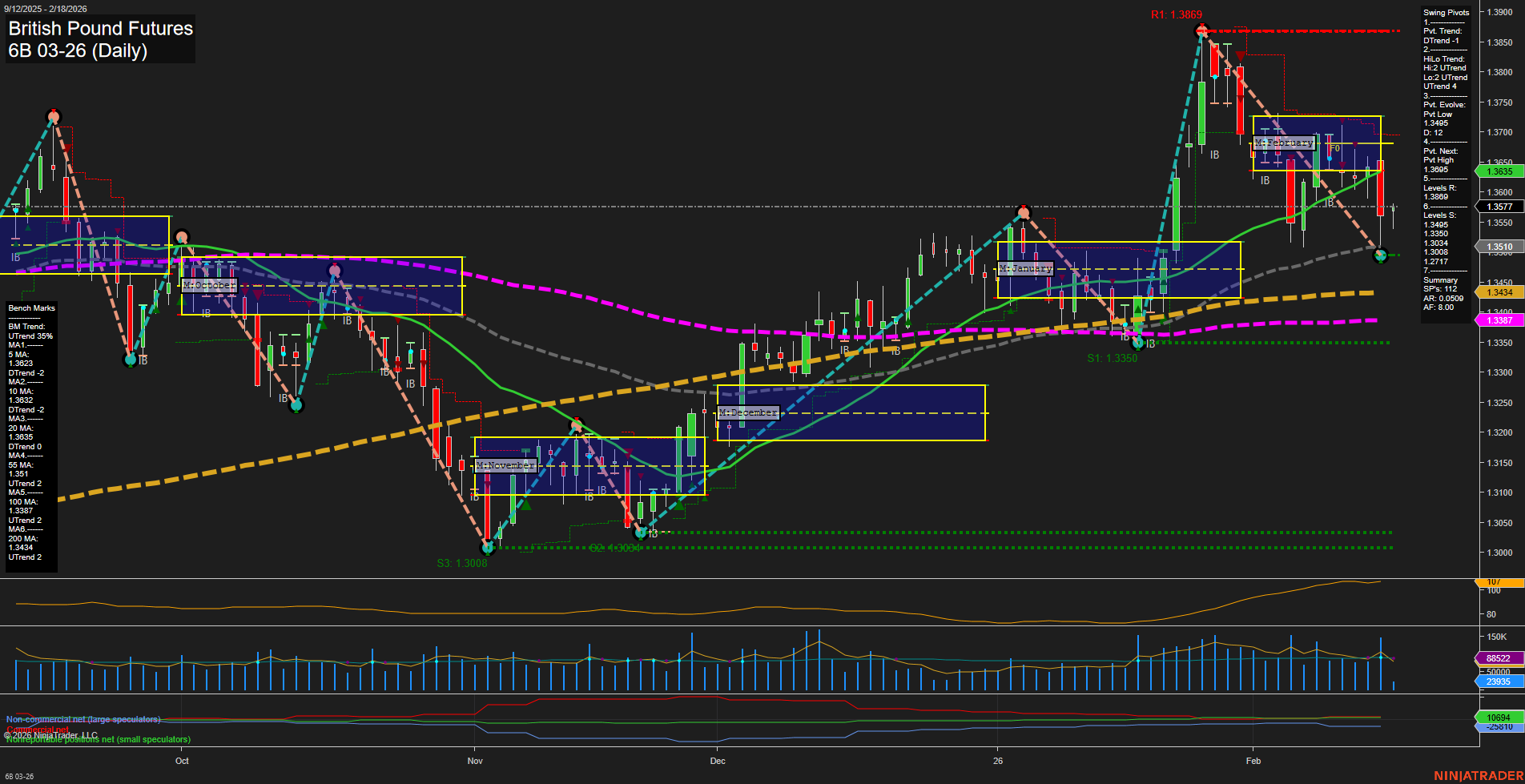

The British Pound Futures (6B) daily chart is currently showing a shift in momentum, with price action characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction in the very short term. Both the weekly and monthly session fib grids (WSFG and MSFG) are trending down, with price trading below their respective NTZ/F0% levels, reinforcing a bearish short- and intermediate-term outlook. The swing pivot structure confirms this, as the short-term pivot trend is down (DTrend), while the intermediate-term HiLo trend remains up, suggesting a possible corrective phase within a larger uptrend. Key resistance levels are clustered above at 1.3600, 1.3685, and 1.3869, while support is found at 1.3506, 1.3406, and 1.3350. Daily benchmarks show all short- and intermediate-term moving averages trending down, with price currently below these levels, further supporting the bearish bias in the near term. However, the 100-day and 200-day moving averages are still in uptrends, indicating that the longer-term structure remains bullish. Recent trade signals have alternated between short and long, reflecting choppy, range-bound conditions and a market searching for direction after a recent sell-off from the February highs. Volatility (ATR) and volume (VOLMA) are moderate, suggesting neither panic selling nor aggressive accumulation. Overall, the market is in a corrective pullback within a longer-term uptrend, with the short- and intermediate-term trends currently favoring the bears. The price is testing key support levels, and the next directional move will likely be determined by whether these supports hold or if resistance levels cap any bounce attempts. The environment is characterized by consolidation and potential for further volatility as the market digests recent moves and awaits new catalysts.