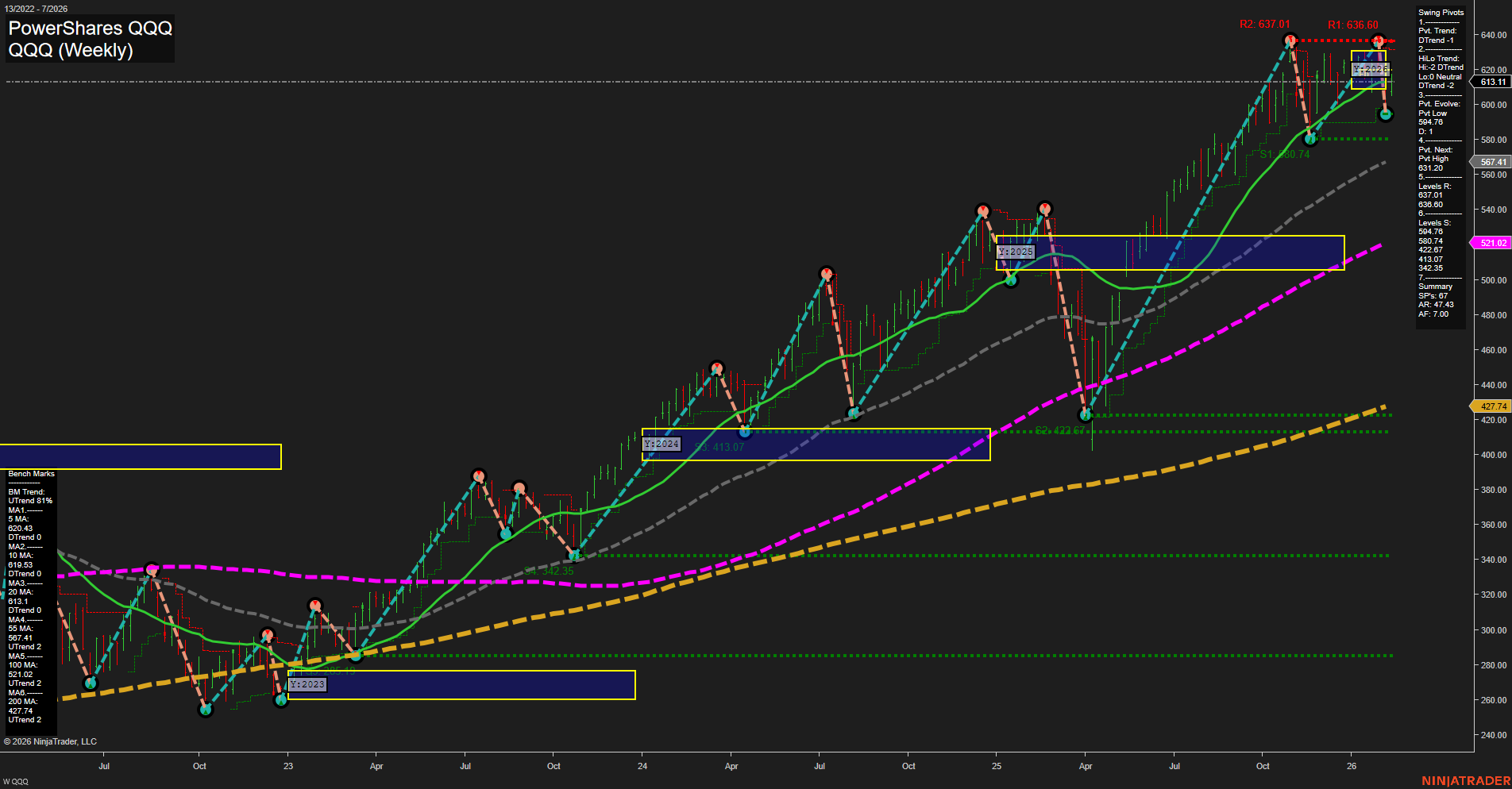

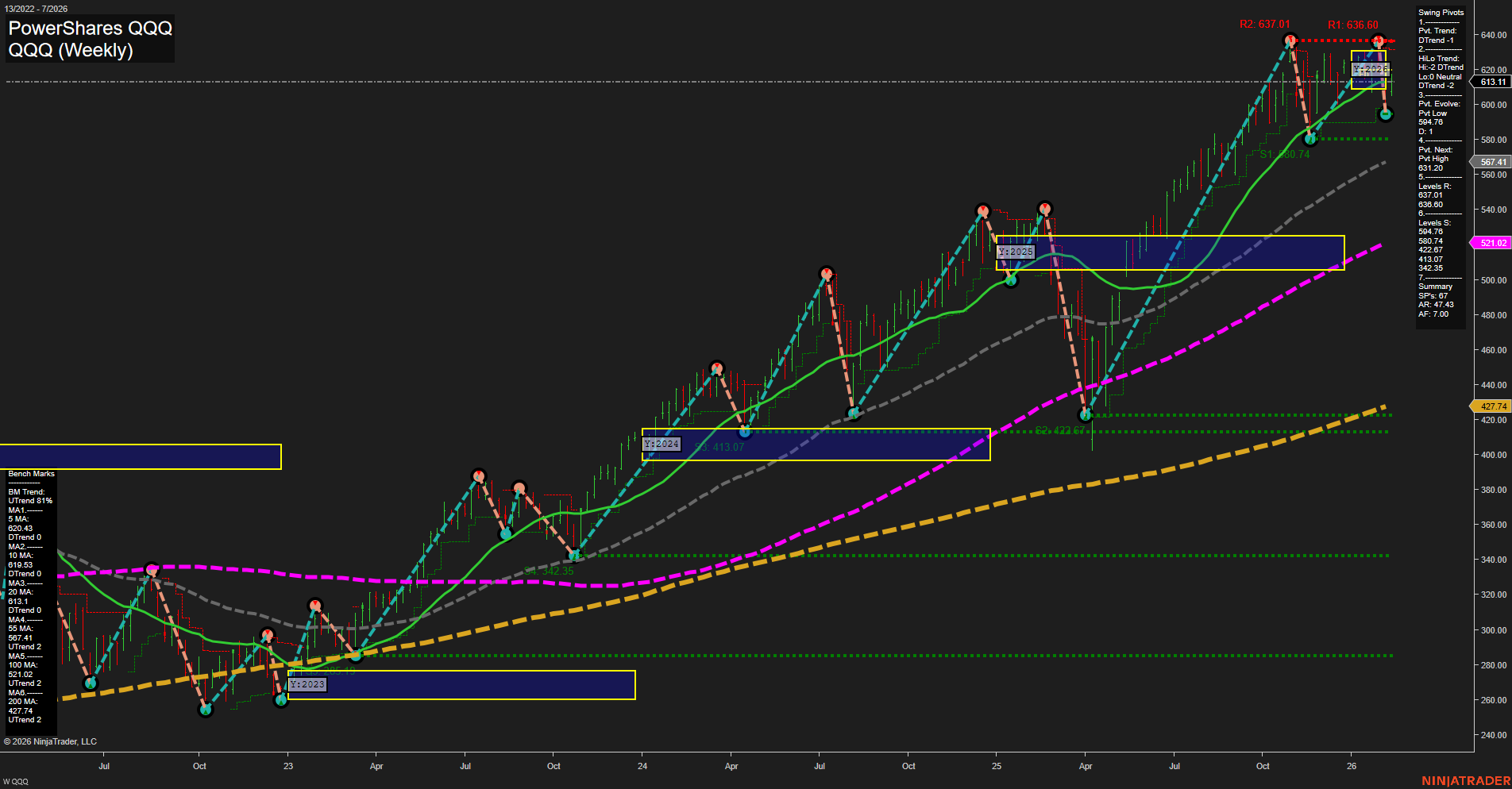

QQQ PowerShares QQQ Weekly Chart Analysis: 2026-Feb-12 07:23 CT

Price Action

- Last: 613.11,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 637.01,

- 4. Pvt. Next: Pvt low 567.41,

- 5. Levels R: 637.01, 636.60,

- 6. Levels S: 567.41, 521.02, 472.67.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 620.43 DTrend,

- (Intermediate-Term) 10 Week: 613.14 DTrend,

- (Long-Term) 20 Week: 567.41 UTrend,

- (Long-Term) 55 Week: 521.02 UTrend,

- (Long-Term) 100 Week: 427.74 UTrend,

- (Long-Term) 200 Week: 427.74 UTrend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The QQQ weekly chart shows a market in transition. Price action has recently pulled back from a swing high at 637.01, with the last price at 613.11 and average momentum. Short-term signals are bearish, as indicated by the downtrend in both the 5- and 10-week moving averages and the current swing pivot trend. However, the intermediate- and long-term outlooks remain bullish, supported by uptrends in the 20-, 55-, 100-, and 200-week moving averages and a higher low structure on the swing pivots. The market is consolidating above key support at 567.41, with resistance at the recent highs. This setup suggests a corrective phase within a broader uptrend, with the potential for further consolidation or a resumption of the upward move if support holds. Volatility has increased, and the market is digesting gains after a strong rally, typical of a swing trader’s environment where both pullbacks and trend continuations are in play.

Chart Analysis ATS AI Generated: 2026-02-12 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.