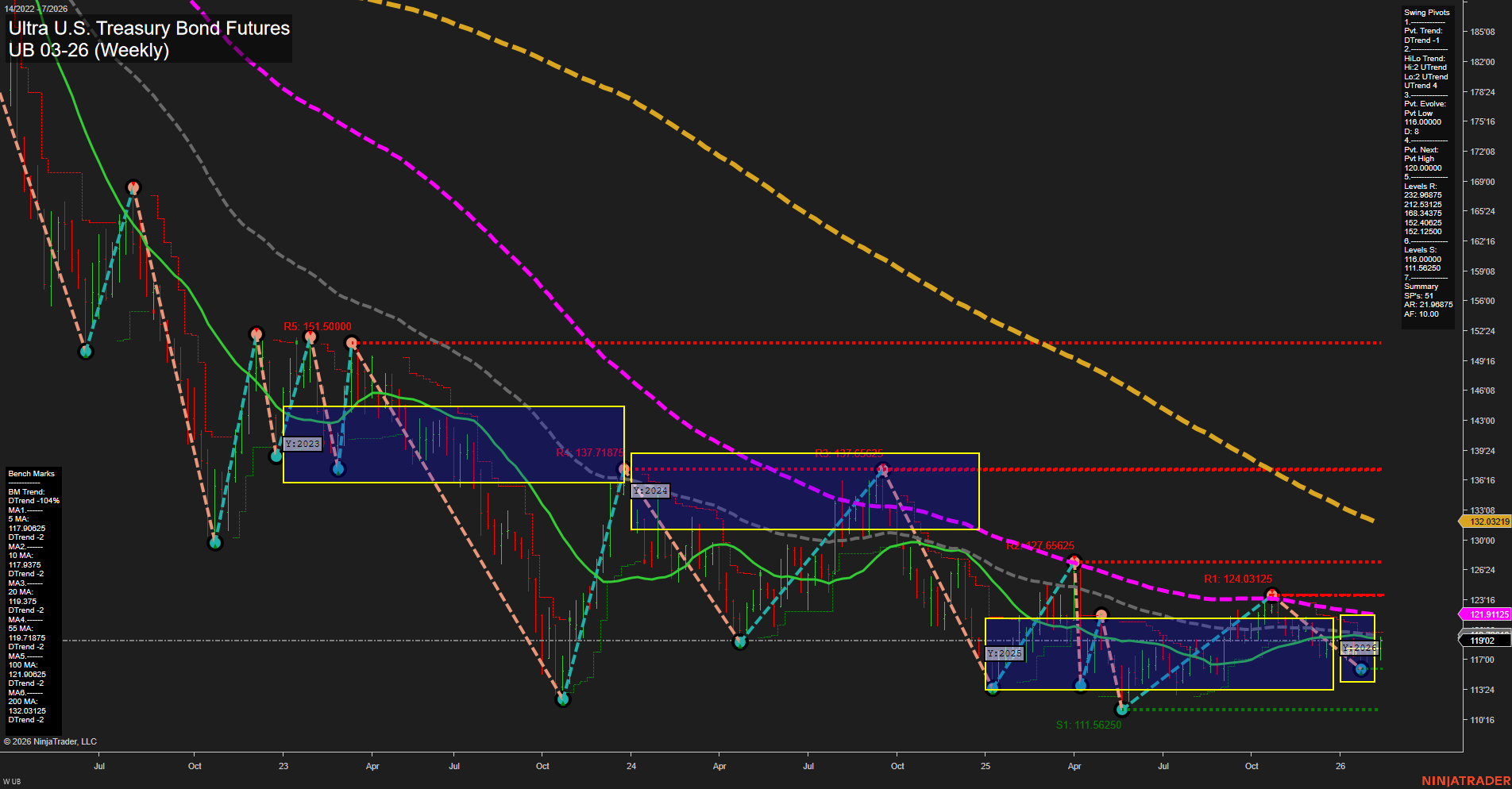

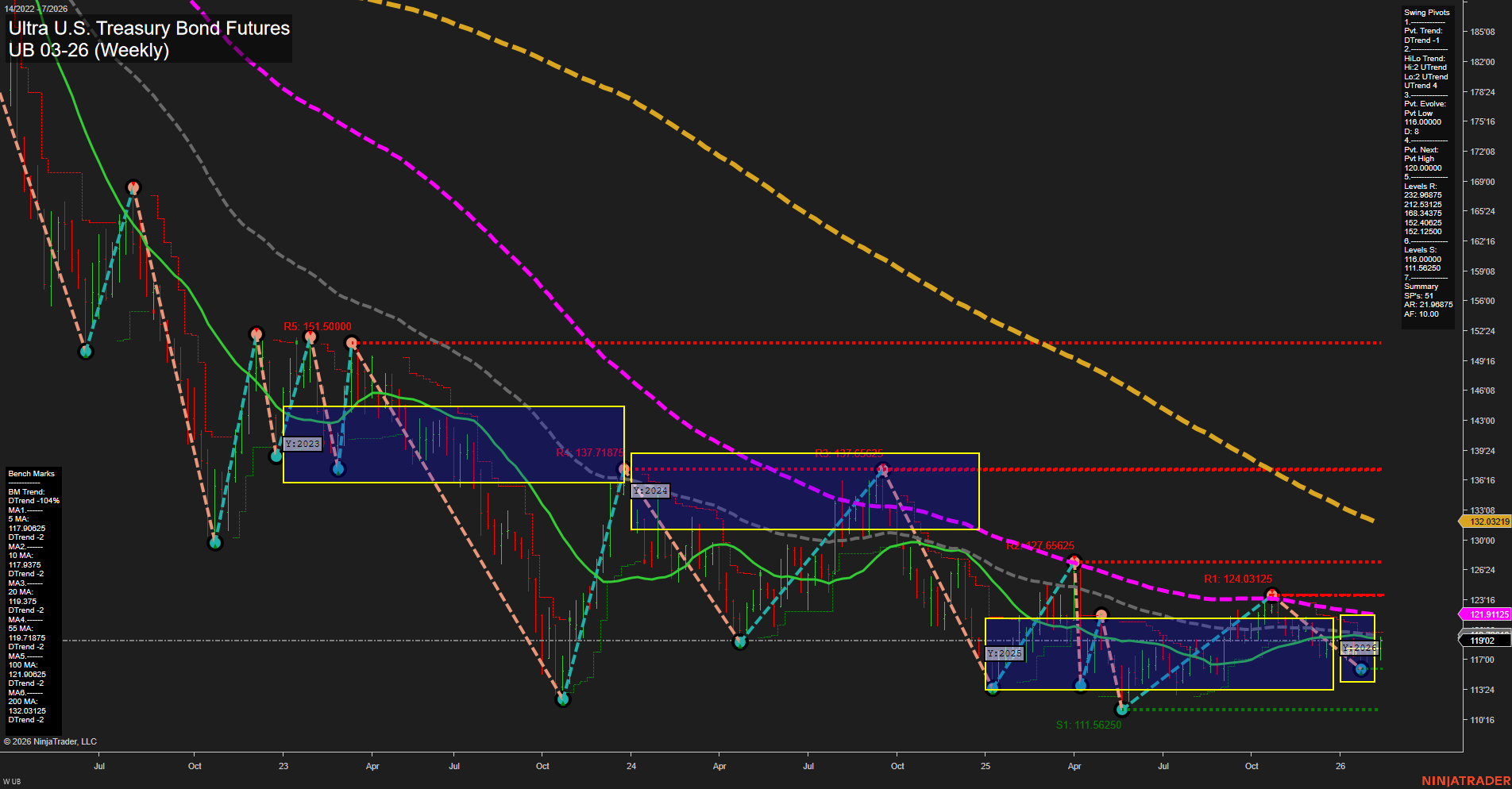

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2026-Feb-12 07:19 CT

Price Action

- Last: 119'07,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 72%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 48%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 116'00,

- 4. Pvt. Next: Pvt high 120'00,

- 5. Levels R: 120'00, 124'03, 127'65, 137'71, 151'50,

- 6. Levels S: 116'00, 111'56.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 119'27 Up Trend,

- (Intermediate-Term) 10 Week: 119'14 Up Trend,

- (Long-Term) 20 Week: 121'91 Up Trend,

- (Long-Term) 55 Week: 121'03 Down Trend,

- (Long-Term) 100 Week: 132'03 Down Trend,

- (Long-Term) 200 Week: 130'09 Down Trend.

Recent Trade Signals

- 10 Feb 2026: Long UB 03-26 @ 119.09375 Signals.USAR.TR720

- 10 Feb 2026: Long UB 03-26 @ 118 Signals.USAR-MSFG

- 10 Feb 2026: Long UB 03-26 @ 117.8125 Signals.USAR-WSFG

- 05 Feb 2026: Long UB 03-26 @ 117.625 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has stabilized with medium-sized bars and average momentum, suggesting a pause after recent volatility. The short-term (WSFG) and intermediate-term (MSFG) Fib grid trends are both up, with price holding above their respective NTZ/F0% levels, indicating underlying bullish pressure. However, the short-term swing pivot trend is still down, reflecting recent pullbacks, while the intermediate-term HiLo trend has shifted up, hinting at a possible reversal or base formation.

Key resistance levels are clustered at 120'00 and above, with the next major support at 116'00. The 5- and 10-week moving averages are trending up, supporting the intermediate-term bullish case, but longer-term benchmarks (55, 100, 200 week) remain in downtrends, showing that the broader bear market is not yet fully reversed.

Recent trade signals have all been to the long side, aligning with the improving intermediate-term structure. Overall, the market is showing early signs of a potential trend change, with intermediate-term bullishness emerging, but short-term and long-term signals remain mixed. The market appears to be in a consolidation phase, possibly building a base for a larger move if resistance levels are overcome.

Chart Analysis ATS AI Generated: 2026-02-12 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.