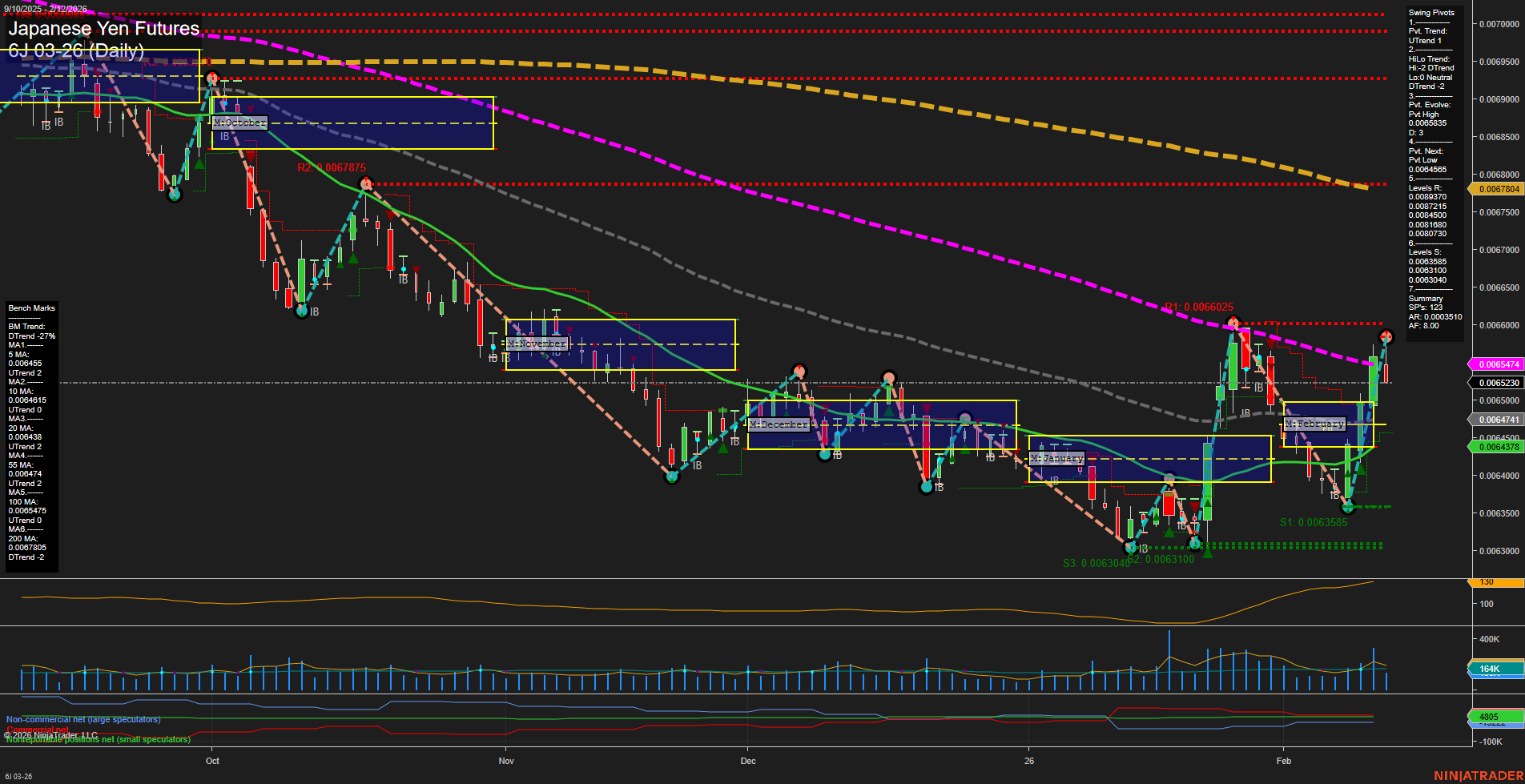

The Japanese Yen futures have recently experienced a strong upside move, as evidenced by large bullish bars and fast momentum. Price is trading above all key session fib grid levels (weekly, monthly, yearly), with the WSFG and MSFG both showing an upward trend and price holding above their NTZ zones, indicating strong short- and intermediate-term bullish sentiment. The swing pivot structure confirms a short-term uptrend, with the most recent pivot high at current levels, though the intermediate-term HiLo trend remains in a downtrend, suggesting the broader structure is still in transition. Daily benchmarks show short- and intermediate-term moving averages have turned up, while the longer-term 55, 100, and 200-day MAs remain in a downtrend, highlighting that the current rally is still counter to the prevailing long-term trend. ATR and volume are elevated, reflecting increased volatility and participation. Recent trade signals have all triggered long entries, aligning with the current bullish momentum. Overall, the market is in a short-term and intermediate-term bullish phase, with the potential for further upside as long as price holds above key support levels. However, the long-term trend remains neutral as the market tests major resistance levels and the longer-term moving averages have yet to confirm a full trend reversal. The current environment is characterized by a strong rally, possible short covering, and a test of overhead resistance, with the potential for either a continuation higher or a pullback as the market digests recent gains.