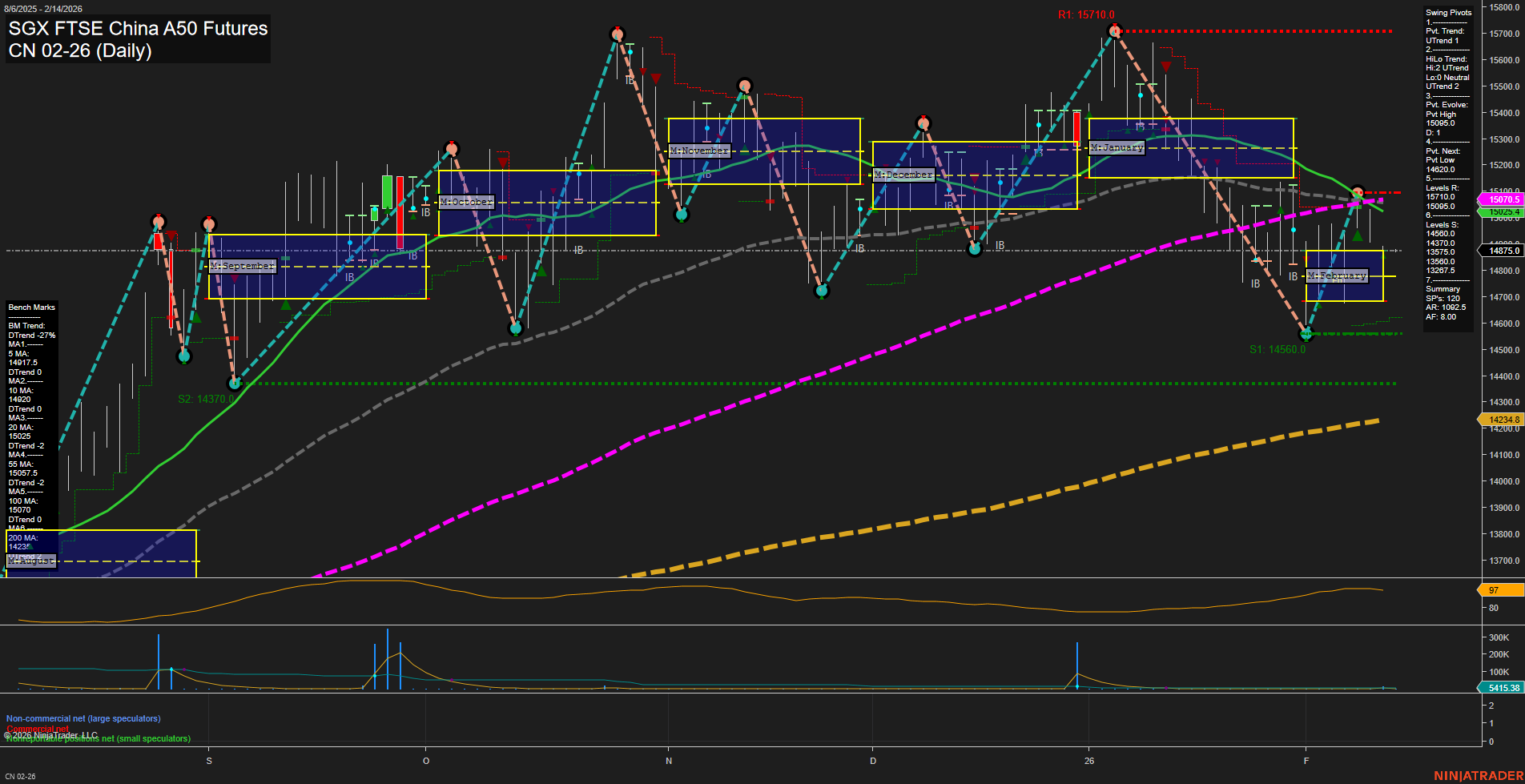

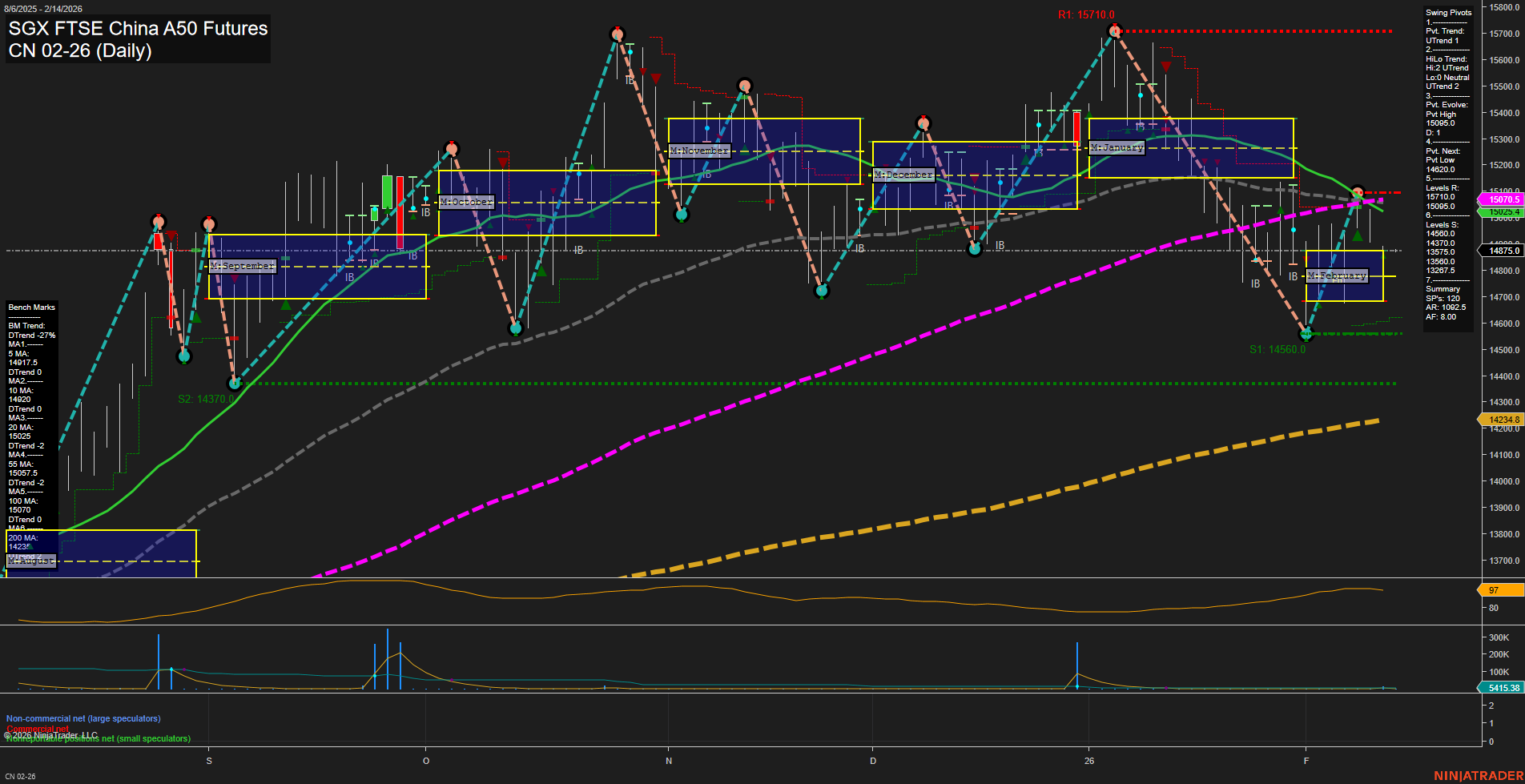

CN SGX FTSE China A50 Futures Daily Chart Analysis: 2026-Feb-12 07:07 CT

Price Action

- Last: 15075.0,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 15095.0,

- 4. Pvt. Next: Pvt low 14620.0,

- 5. Levels R: 15710.0, 15095.0,

- 6. Levels S: 14620.0, 14560.0, 14370.0, 13257.5.

Daily Benchmarks

- (Short-Term) 5 Day: 14971.5 Down Trend,

- (Short-Term) 10 Day: 15028.5 Down Trend,

- (Intermediate-Term) 20 Day: 15057.5 Down Trend,

- (Intermediate-Term) 55 Day: 15187.0 Down Trend,

- (Long-Term) 100 Day: 15070.0 Down Trend,

- (Long-Term) 200 Day: 14234.8 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The CN SGX FTSE China A50 Futures daily chart currently reflects a market in transition. Price action is consolidating near 15075.0 with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains down, suggesting a possible countertrend bounce within a broader corrective phase. All key moving averages (5, 10, 20, 55, 100-day) are trending down, reinforcing the intermediate-term bearish bias, while the 200-day MA is still in an uptrend, hinting at longer-term structural support. Resistance is clustered at 15095.0 and 15710.0, with support levels layered below at 14620.0, 14560.0, and 14370.0. Volatility (ATR) is moderate, and volume metrics are stable. Overall, the market is in a neutral-to-bearish posture, with short-term attempts to recover facing headwinds from prevailing intermediate-term weakness. The environment is characterized by consolidation and potential for further choppy price action unless a decisive breakout or breakdown occurs.

Chart Analysis ATS AI Generated: 2026-02-12 07:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.