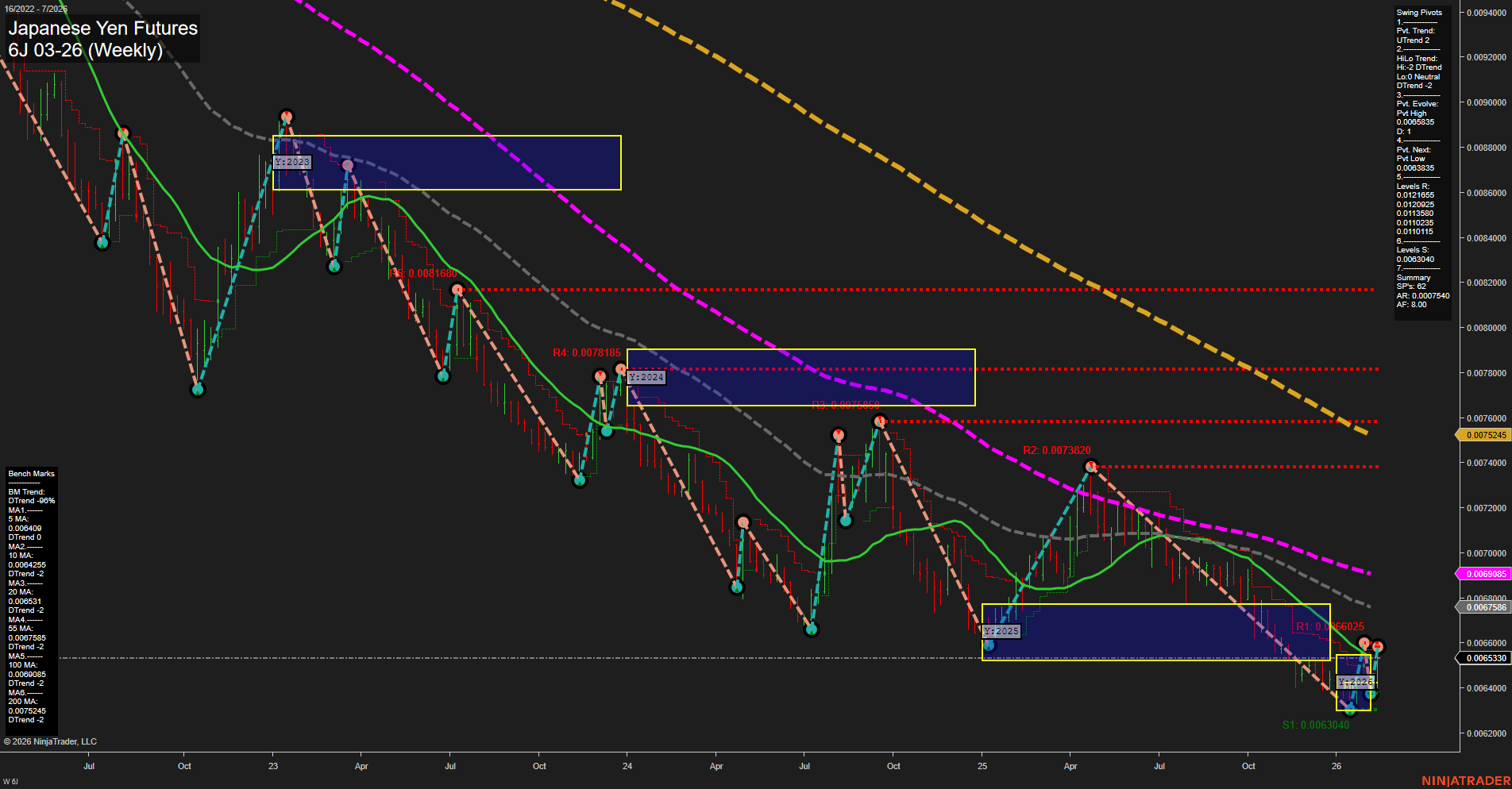

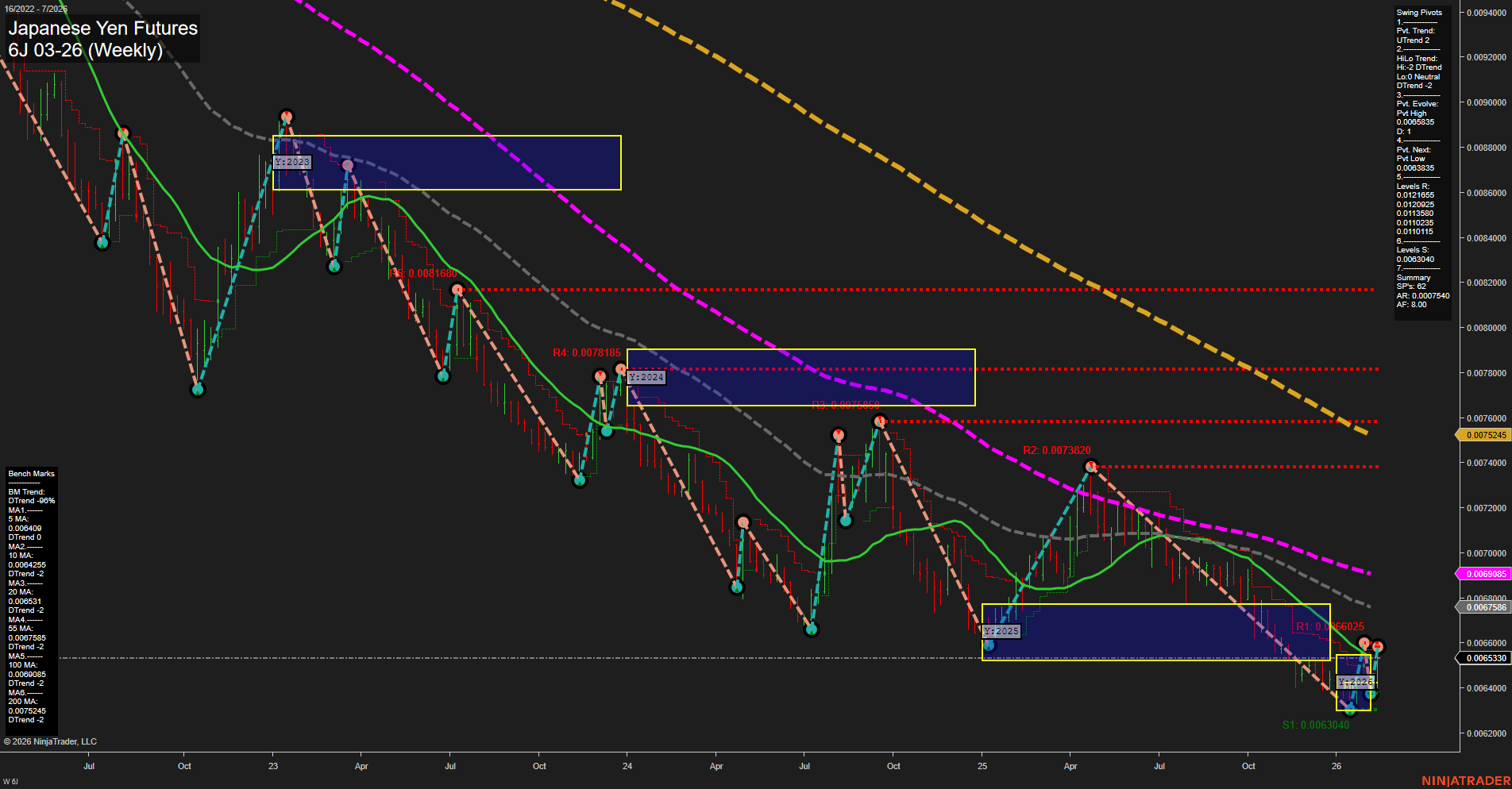

6J Japanese Yen Futures Weekly Chart Analysis: 2026-Feb-12 07:04 CT

Price Action

- Last: 0.0065340,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 137%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 20%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 0.0069835,

- 4. Pvt. Next: Pvt Low 0.0063285,

- 5. Levels R: 0.0075245, 0.0073820, 0.0071855, 0.0071680, 0.0070255, 0.0069835, 0.0069115,

- 6. Levels S: 0.0063040.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0064690 DTrend,

- (Intermediate-Term) 10 Week: 0.0064255 DTrend,

- (Long-Term) 20 Week: 0.0065831 DTrend,

- (Long-Term) 55 Week: 0.0071855 DTrend,

- (Long-Term) 100 Week: 0.0069695 DTrend,

- (Long-Term) 200 Week: 0.0075245 DTrend.

Recent Trade Signals

- 10 Feb 2026: Long 6J 03-26 @ 0.0064995 Signals.USAR-MSFG

- 10 Feb 2026: Long 6J 03-26 @ 0.0064995 Signals.USAR.TR720

- 09 Feb 2026: Long 6J 03-26 @ 0.0064455 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The Japanese Yen futures (6J) weekly chart shows a recent shift in short-term momentum, with price action breaking above the NTZ center and the WSFG, MSFG, and YSFG all indicating an upward trend bias. The most recent swing pivot trend has turned up (UTrend), suggesting a possible short-term reversal or bounce from oversold conditions, supported by recent long trade signals. However, the intermediate-term HiLo trend remains down, and all major moving averages (from 5-week to 200-week) are still in a downtrend, highlighting persistent long-term bearish pressure. Resistance levels are stacked above, with the nearest at 0.0069835 and major resistance at 0.0075245, while support is found at 0.0063040. The overall structure suggests a potential for a short-term rally or corrective move within a broader bearish context, as the market tests whether this bounce can develop into a more sustained reversal or if it will encounter resistance and resume the longer-term downtrend. Volatility appears moderate, and the market is at a technical inflection point, with swing traders watching for confirmation of trend continuation or reversal.

Chart Analysis ATS AI Generated: 2026-02-12 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.