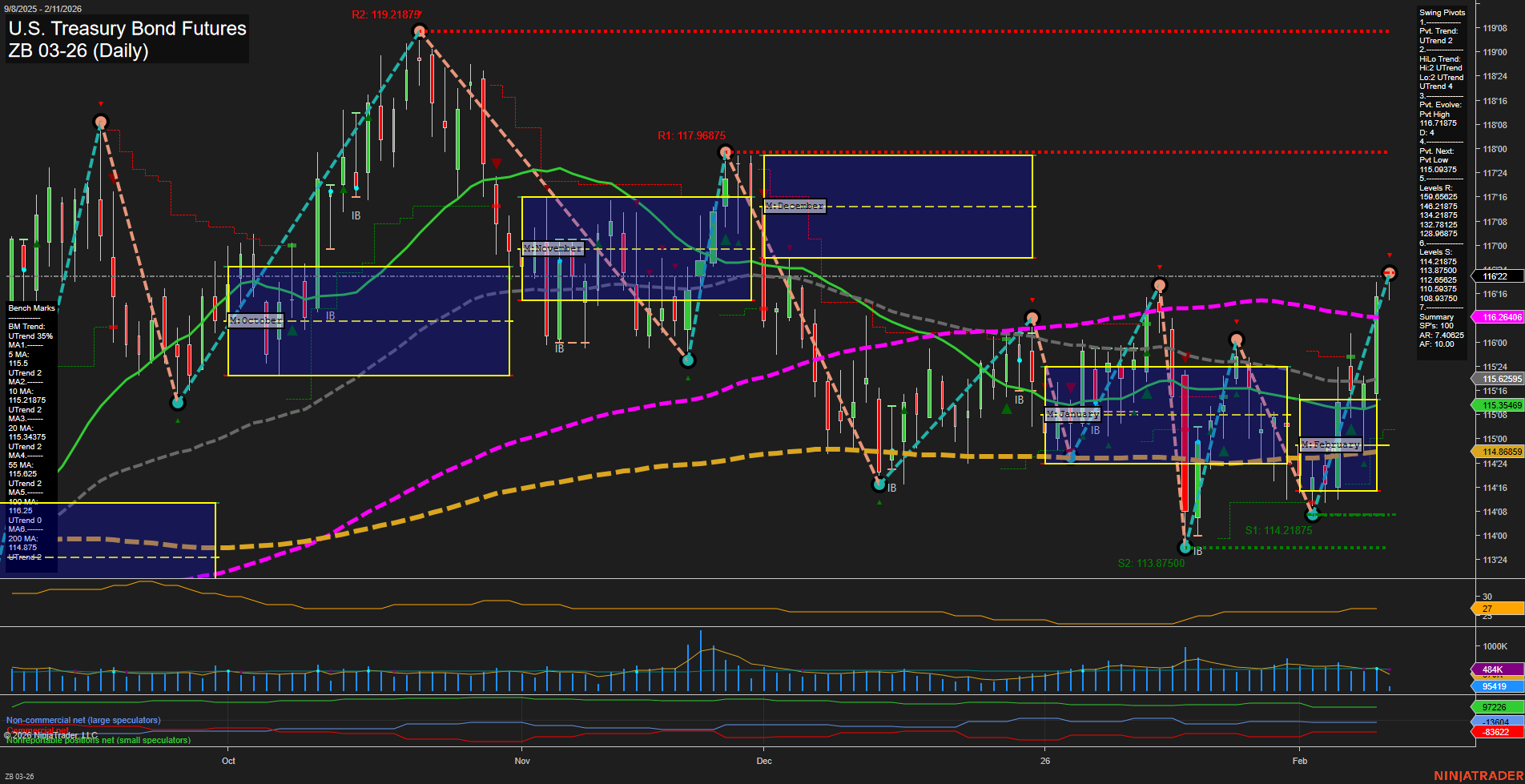

The ZB U.S. Treasury Bond Futures daily chart currently reflects a strong bullish momentum in the short and intermediate term, as evidenced by large, fast-moving bars and an upward trend in both swing pivots and all key short- and intermediate-term moving averages. The price has recently broken above several resistance levels, with the most recent swing pivot marking a new high at 116.21875. The 5, 10, 20, and 55-day moving averages are all trending upward, supporting the current rally, while the 100-day moving average remains in a downtrend, indicating that the longer-term trend is still neutral and has not fully reversed. The 200-day moving average is trending up, suggesting underlying support for the broader trend. Volatility, as measured by ATR, is elevated, and volume remains robust, confirming active participation in the current move. The market is in a phase of strong upward momentum, with price action breaking out of previous consolidation ranges and testing higher resistance levels. However, the neutral stance of the session fib grids (weekly, monthly, yearly) suggests that the market is at a potential inflection point, with no clear directional bias from the broader context. Overall, the technical structure favors continued bullishness in the near term, while the long-term outlook remains neutral pending further confirmation of trend reversal.