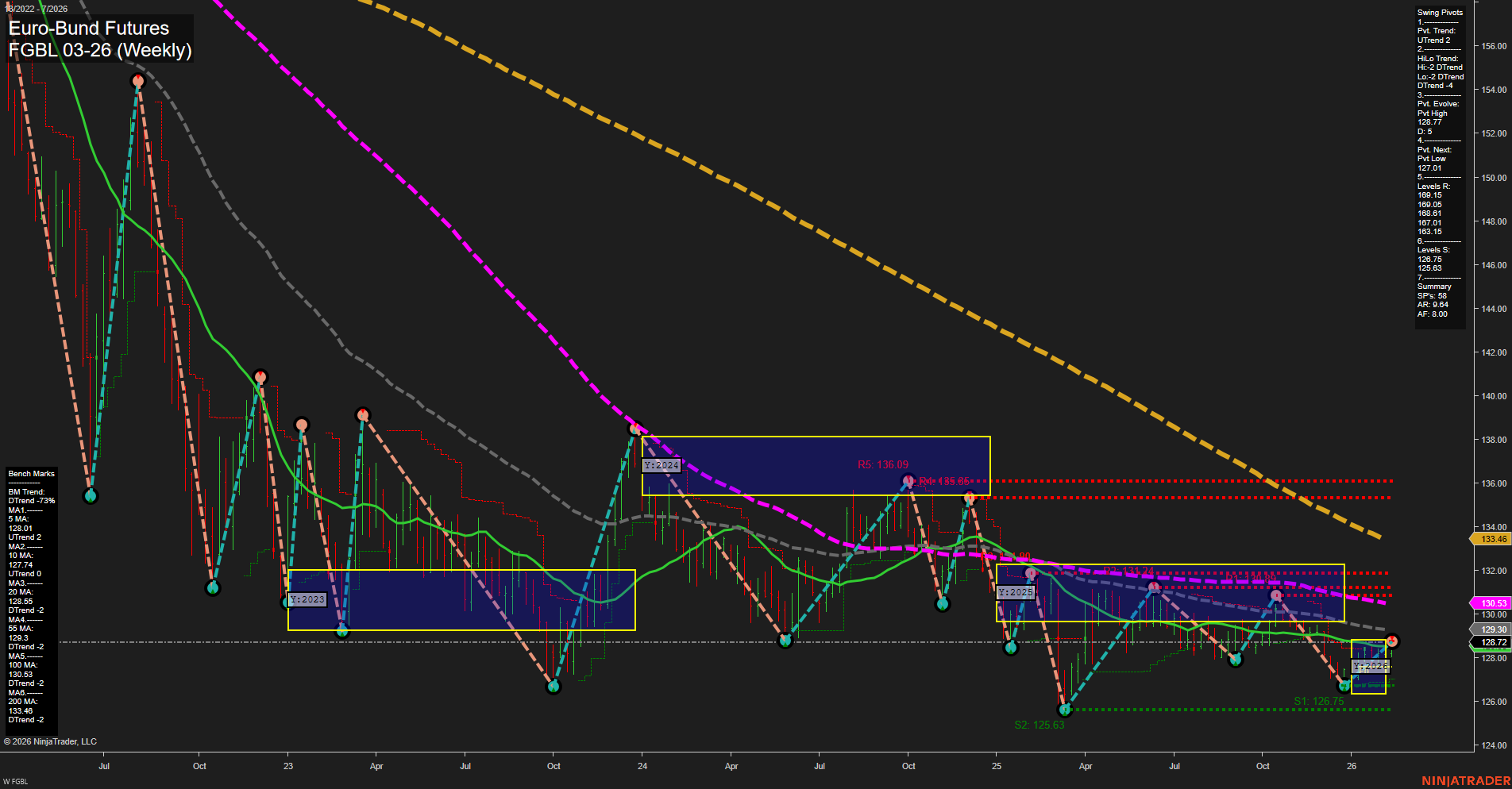

The FGBL Euro-Bund Futures weekly chart shows a market in transition. Price action is currently consolidating near 128.72 with medium-sized bars and slow momentum, suggesting a pause after recent volatility. The short-term WSFG and monthly MSFG both indicate an upward trend, with price holding above their respective NTZ/F0% levels, reflecting a constructive bias for swing traders looking for upside continuation. However, the intermediate-term HiLo trend remains down, and most long-term moving averages (20, 55, 100, 200 week) are still trending lower, highlighting persistent overhead resistance and a lack of broad-based bullish confirmation. Swing pivot analysis reveals the most recent evolution was a pivot high at 132.17, with the next key support at 127.07 and major resistance levels stacked above at 133.15–136.09. The recent cluster of long trade signals aligns with the short-term uptrend, but the presence of a short signal just prior suggests ongoing choppiness and potential for false breakouts. Overall, the market is showing early signs of a possible trend reversal, but remains range-bound between well-defined support and resistance, with a need for stronger momentum or a breakout above the 20/55/100-week moving averages to confirm a sustained bullish move. Swing traders should be attentive to further price action around these key levels, as the market could either build on this base for a rally or revert back into the established range.