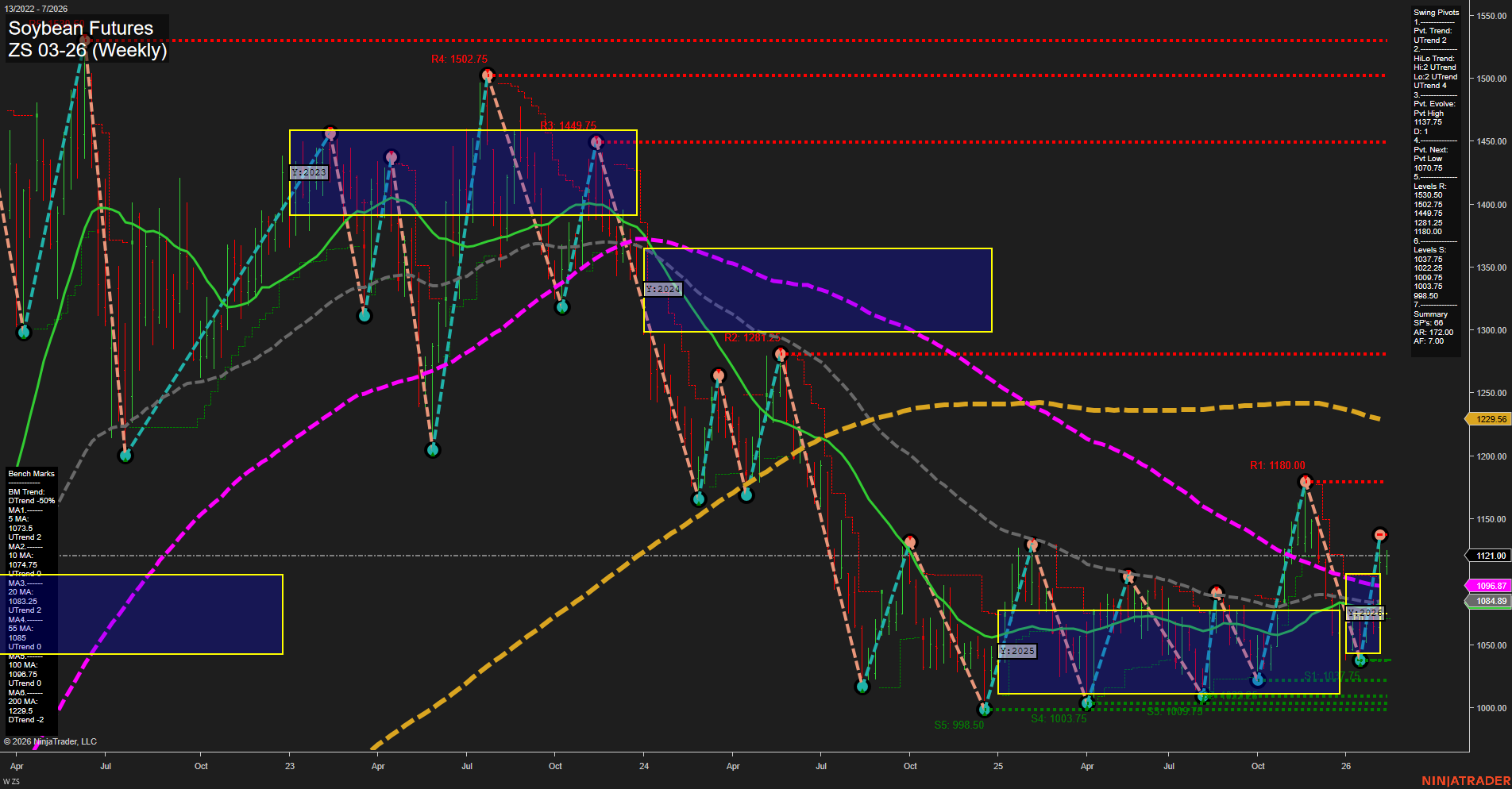

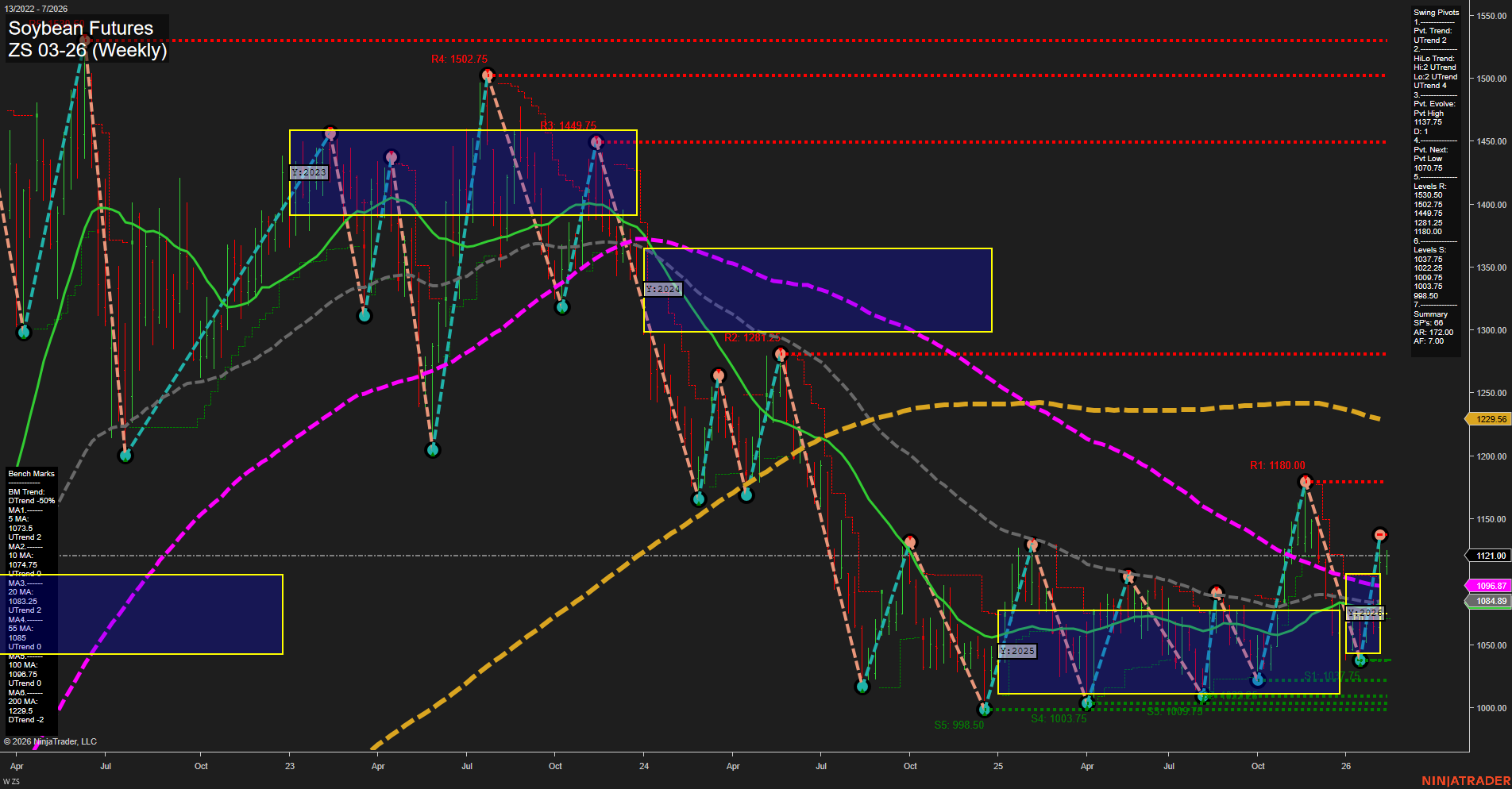

ZS Soybean Futures Weekly Chart Analysis: 2026-Feb-11 07:23 CT

Price Action

- Last: 1121.00,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 59%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1137.75,

- 4. Pvt. Next: Pvt Low 1070.75,

- 5. Levels R: 1502.75, 1449.75, 1417.25, 1281.25, 1188.00, 1180.00,

- 6. Levels S: 1070.75, 1022.75, 1003.75, 1000.75, 998.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1103.3 Up Trend,

- (Intermediate-Term) 10 Week: 1074.75 Up Trend,

- (Long-Term) 20 Week: 1084.89 Up Trend,

- (Long-Term) 55 Week: 1096.67 Down Trend,

- (Long-Term) 100 Week: 1108.75 Down Trend,

- (Long-Term) 200 Week: 1229.56 Down Trend.

Recent Trade Signals

- 11 Feb 2026: Long ZS 03-26 @ 1118.75 Signals.USAR-WSFG

- 04 Feb 2026: Long ZS 03-26 @ 1091 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures have shifted into a bullish short- and intermediate-term structure, with price action breaking above key NTZ/F0% levels across weekly and monthly session grids. Momentum is average, and recent bars show medium size, indicating steady but not explosive movement. Both swing pivot and HiLo trends are up, with the most recent pivot high at 1137.75 and next support at 1070.75, suggesting a higher-low structure is forming. Multiple resistance levels remain overhead, but the market has cleared several intermediate resistance points. Weekly benchmarks (5, 10, 20 week) are all trending up, while longer-term (55, 100, 200 week) moving averages are still in downtrends, reflecting a market in transition from a longer-term bearish phase to a potential new uptrend. Recent trade signals confirm the bullish short-term bias. The overall setup points to a market in recovery mode, with the potential for further upside if momentum persists and longer-term averages begin to flatten or turn up. The environment is characterized by a bounce from prior lows, a possible trend continuation, and a test of higher resistance zones.

Chart Analysis ATS AI Generated: 2026-02-11 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.