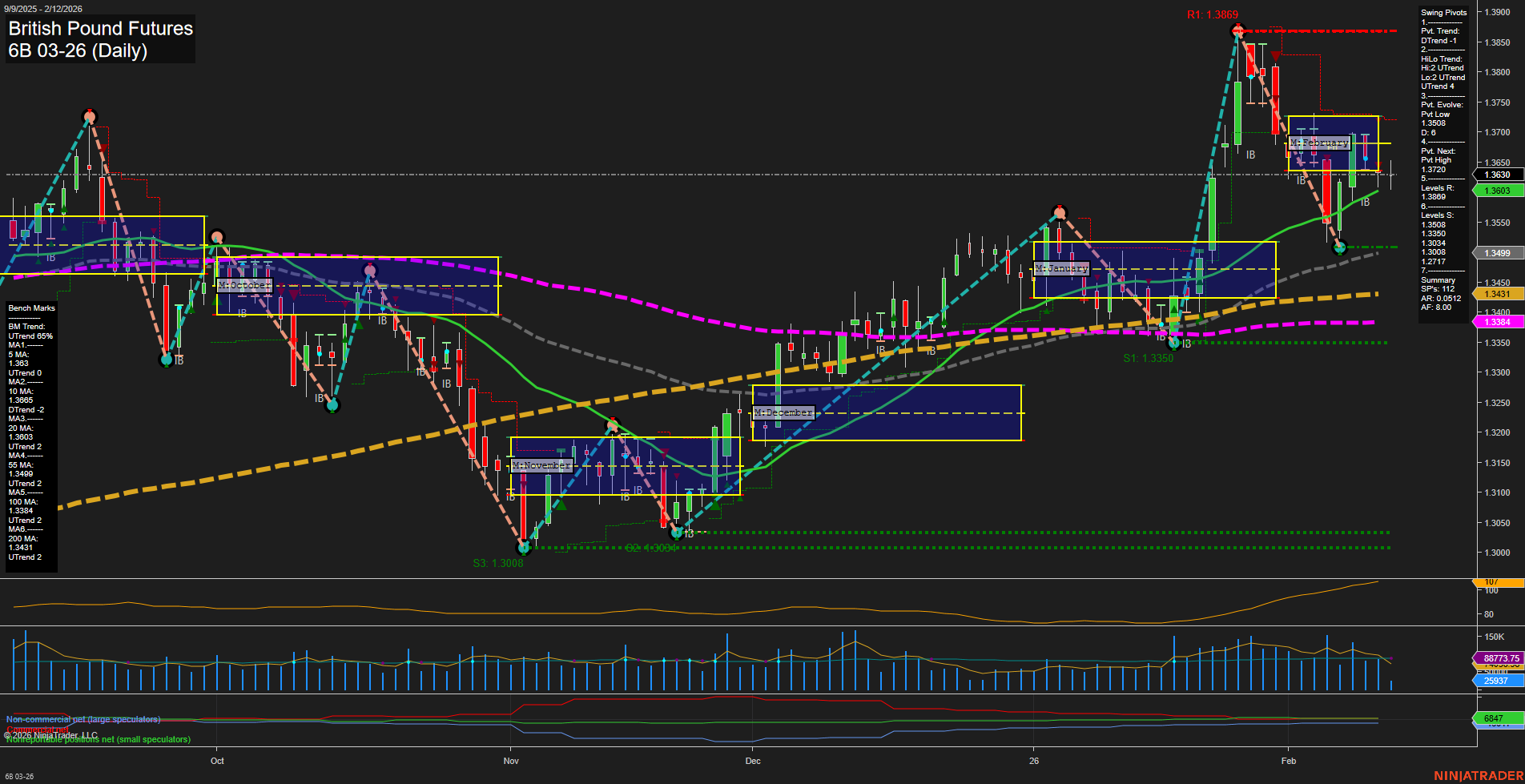

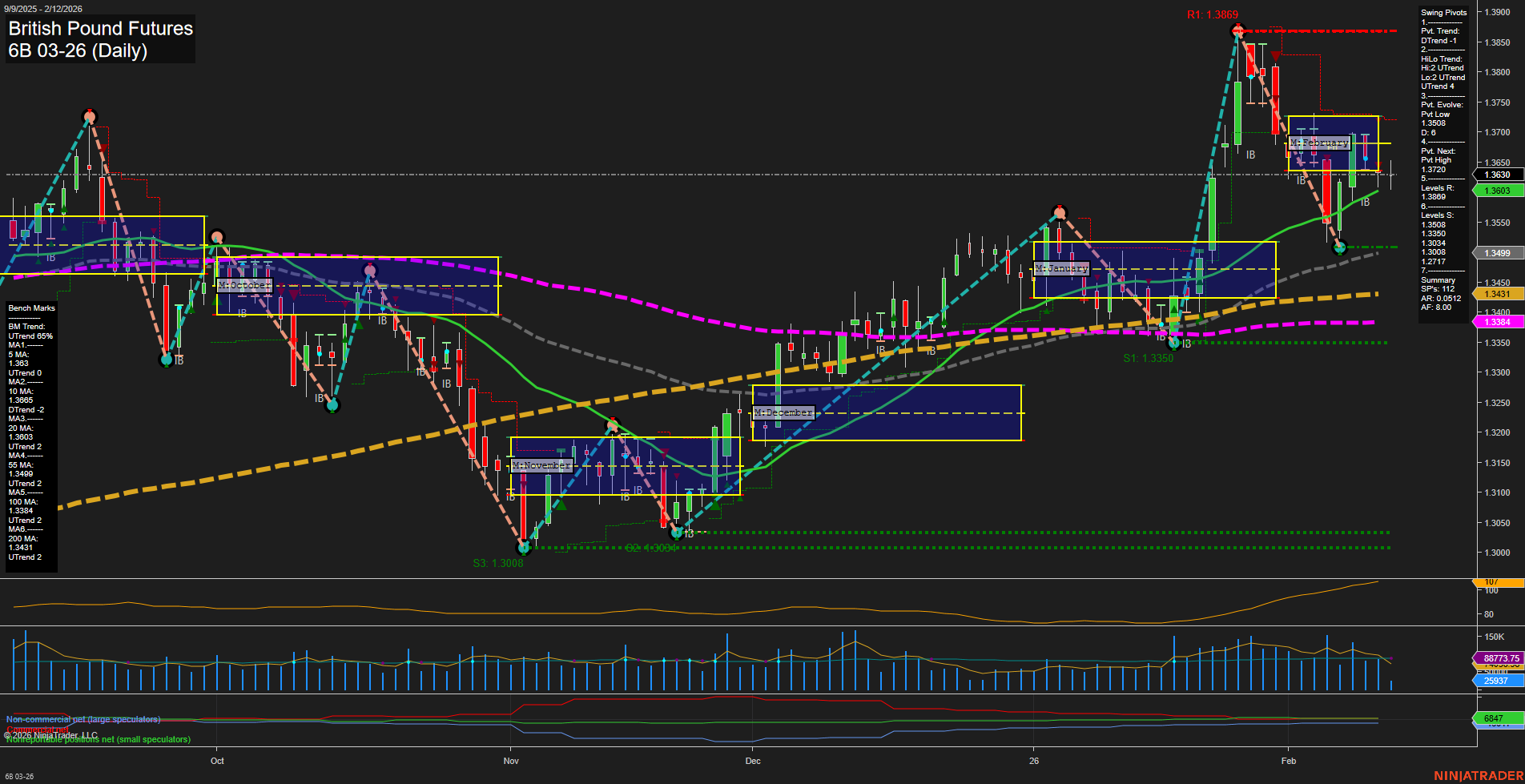

6B British Pound Futures Daily Chart Analysis: 2026-Feb-12 07:01 CT

Price Action

- Last: 1.3630,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.3606,

- 4. Pvt. Next: Pvt high 1.3720,

- 5. Levels R: 1.3869, 1.3806, 1.3720, 1.3694, 1.3630,

- 6. Levels S: 1.3499, 1.3450, 1.3431, 1.3384.

Daily Benchmarks

- (Short-Term) 5 Day: 1.3603 Up Trend,

- (Short-Term) 10 Day: 1.3655 Down Trend,

- (Intermediate-Term) 20 Day: 1.3685 Down Trend,

- (Intermediate-Term) 55 Day: 1.3803 Up Trend,

- (Long-Term) 100 Day: 1.3384 Up Trend,

- (Long-Term) 200 Day: 1.3431 Up Trend.

Additional Metrics

Recent Trade Signals

- 12 Feb 2026: Short 6B 03-26 @ 1.3615 Signals.USAR-MSFG

- 12 Feb 2026: Short 6B 03-26 @ 1.3615 Signals.USAR.TR120

- 11 Feb 2026: Long 6B 03-26 @ 1.3655 Signals.USAR-WSFG

- 05 Feb 2026: Short 6B 03-26 @ 1.3549 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6B British Pound Futures daily chart shows a market in transition. Short-term price action is mixed, with average momentum and medium-sized bars, while the weekly session fib grid (WSFG) trend remains up, indicating some underlying support. However, the monthly session fib grid (MSFG) trend is down, and price is currently below the monthly NTZ, suggesting intermediate-term weakness. The swing pivot structure confirms this, with a short-term downtrend (DTrend) but an intermediate-term uptrend (UTrend), highlighting a possible pullback within a broader uptrend. Resistance levels cluster above at 1.3694–1.3869, while support is found at 1.3499–1.3384. Daily benchmarks are mixed: the 5-day MA is trending up, but the 10- and 20-day MAs are down, while longer-term MAs (55, 100, 200) remain in uptrends, supporting a bullish long-term outlook. Recent trade signals reflect this indecision, with both short and long entries triggered in the past week. Volatility (ATR) and volume (VOLMA) are elevated, indicating active trading conditions. Overall, the market is consolidating after a strong rally, with short-term direction uncertain, intermediate-term bias bearish, and long-term structure still bullish. Swing traders may observe for resolution of this consolidation, as the market tests key support and resistance levels.

Chart Analysis ATS AI Generated: 2026-02-12 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.