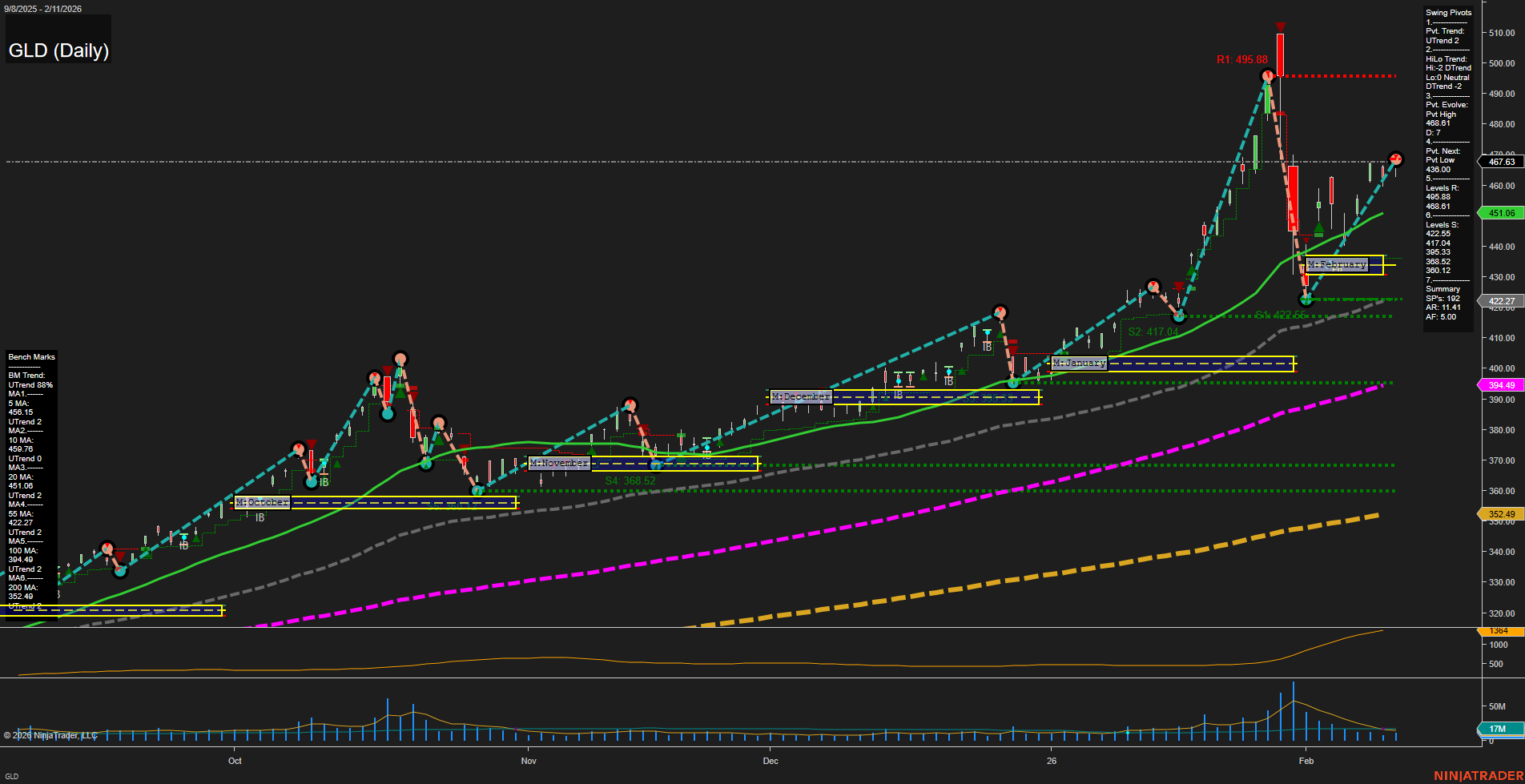

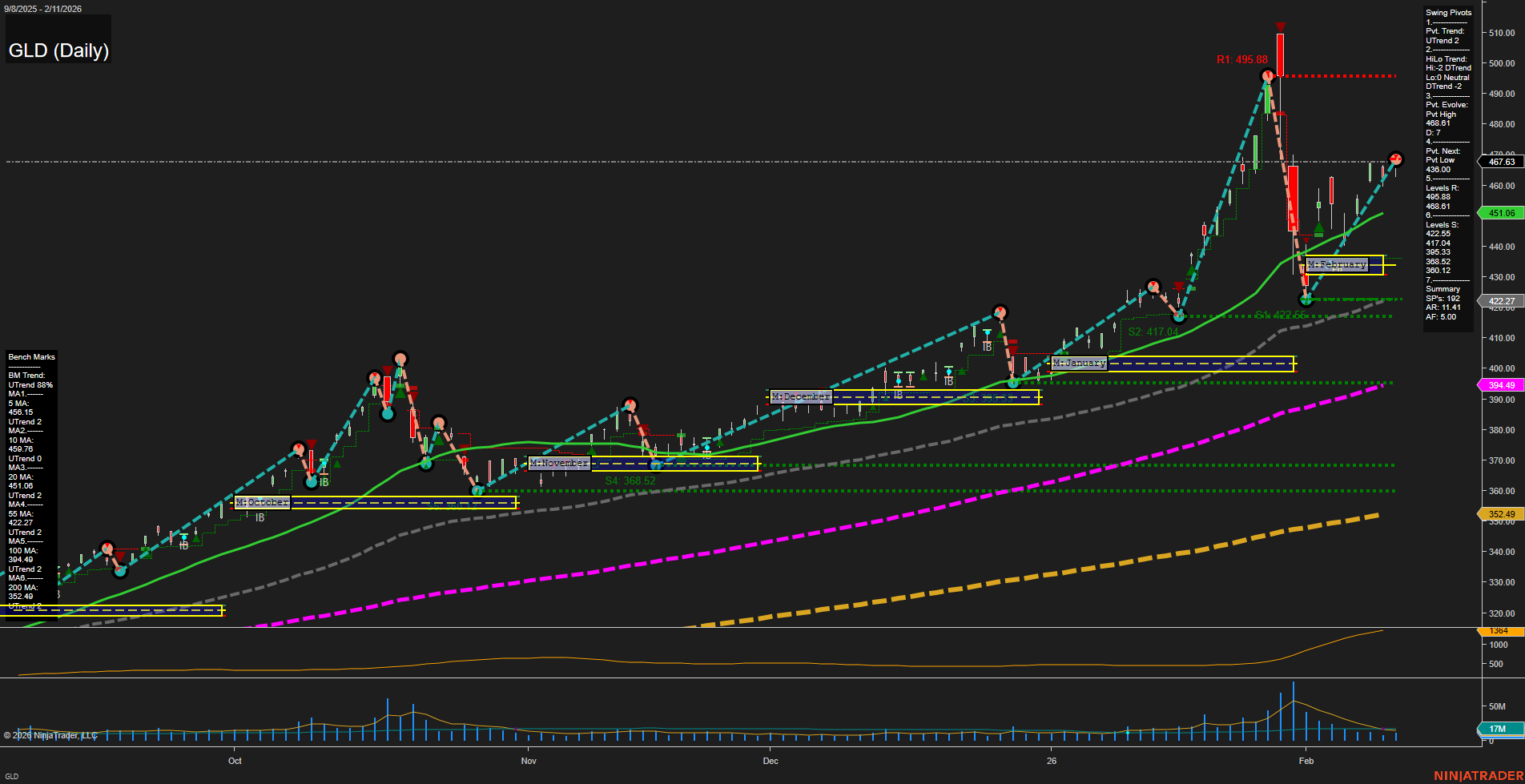

GLD SPDR Gold Shares Daily Chart Analysis: 2026-Feb-12 07:14 CT

Price Action

- Last: 422.77,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 467.63,

- 4. Pvt. Next: Pvt low 438.00,

- 5. Levels R: 495.88, 485.95, 468.81, 467.63,

- 6. Levels S: 422.65, 417.04, 368.52, 300.12.

Daily Benchmarks

- (Short-Term) 5 Day: 456.19 Up Trend,

- (Short-Term) 10 Day: 450.16 Up Trend,

- (Intermediate-Term) 20 Day: 451.06 Up Trend,

- (Intermediate-Term) 55 Day: 394.49 Up Trend,

- (Long-Term) 100 Day: 380.44 Up Trend,

- (Long-Term) 200 Day: 352.49 Up Trend.

Additional Metrics

- ATR: 159,

- VOLMA: 7,207,880.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

GLD has recently experienced a sharp pullback from its all-time high at 495.88, with large, fast-moving bars indicating heightened volatility and a potential exhaustion move. The short-term swing pivot trend has shifted back to an uptrend, but the intermediate-term HiLo trend remains in a downtrend, reflecting a market in transition after a significant rally and subsequent correction. Price is currently consolidating above a key support cluster (422.65/417.04), with resistance levels overhead at 467.63 and 468.81. All benchmark moving averages are trending upward, confirming the underlying long-term bullish structure, though the current price is below the short-term averages, suggesting a pause or retracement phase. ATR remains elevated, and volume has spiked, signaling active participation and possible positioning for the next directional move. The overall environment is one of consolidation after a volatile correction, with the long-term trend intact but short- and intermediate-term signals mixed as the market digests recent gains and tests support.

Chart Analysis ATS AI Generated: 2026-02-12 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.