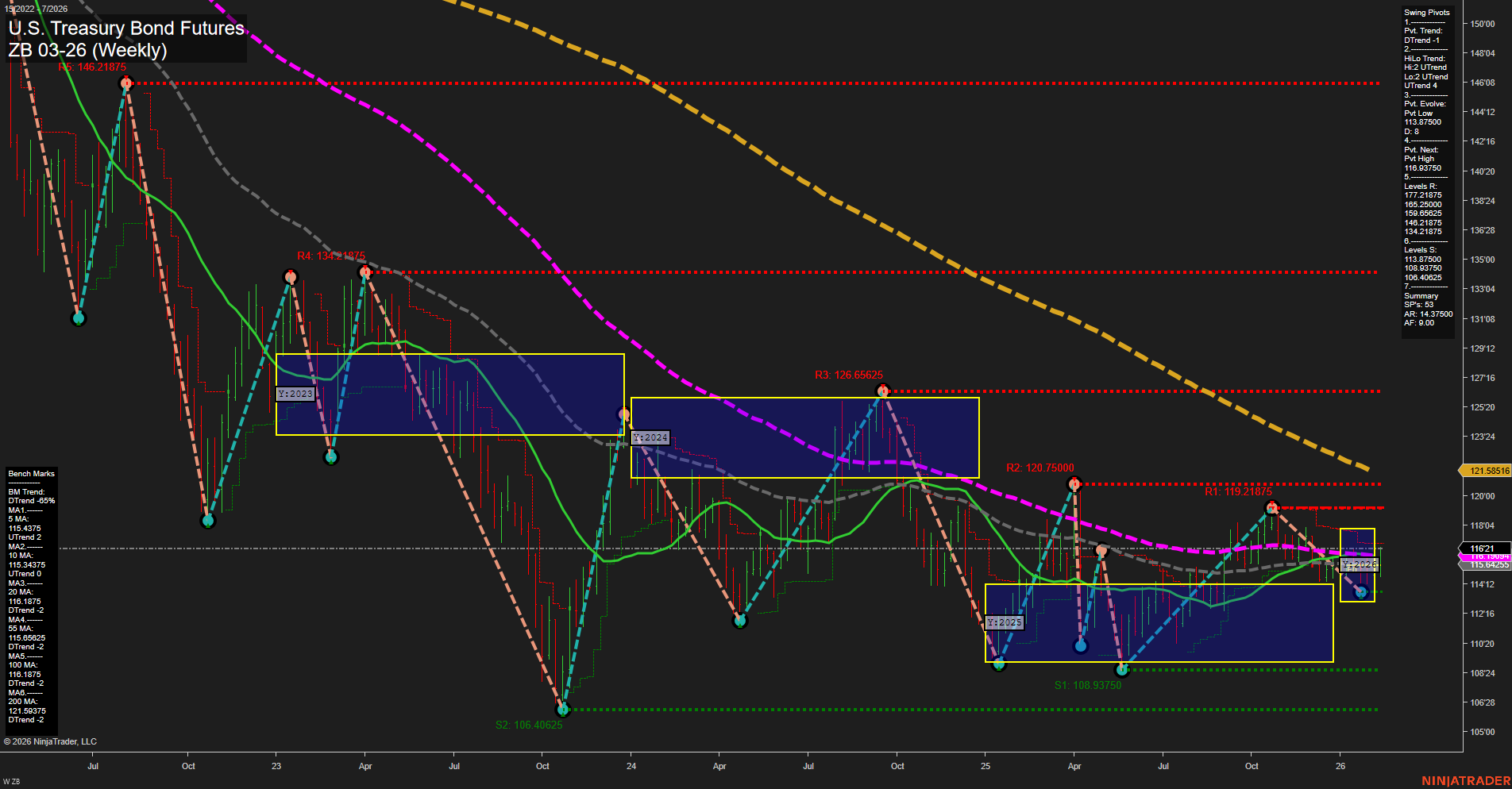

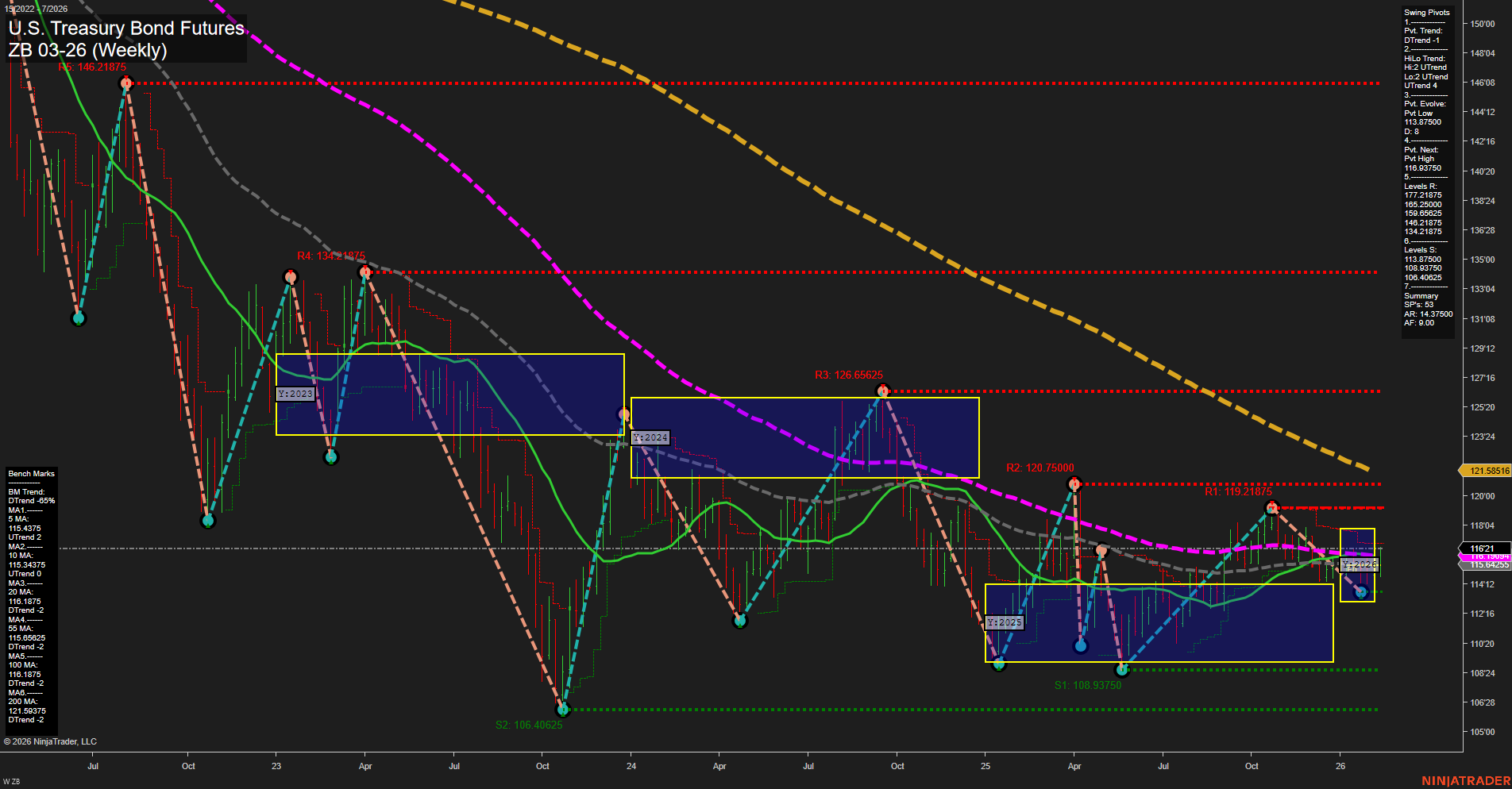

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2026-Feb-11 07:22 CT

Price Action

- Last: 121.58516,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend-1,

- (Intermediate-Term) 2. HiLo Trend: UTrend-2,

- 3. Pvt. Evolve: Pvt Low 113.87500,

- 4. Pvt. Next: Pvt High 119.93750,

- 5. Levels R: 146.21875, 134.21875, 126.65625, 120.75000, 119.21875,

- 6. Levels S: 113.87500, 108.93750, 108.40625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115.4375 Down Trend,

- (Intermediate-Term) 10 Week: 115.94375 Up Trend,

- (Long-Term) 20 Week: 116.1245 Up Trend,

- (Long-Term) 55 Week: 115.96625 Up Trend,

- (Long-Term) 100 Week: 110.1875 Up Trend,

- (Long-Term) 200 Week: 111.86475 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently consolidating with medium-sized bars and slow momentum, reflecting indecision and a lack of strong directional conviction. The short-term trend is bearish, as indicated by the most recent swing pivot downtrend and a 5-week moving average in decline. However, the intermediate-term outlook is more constructive, with the 10, 20, 55, and 100-week moving averages all trending higher, and the HiLo swing trend showing an uptrend. Long-term signals remain neutral, with the 200-week moving average still in a downtrend, suggesting that the market has not yet fully reversed its broader bearish structure. Key resistance levels are clustered above at 119.21875 and 120.75000, while support is found at 113.87500 and 108.93750. The market is currently trading within a neutral zone, with no clear breakout or breakdown, and is likely to remain range-bound until a decisive move occurs. This environment favors swing traders who can capitalize on mean reversion and range trading strategies, while remaining alert for any signs of a sustained trend change.

Chart Analysis ATS AI Generated: 2026-02-11 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.