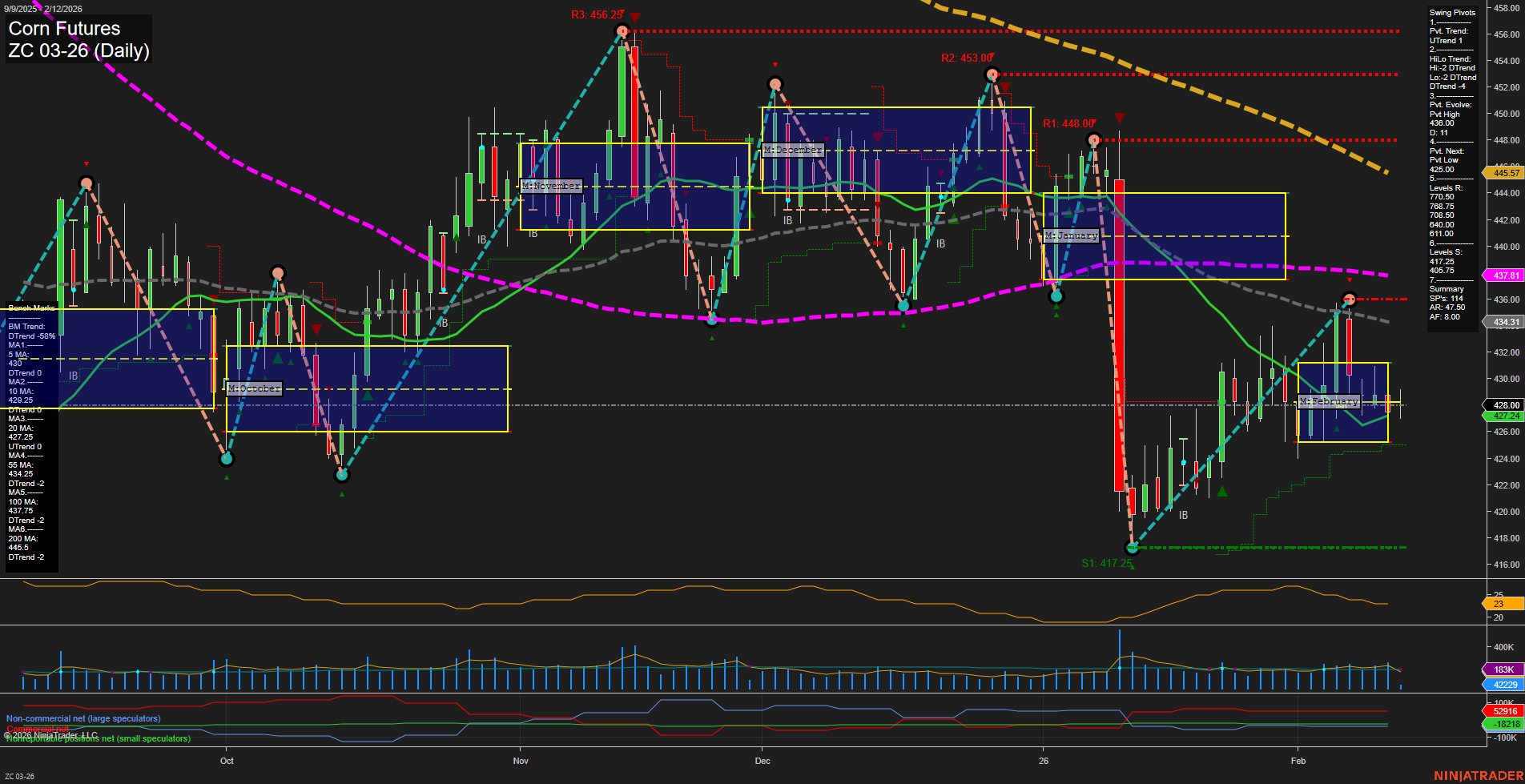

Corn futures are currently trading in a medium-range bar environment with average momentum, reflecting a market that is neither strongly trending nor consolidating tightly. The price is below all major session fib grid centers (weekly, monthly, yearly), and all these grids are trending down, indicating persistent bearish pressure across all timeframes. Swing pivots show a short-term uptrend, but the intermediate-term trend remains down, with the most recent pivot high at 434.00 and the next potential pivot low at 425.00. Resistance levels are stacked above, with significant resistance at 434.00 and higher, while support is found at 417.25 and 405.75. Daily benchmarks reinforce the bearish bias, as most moving averages (except the 20-day) are in downtrends and price is trading below them. The 20-day MA is the only one showing an uptrend, suggesting a possible short-term bounce or retracement within a broader downtrend. ATR and volume metrics indicate moderate volatility and participation. Recent trade signals show mixed short and long entries, reflecting the choppy, two-way action as the market tests support and resistance zones. Overall, the market is in a corrective phase within a larger downtrend, with short-term attempts to rally facing strong overhead resistance. The technical setup suggests a market that is vulnerable to further downside if support levels break, but with potential for short-lived bounces as traders react to oversold conditions and key technical levels.