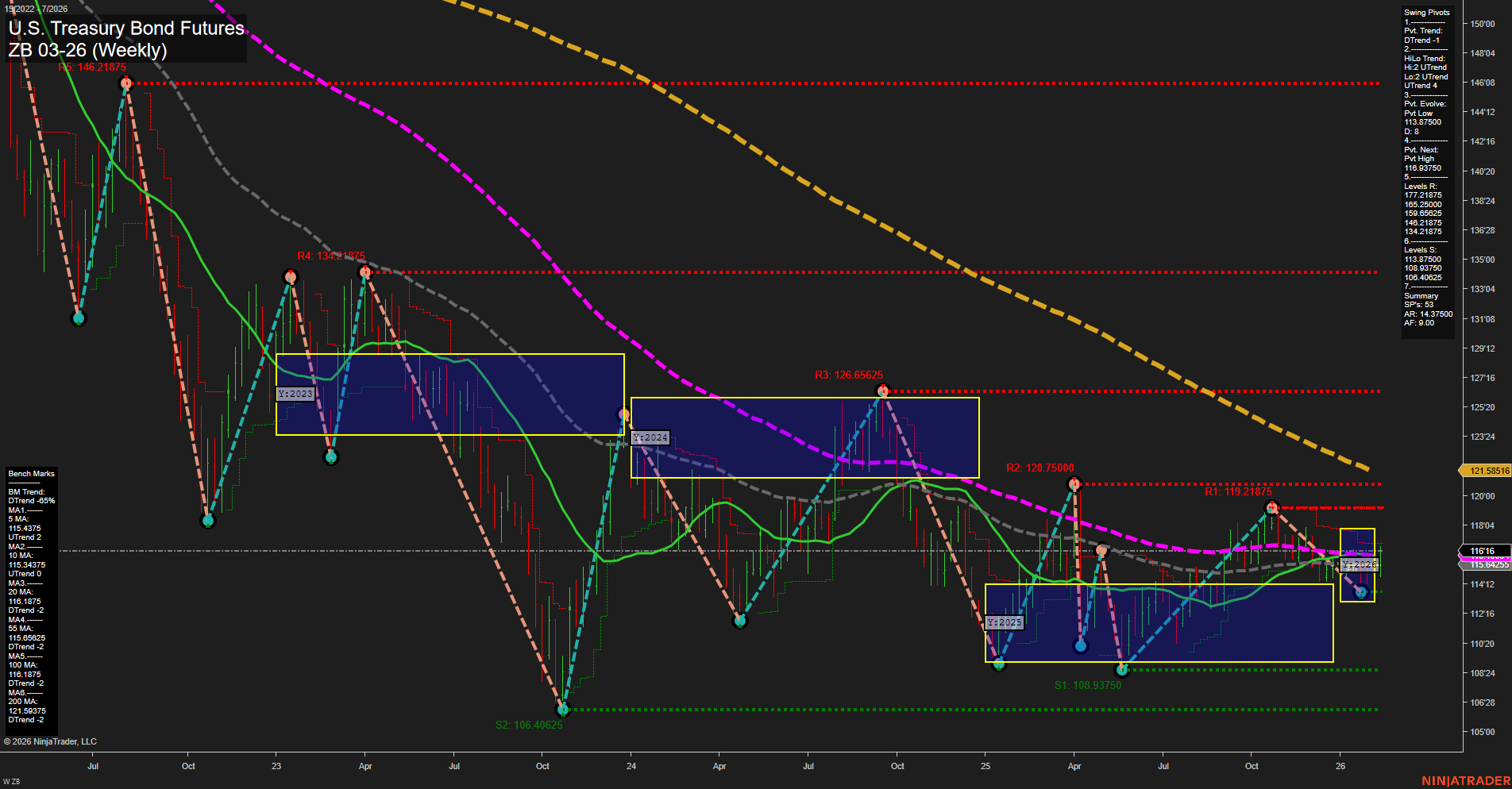

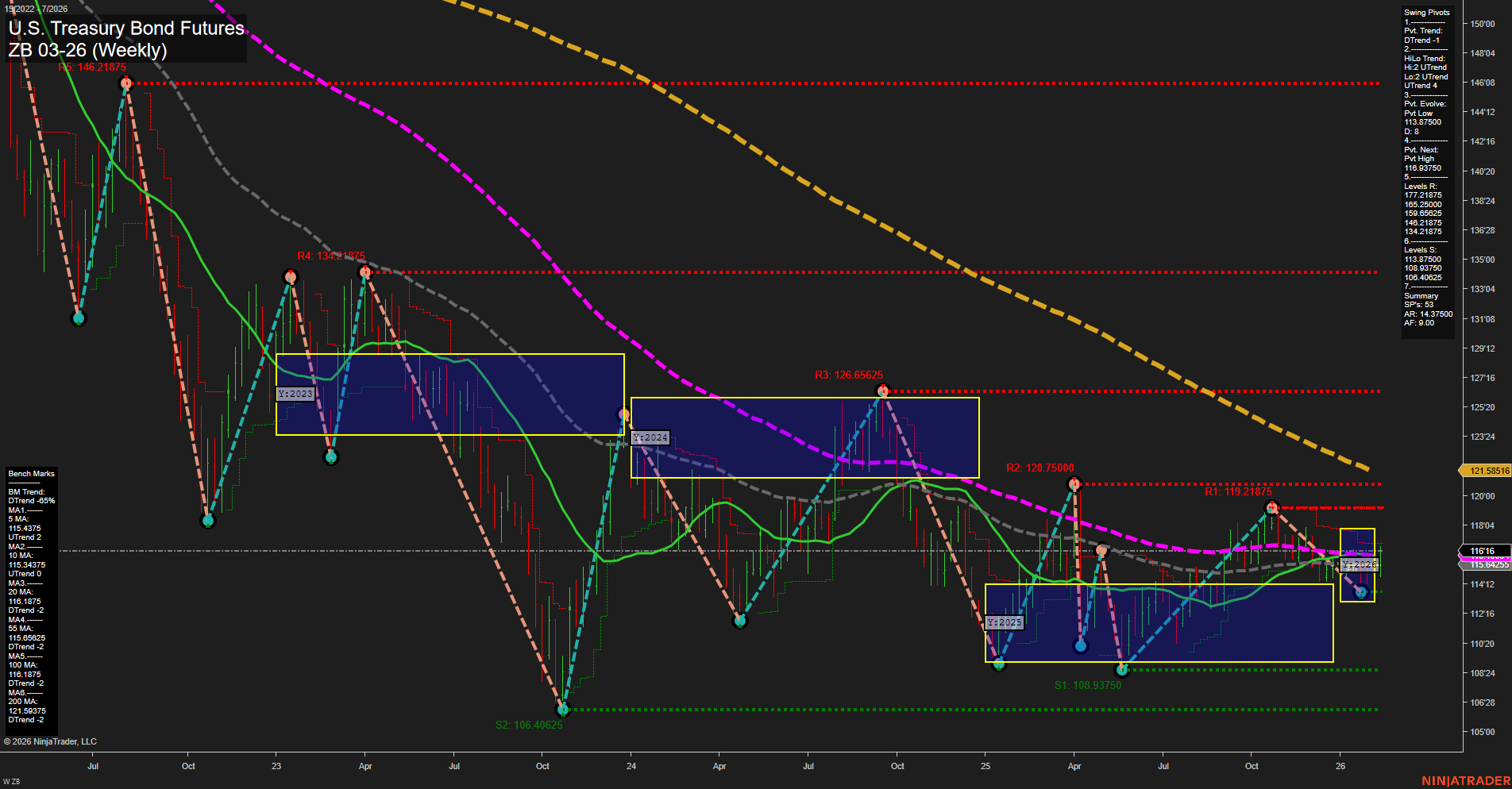

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2026-Feb-12 07:21 CT

Price Action

- Last: 121.58516,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend-1,

- (Intermediate-Term) 2. HiLo Trend: UTrend-2,

- 3. Pvt. Evolve: Pvt Low 113.87500,

- 4. Pvt. Next: Pvt High 119.93750,

- 5. Levels R: 146.21875, 134.9375, 126.65625, 120.75, 119.21875,

- 6. Levels S: 113.875, 108.9375, 106.40625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115.4375 Down Trend,

- (Intermediate-Term) 10 Week: 115.94375 Up Trend,

- (Long-Term) 20 Week: 116.1875 Up Trend,

- (Long-Term) 55 Week: 115.9625 Down Trend,

- (Long-Term) 100 Week: 110.1875 Up Trend,

- (Long-Term) 200 Week: 121.86437 Down Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition, with price currently at 121.58516 and momentum on the slower side. The short-term trend is neutral, as indicated by the WSFG and the most recent swing pivot direction (DTrend-1), suggesting a pause or consolidation after recent moves. Intermediate-term signals are more constructive, with the HiLo trend (UTrend-2) and several moving averages (10 and 20 week) turning upward, hinting at a potential recovery or sustained bounce from recent lows. Long-term signals remain mixed, with the 200-week moving average still in a downtrend, but the 100-week average trending up, reflecting a market that is stabilizing but not yet in a confirmed uptrend. Key resistance levels are clustered above, notably at 120.75 and 119.21875, while support is firm at 113.875 and 108.9375. The overall structure suggests the market is digesting prior volatility, with a bias toward range-bound or consolidative action in the short term, but with improving prospects on the intermediate horizon as higher lows and upward-trending averages begin to assert themselves. No clear breakout or breakdown is evident, and the market appears to be awaiting a catalyst for the next directional move.

Chart Analysis ATS AI Generated: 2026-02-12 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.