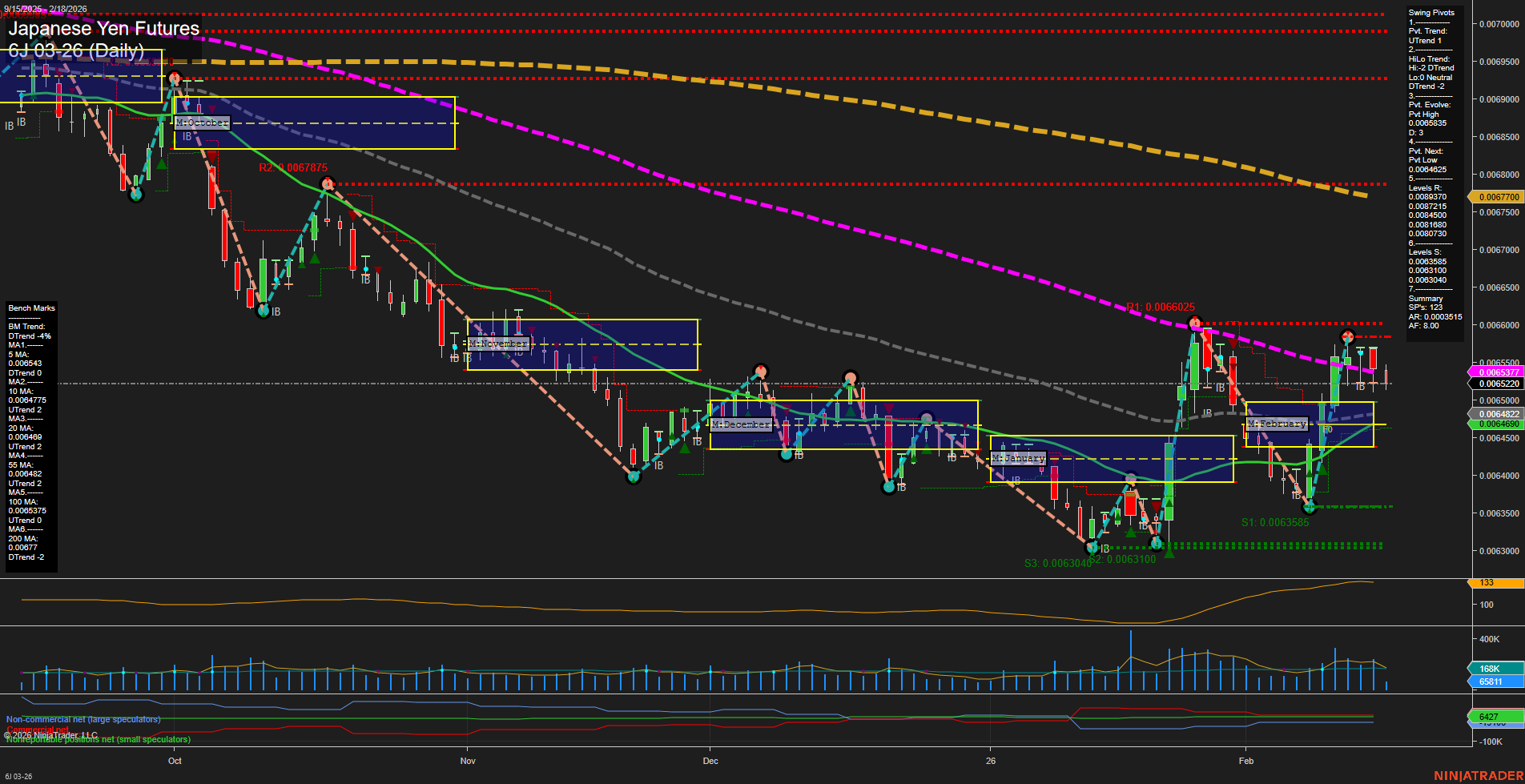

The 6J Japanese Yen Futures daily chart shows a market in transition. Short-term price action is neutral, with medium-sized bars and average momentum, reflecting recent choppy trading and a lack of clear direction. The weekly session fib grid (WSFG) trend is down, with price below the NTZ, indicating short-term weakness. However, the monthly (MSFG) and yearly (YSFG) session fib grids both show price above their respective NTZs and an upward trend, suggesting intermediate and long-term bullishness. Swing pivots highlight a short-term uptrend (UTrend) but an intermediate-term downtrend (DTrend), with the most recent pivot evolving at a high and the next key reversal level set at a lower price. Resistance levels are stacked above, with the nearest at 0.0065730 and 0.0065025, while support is found at 0.0063585 and below. Daily benchmarks show short-term moving averages trending up, while intermediate and long-term averages remain in a downtrend, reflecting a market that is attempting to recover but still faces overhead resistance from longer-term sellers. ATR and volume metrics indicate moderate volatility and healthy participation. Recent trade signals have shifted from long to short, reflecting the mixed signals and possible short-term pullback within a broader recovery attempt. Overall, the market is consolidating after a rally, with potential for further upside if intermediate and long-term trends continue to strengthen, but short-term caution is warranted as the market digests recent gains and tests key support and resistance levels.