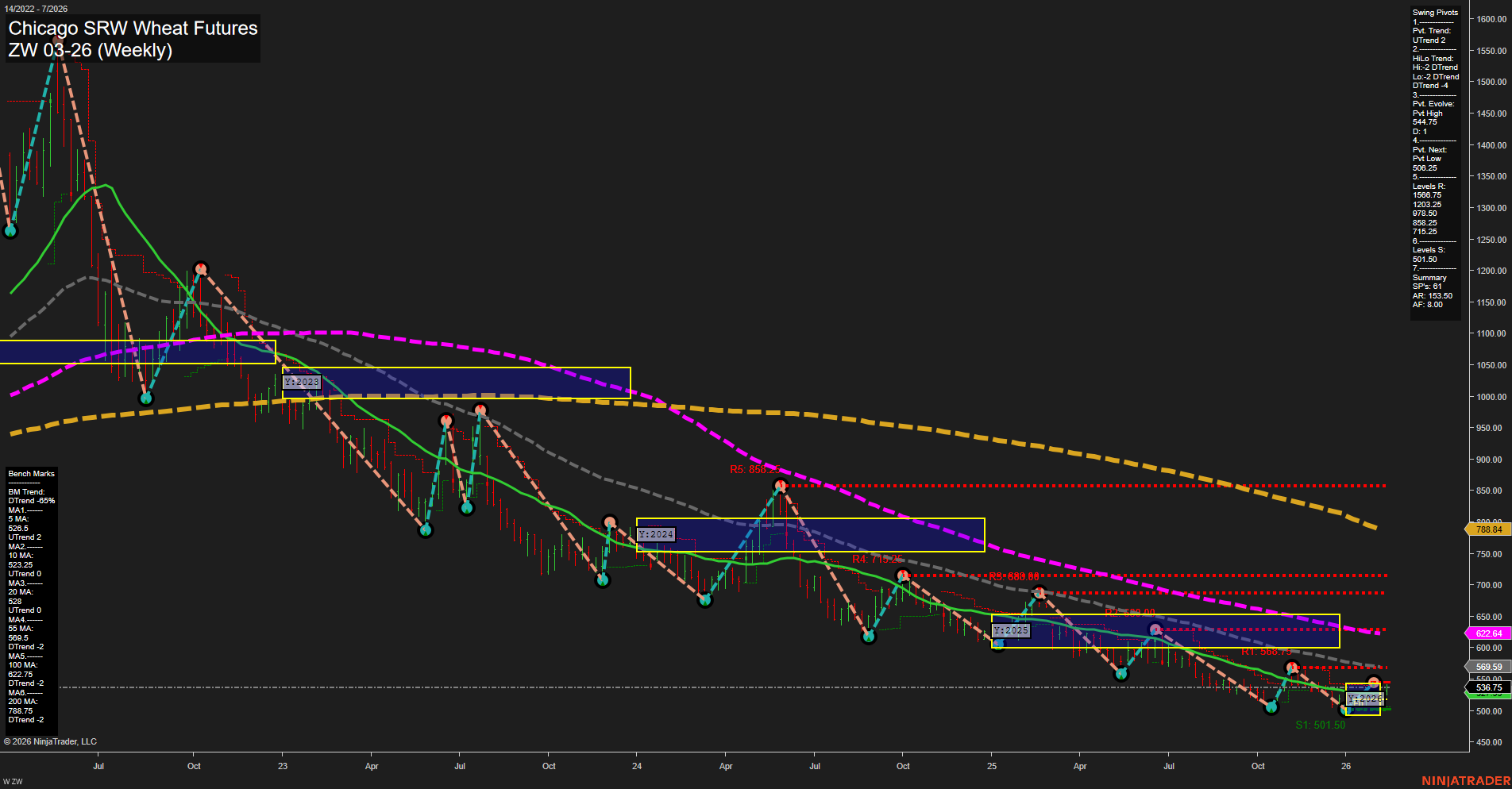

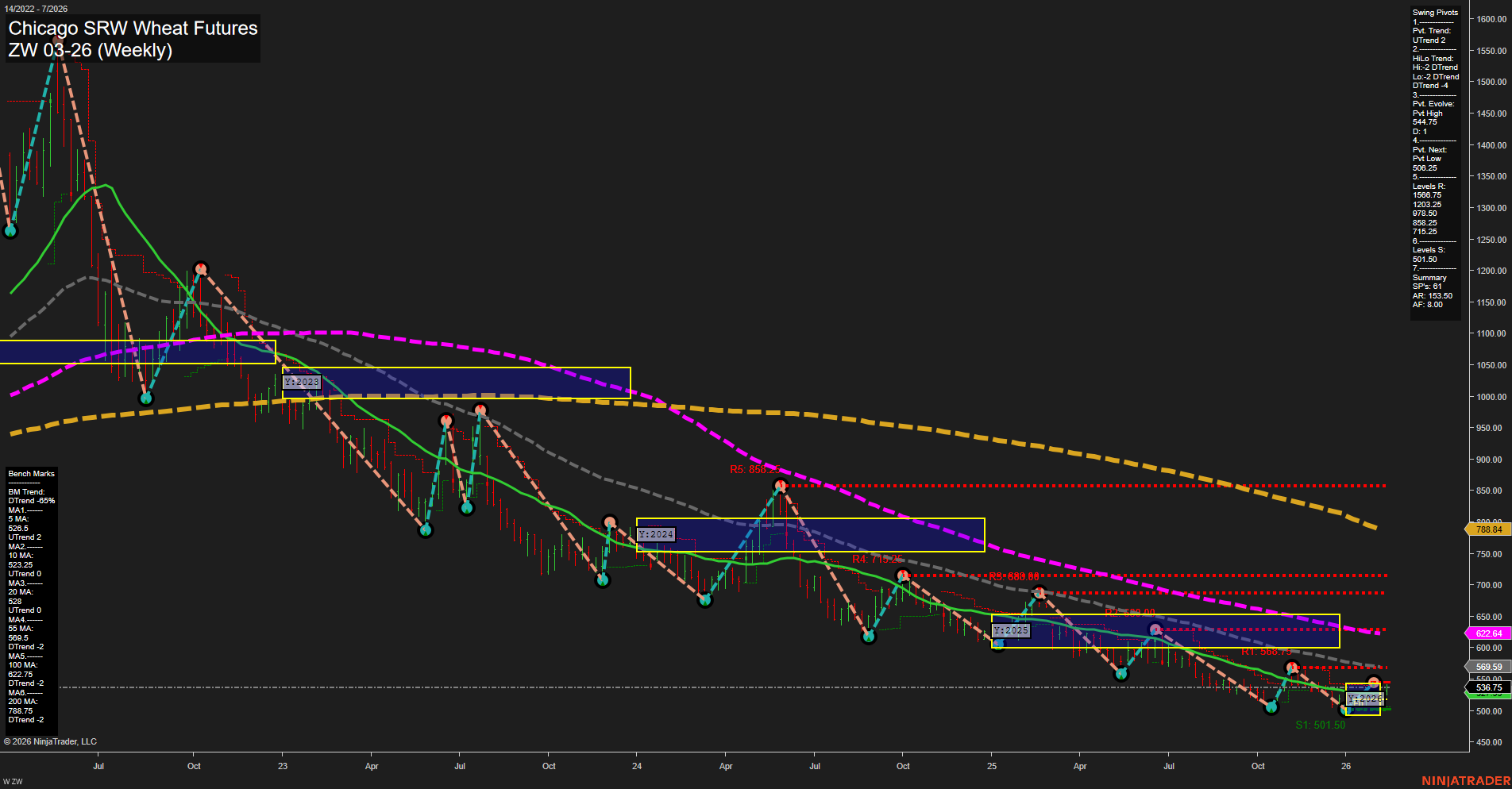

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2026-Feb-12 07:23 CT

Price Action

- Last: 536.75,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 43%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 543.75,

- 4. Pvt. Next: Pvt Low 505.25,

- 5. Levels R: 850.00, 717.25, 688.00, 622.64, 543.75,

- 6. Levels S: 501.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 533.25 Down Trend,

- (Intermediate-Term) 10 Week: 552.94 Down Trend,

- (Long-Term) 20 Week: 599.5 Down Trend,

- (Long-Term) 55 Week: 702.74 Down Trend,

- (Long-Term) 100 Week: 788.74 Down Trend,

- (Long-Term) 200 Week: 980.75 Down Trend.

Recent Trade Signals

- 11 Feb 2026: Long ZW 03-26 @ 538 Signals.USAR.TR120

- 11 Feb 2026: Long ZW 03-26 @ 534.75 Signals.USAR-WSFG

- 11 Feb 2026: Short ZW 03-26 @ 531.5 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures weekly chart shows a market in a prolonged downtrend, with all major long-term and intermediate-term moving averages trending lower and price trading well below these benchmarks. The short-term WSFG trend has turned up, with price currently above the weekly session fib grid center, but momentum remains slow and bars are small, indicating a lack of strong conviction. Swing pivot analysis confirms a dominant downtrend in both short- and intermediate-term trends, with the most recent pivot high at 543.75 and next support at 501.50. Resistance levels are stacked well above current price, highlighting the overhead supply. Recent trade signals are mixed, with both long and short entries triggered in the last session, reflecting the choppy, indecisive nature of the current price action. Overall, the market remains structurally bearish on the intermediate and long-term timeframes, with only tentative short-term stabilization. The price is consolidating near multi-year lows, and any sustained bounce would need to overcome significant resistance and reverse the entrenched downtrend.

Chart Analysis ATS AI Generated: 2026-02-12 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.