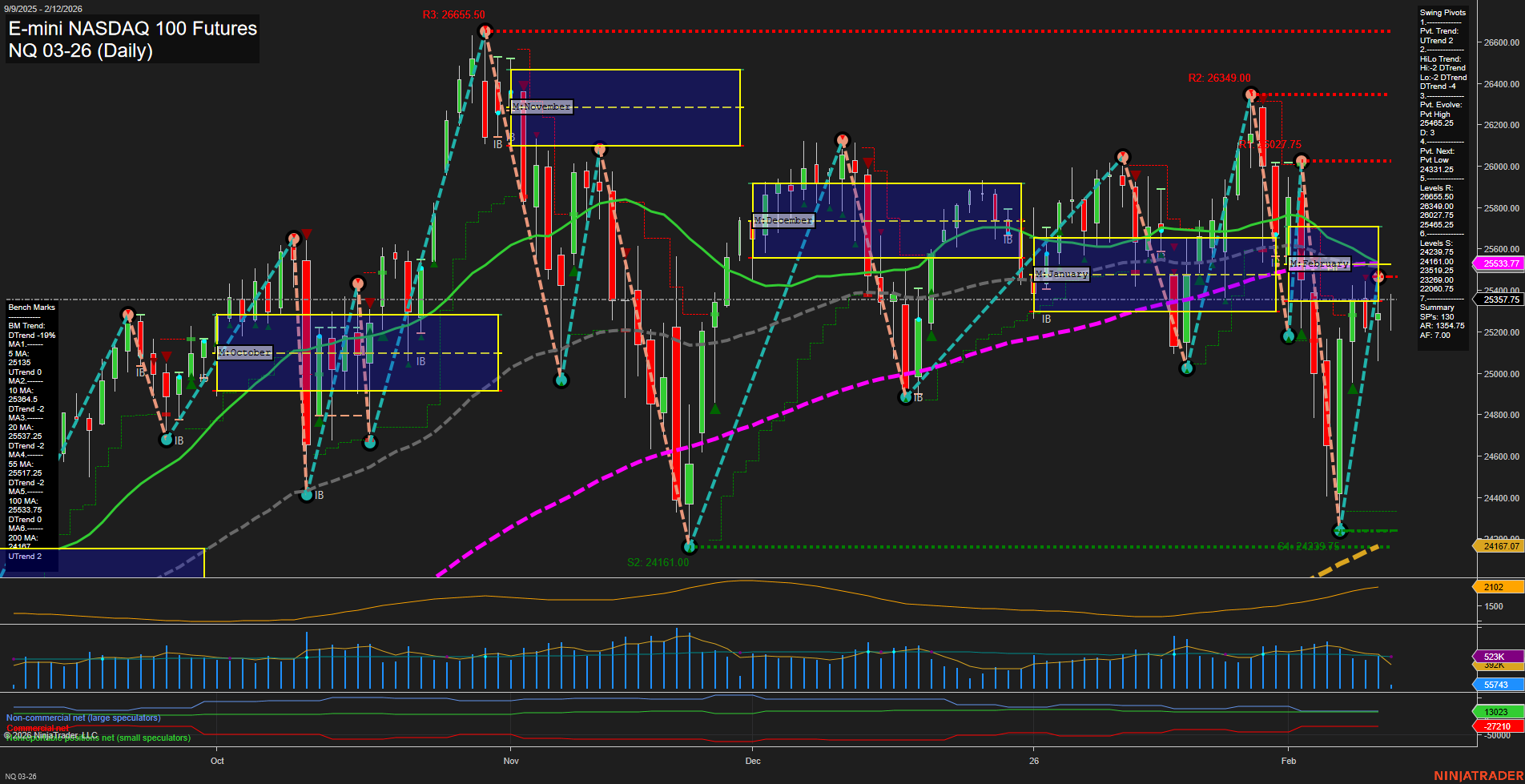

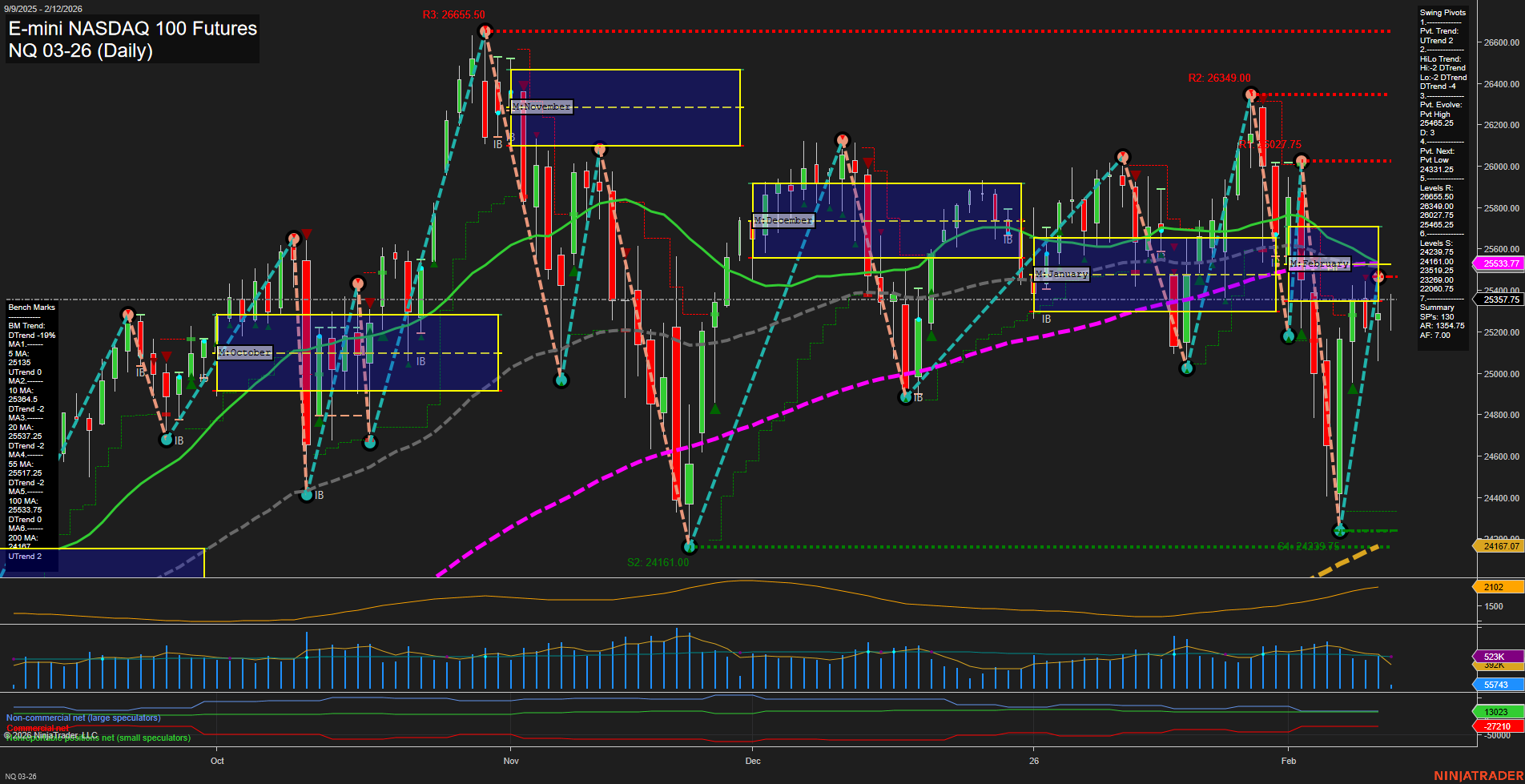

NQ E-mini NASDAQ 100 Futures Daily Chart Analysis: 2026-Feb-12 07:16 CT

Price Action

- Last: 25,357.75,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -10%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -11%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 26,049.25,

- 4. Pvt. Next: Pvt Low 24,239.75,

- 5. Levels R: 26,431.25, 26,349.00, 26,049.25, 25,827.75, 25,684.00, 25,533.77,

- 6. Levels S: 24,239.75, 24,161.00.

Daily Benchmarks

- (Short-Term) 5 Day: 25,153 Up Trend,

- (Short-Term) 10 Day: 25,137 Up Trend,

- (Intermediate-Term) 20 Day: 25,377.25 Down Trend,

- (Intermediate-Term) 55 Day: 25,617.25 Down Trend,

- (Long-Term) 100 Day: 25,883.75 Down Trend,

- (Long-Term) 200 Day: 25,683.75 Down Trend.

Additional Metrics

- ATR: 1618,

- VOLMA: 626746.

Recent Trade Signals

- 11 Feb 2026: Long NQ 03-26 @ 25271 Signals.USAR-WSFG

- 06 Feb 2026: Long NQ 03-26 @ 25084.25 Signals.USAR.TR120

- 04 Feb 2026: Short NQ 03-26 @ 25194.25 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures daily chart shows a strong short-term recovery with fast momentum and large bars, as evidenced by the recent sharp bounce from support near 24,239.75. The short-term trend has shifted to an uptrend, supported by both the 5-day and 10-day moving averages turning up, and the price currently trading above the weekly session fib grid (WSFG) NTZ center. However, the intermediate and long-term outlooks remain bearish, with the monthly and yearly session fib grids (MSFG and YSFG) both trending down and price below their respective NTZ centers. The 20, 55, 100, and 200-day moving averages are all in downtrends, indicating persistent overhead resistance and a lack of sustained longer-term buying pressure. Swing pivot analysis highlights a recent pivot high at 26,049.25 and a key support at 24,239.75, with multiple resistance levels overhead. Volatility remains elevated (ATR 1618), and volume is robust. Recent trade signals reflect a short-term bullish bias, but the broader context suggests this move is a countertrend rally within a larger bearish structure. The market is currently in a recovery phase, testing resistance levels after a significant sell-off, but faces headwinds from higher timeframe trends and moving averages.

Chart Analysis ATS AI Generated: 2026-02-12 07:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.