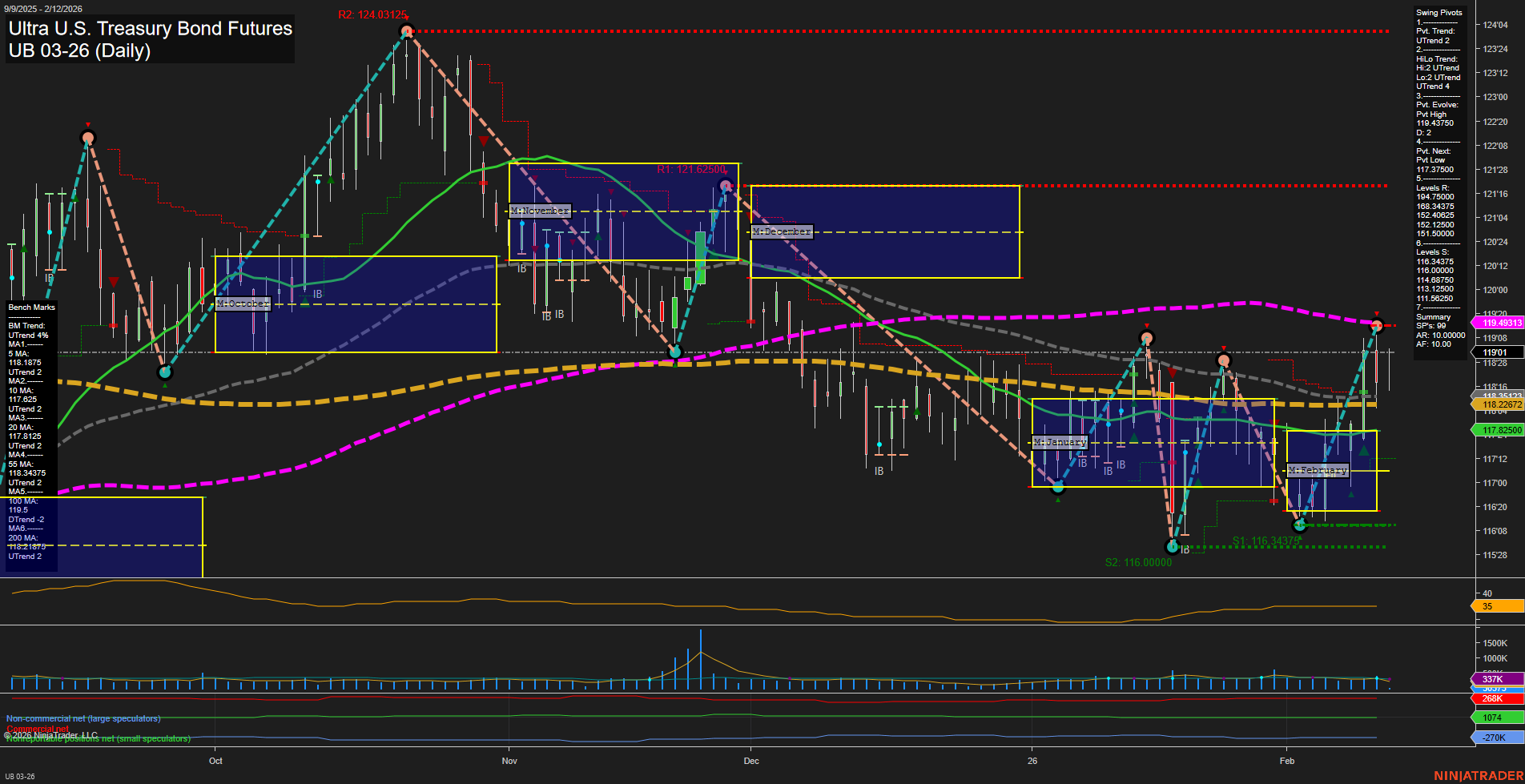

The UB Ultra U.S. Treasury Bond Futures are showing a coordinated uptrend across short, intermediate, and long-term timeframes. Price action has recently accelerated above key session fib grid levels, with the last price at 119.09375 and momentum holding at an average pace. The swing pivot structure confirms a short-term uptrend, with the most recent pivot high at 119.4375 and the next potential pivot low at 117.375, suggesting a healthy sequence of higher highs and higher lows. Resistance is layered above at 119.4375, 121.625, and 124.03125, while support is well-defined at 117.375 and below. Benchmark moving averages reinforce the bullish bias in the short and intermediate term, with the 5, 10, and 20-day MAs trending up and price trading above these levels. However, the 55, 100, and 200-day MAs remain in a downtrend, indicating that the longer-term structure is still in transition, but the recent price action is challenging these longer-term averages. ATR and volume metrics suggest moderate volatility and healthy participation. Recent trade signals have all been to the long side, aligning with the prevailing uptrend. The market appears to be in a recovery phase, possibly following a prior period of consolidation or pullback, and is now testing overhead resistance levels. The technical setup favors trend continuation, with the potential for further upside if resistance levels are breached, while the well-defined support zones provide a clear structure for monitoring any retracement or reversal.