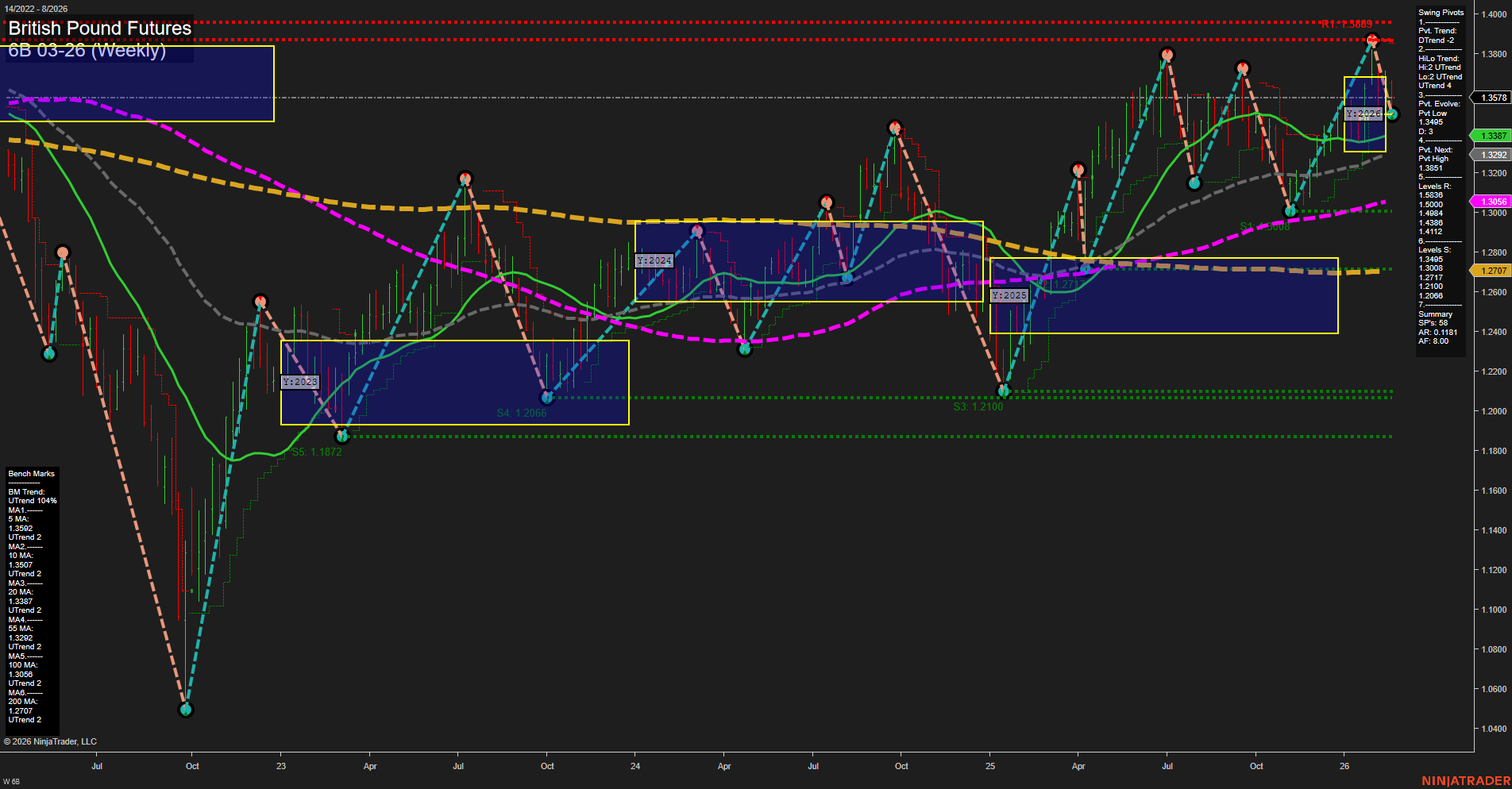

The British Pound Futures (6B) weekly chart currently reflects a mixed environment for swing traders. Price action shows medium-sized bars with average momentum, indicating neither extreme volatility nor a strong directional push. Short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both down, with price trading below their respective NTZ/F0% levels, suggesting recent weakness and a short-term bearish bias. However, the long-term (YSFG) trend remains up, with price above the yearly NTZ/F0%, highlighting underlying strength in the broader trend. Swing pivot analysis reveals a short-term downtrend, but the intermediate-term HiLo trend is still up, pointing to a possible corrective phase within a larger uptrend. Resistance is clustered near recent highs (1.3689, 1.3649, 1.3615), while support is found at 1.3226, 1.3200, and 1.3066, which could act as key levels for future price reactions. All benchmark moving averages from 5-week to 200-week are in uptrends, reinforcing the long-term bullish structure despite the current pullback. Recent trade signals have alternated between short and long, reflecting the choppy, corrective nature of the current market phase. Overall, the short-term outlook is bearish, the intermediate-term is neutral as the market consolidates, and the long-term remains bullish, with the potential for trend continuation if support levels hold and momentum returns.