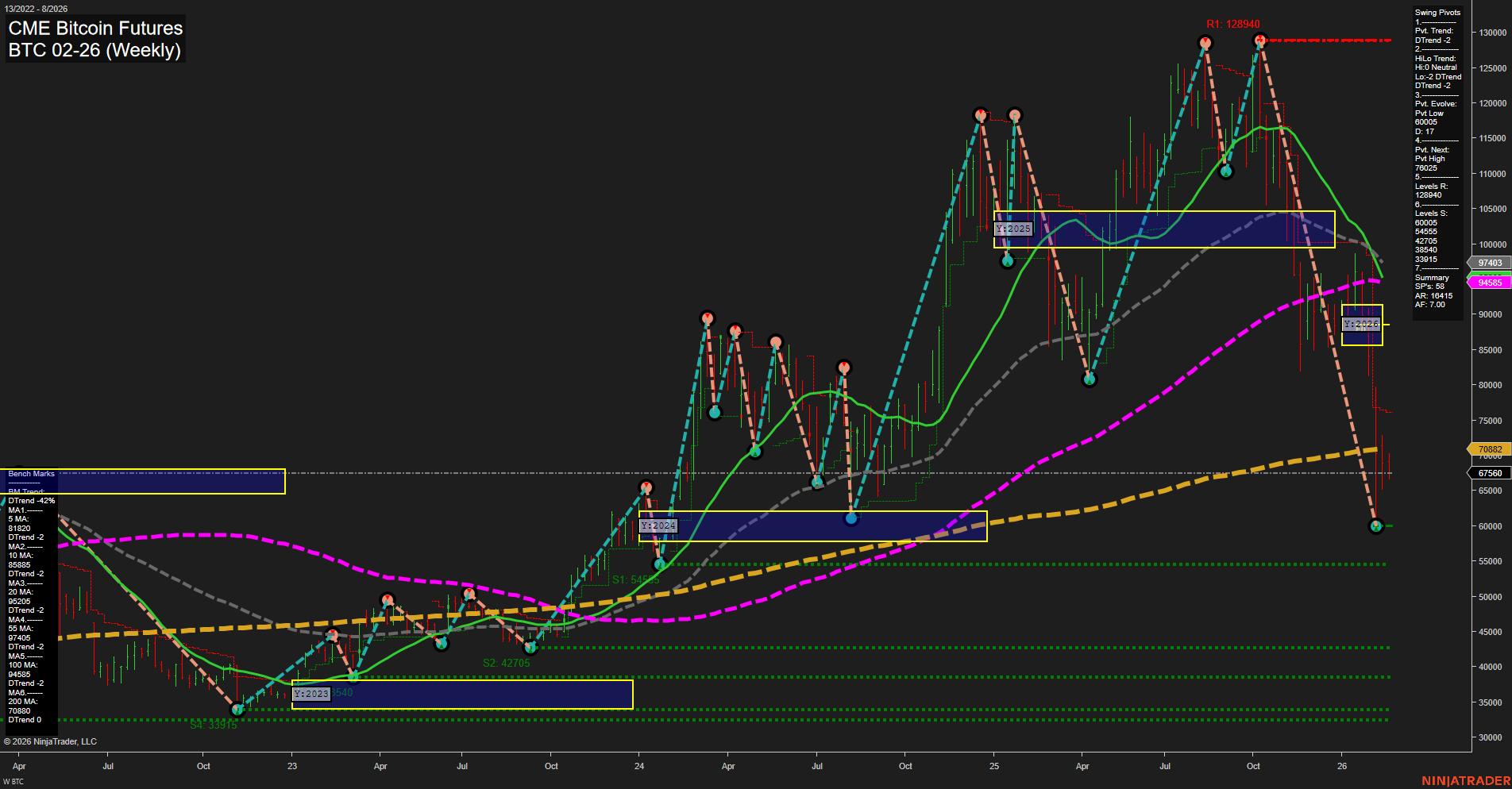

BTC CME Bitcoin Futures Weekly Chart Analysis: 2026-Feb-18 07:05 CT

Price Action

- Last: 67,560,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -15%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -47%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -73%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 60,075,

- 4. Pvt. Next: Pvt high 94,555,

- 5. Levels R: 128,940, 94,555, 87,405, 84,105, 77,205,

- 6. Levels S: 60,075, 54,405, 47,205, 39,105, 33,015.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 81,240 Down Trend,

- (Intermediate-Term) 10 Week: 85,855 Down Trend,

- (Long-Term) 20 Week: 97,405 Down Trend,

- (Long-Term) 55 Week: 106,040 Down Trend,

- (Long-Term) 100 Week: 94,555 Down Trend,

- (Long-Term) 200 Week: 70,820 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The BTC CME Bitcoin Futures weekly chart is showing pronounced downside momentum, with large weekly bars and fast momentum confirming a strong selloff. All major Fibonacci grid trends (weekly, monthly, yearly) are aligned to the downside, with price trading well below the NTZ (neutral trading zone) and F0% levels, indicating persistent bearish pressure across all timeframes. Swing pivot analysis highlights a dominant downtrend in both short- and intermediate-term trends, with the most recent pivot low at 60,075 acting as the nearest support, while resistance levels are stacked significantly higher, starting at 77,205 and above. All benchmark moving averages from short to long term are trending down, reinforcing the prevailing bearish structure. The market is in a clear corrective phase following a major top, with no immediate signs of reversal or stabilization. The technical landscape suggests a continuation of the current downtrend, with volatility elevated and the potential for further tests of lower support levels if selling persists.

Chart Analysis ATS AI Generated: 2026-02-18 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.