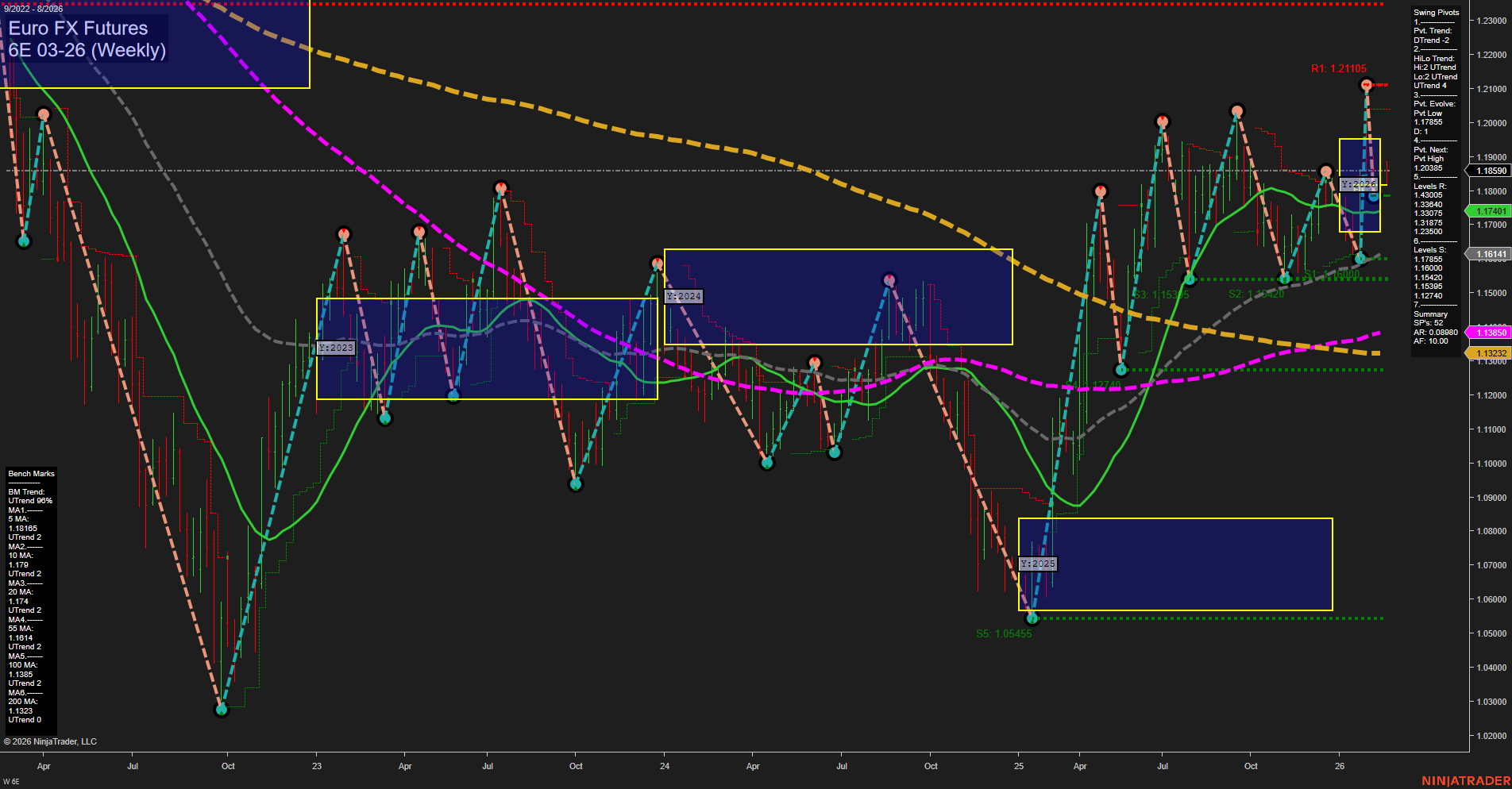

The Euro FX futures are currently experiencing a pullback within a broader long-term uptrend. Price action shows medium-sized bars with slow momentum, indicating a lack of strong directional conviction in the short run. Both the weekly and monthly session fib grids (WSFG and MSFG) are trending down, with price below their respective NTZ/F0% levels, confirming short- and intermediate-term bearishness. Swing pivot analysis aligns with this, as both the short-term and intermediate-term trends are down, and the most recent pivots have established a new swing low at 1.17401. Resistance is layered above at 1.18785, 1.19307, 1.20385, and 1.21105, while support is found at 1.17401, 1.16141, 1.1200, and 1.05455. Weekly benchmarks show short- and intermediate-term moving averages trending down, but all long-term moving averages (20, 55, 100, 200 week) remain in uptrends, supporting the idea of a corrective phase within a larger bullish structure. Recent trade signals have all been to the short side, reflecting the prevailing short-term and intermediate-term weakness. Overall, the market is in a corrective or retracement phase, with the potential for further downside in the near term, but the underlying long-term trend remains upward. This environment may favor swing traders who are attentive to both the ongoing pullback and the possibility of a resumption of the larger uptrend once support levels are tested or confirmed.