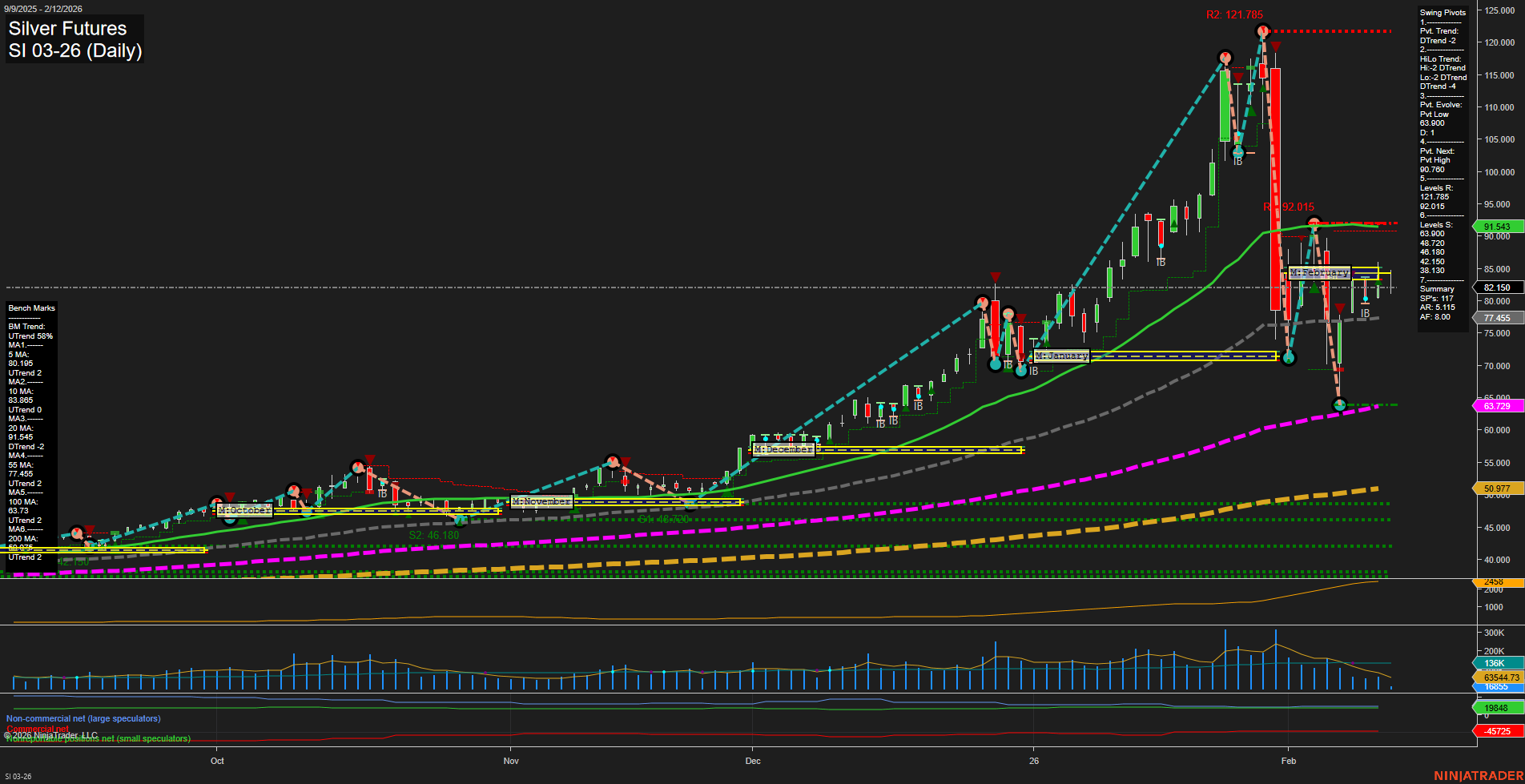

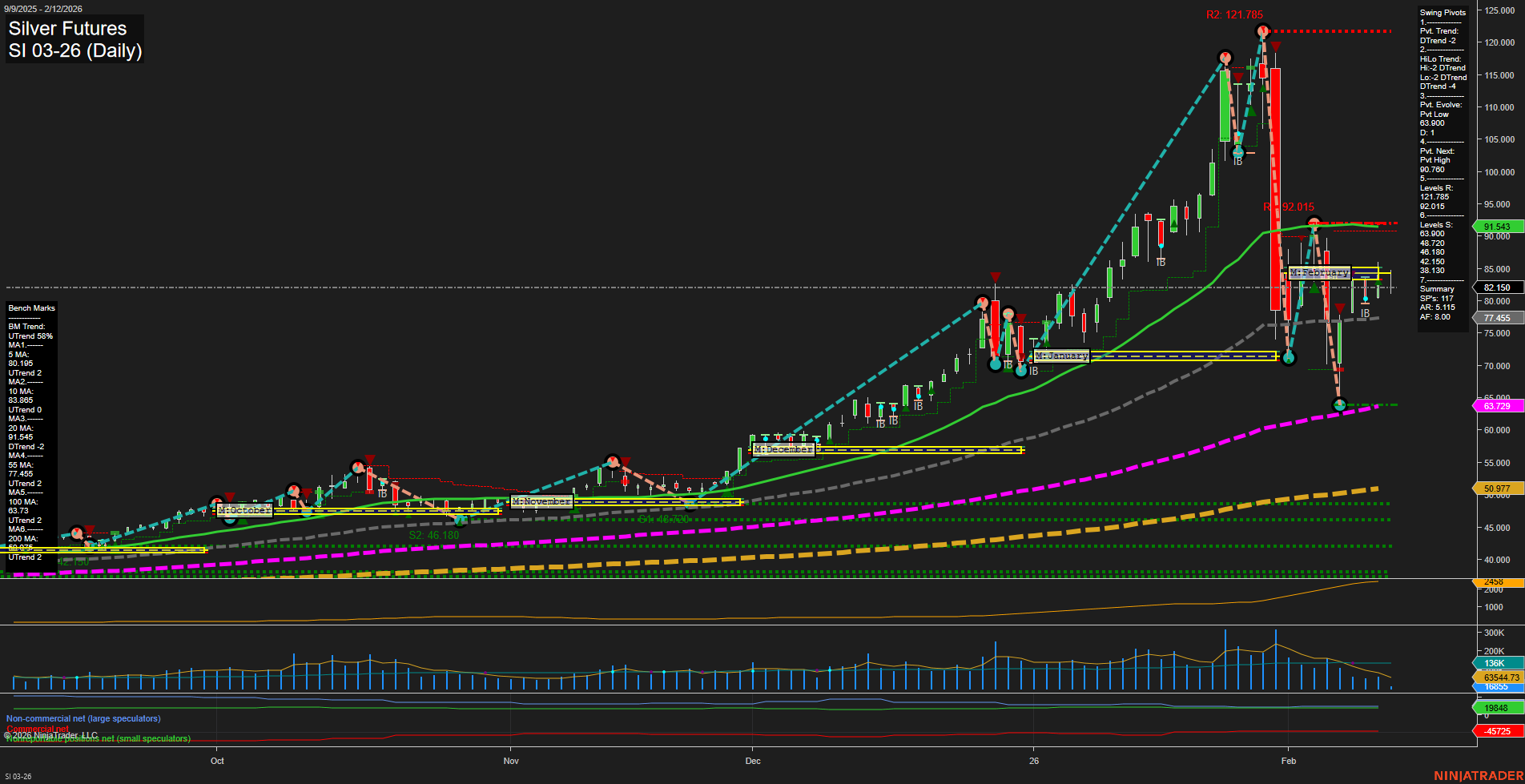

SI Silver Futures Daily Chart Analysis: 2026-Feb-12 07:17 CT

Price Action

- Last: 83.51,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 63.729,

- 4. Pvt. Next: Pvt high 92.015,

- 5. Levels R: 121.785, 92.015,

- 6. Levels S: 63.729, 46.180.

Daily Benchmarks

- (Short-Term) 5 Day: 80.185 Down Trend,

- (Short-Term) 10 Day: 83.885 Down Trend,

- (Intermediate-Term) 20 Day: 91.543 Down Trend,

- (Intermediate-Term) 55 Day: 75.455 Up Trend,

- (Long-Term) 100 Day: 70.703 Up Trend,

- (Long-Term) 200 Day: 50.977 Up Trend.

Additional Metrics

Recent Trade Signals

- 11 Feb 2026: Long SI 03-26 @ 83.51 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

Silver futures have experienced a sharp and volatile correction from recent highs, with large, fast-moving bars indicating heightened volatility and strong momentum to the downside. The short-term and intermediate-term trends, as reflected by both swing pivots and moving averages, are currently bearish, with price trading below key monthly session fib grid levels and short-term benchmarks. However, the long-term trend remains bullish, supported by higher timeframe moving averages and the yearly session fib grid, suggesting the broader uptrend is still intact. The recent bounce from the 63.729 swing low support level and a new long signal may indicate the potential for a short-term retracement or relief rally, but the market remains in a corrective phase with resistance overhead at 92.015 and 121.785. Volatility is elevated, and volume remains robust, reflecting active participation during this correction. The overall structure suggests a market in transition, with the potential for further choppy price action as it tests key support and resistance levels.

Chart Analysis ATS AI Generated: 2026-02-12 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.