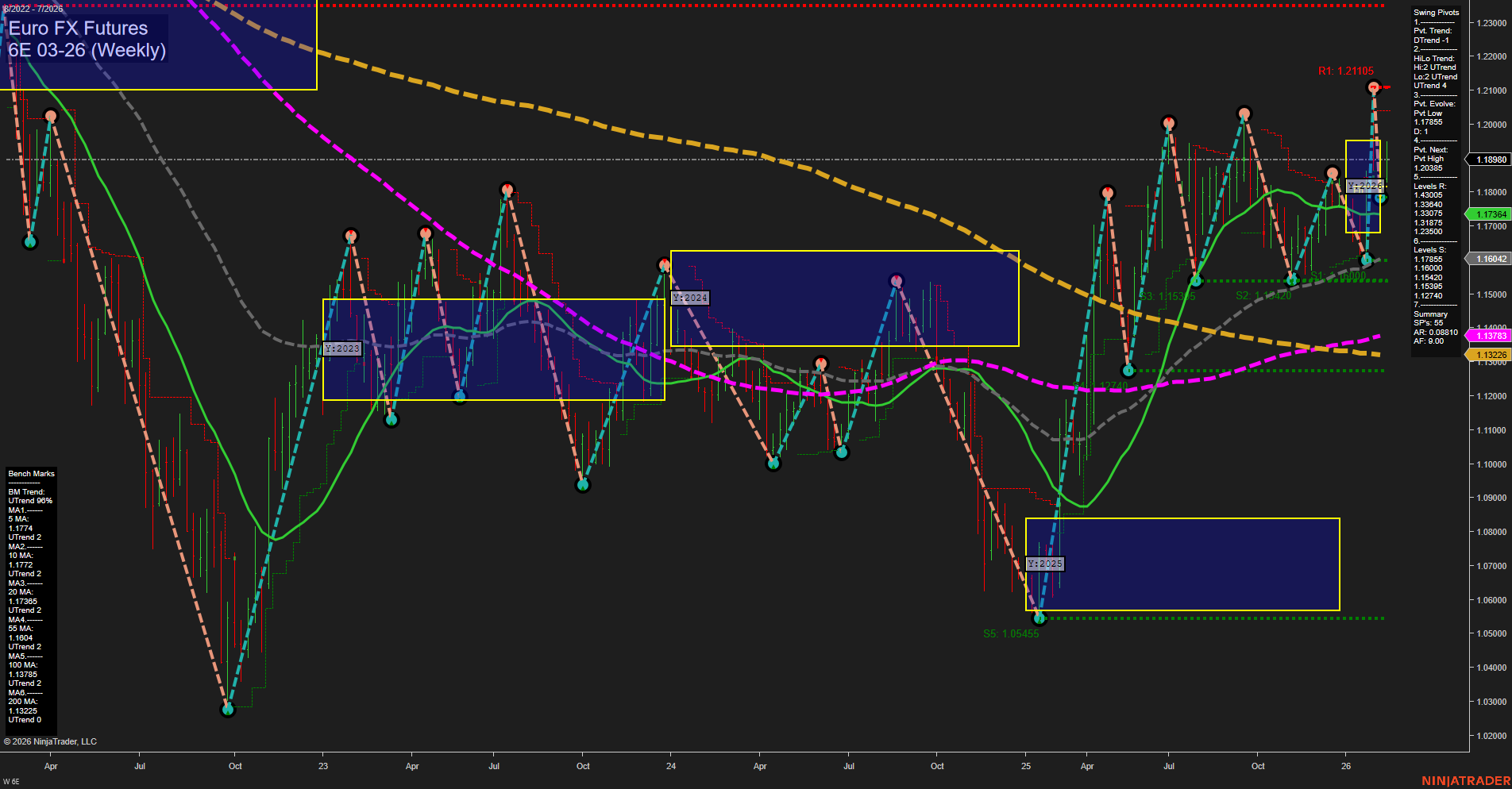

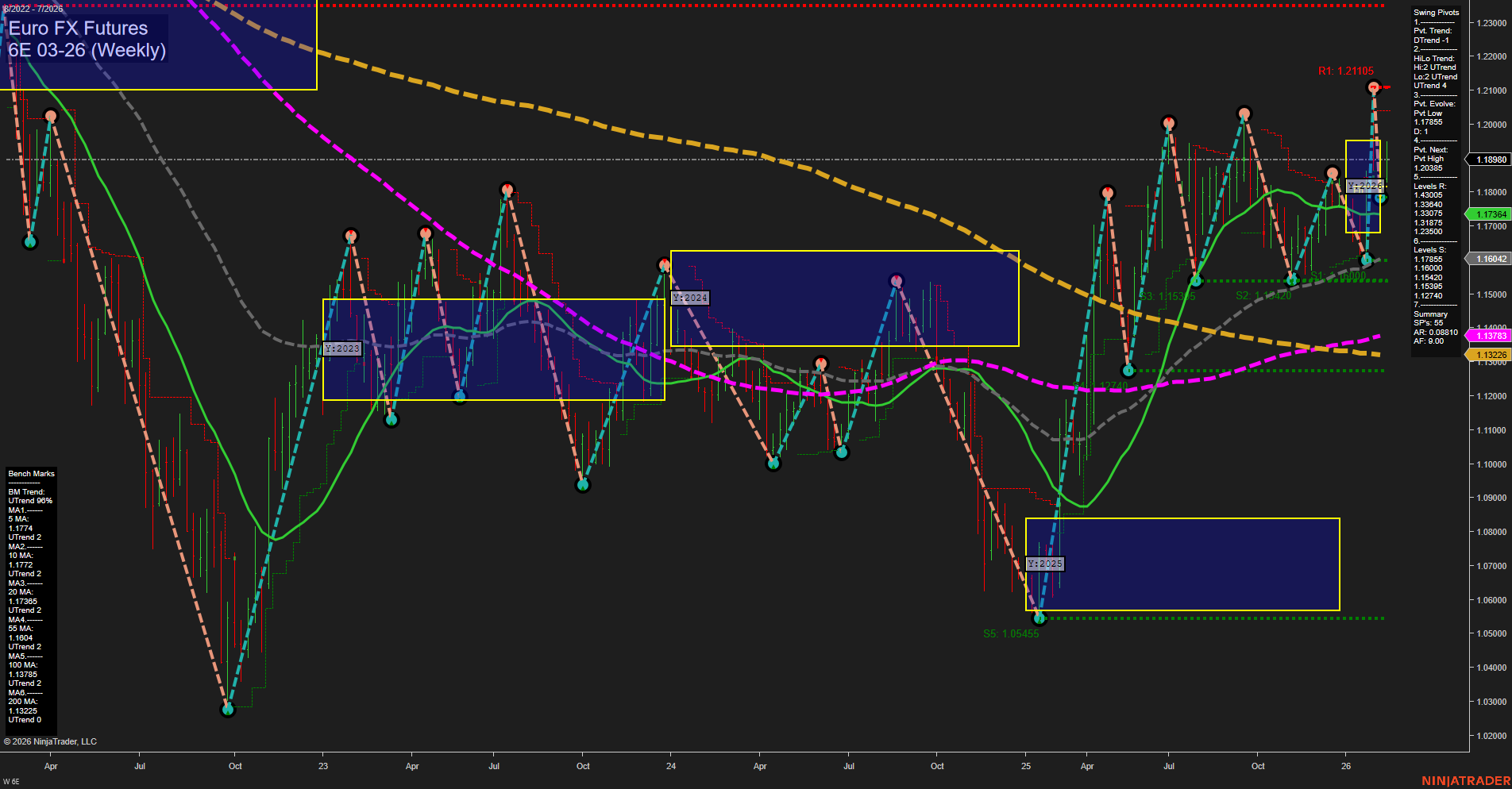

6E Euro FX Futures Weekly Chart Analysis: 2026-Feb-12 07:03 CT

Price Action

- Last: 1.18890,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 29%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1.21105,

- 4. Pvt. Next: Pvt low 1.17364,

- 5. Levels R: 1.21105, 1.20385, 1.19340,

- 6. Levels S: 1.17364, 1.16402, 1.15420, 1.13225.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.1774 Up Trend,

- (Intermediate-Term) 10 Week: 1.1772 Up Trend,

- (Long-Term) 20 Week: 1.1736 Up Trend,

- (Long-Term) 55 Week: 1.1604 Up Trend,

- (Long-Term) 100 Week: 1.1378 Up Trend,

- (Long-Term) 200 Week: 1.1322 Up Trend.

Recent Trade Signals

- 12 Feb 2026: Short 6E 03-26 @ 1.18785 Signals.USAR.TR120

- 11 Feb 2026: Long 6E 03-26 @ 1.1934 Signals.USAR-MSFG

- 09 Feb 2026: Long 6E 03-26 @ 1.18715 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart is showing a strong bullish structure across all timeframes. Price is currently above the NTZ center line on all session fib grids (weekly, monthly, yearly), with each grid’s trend pointing up. Swing pivots confirm this momentum, with both short-term and intermediate-term trends in an uptrend, and the most recent pivot evolving at a new high (1.21105). Support levels are rising, and resistance is being tested at higher levels, indicating buyers are in control. All benchmark moving averages from 5 to 200 weeks are trending upward, reinforcing the underlying strength. Recent trade signals show a mix of short and long entries, but the dominant direction remains up, with only a brief short-term countertrend signal. The market has moved out of a consolidation phase and is now in a clear uptrend, with higher lows and higher highs. Volatility is moderate, and the price action suggests trend continuation rather than reversal. The overall technical landscape is supportive of further upside, with any pullbacks likely to find support at the identified swing lows and moving averages.

Chart Analysis ATS AI Generated: 2026-02-12 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.