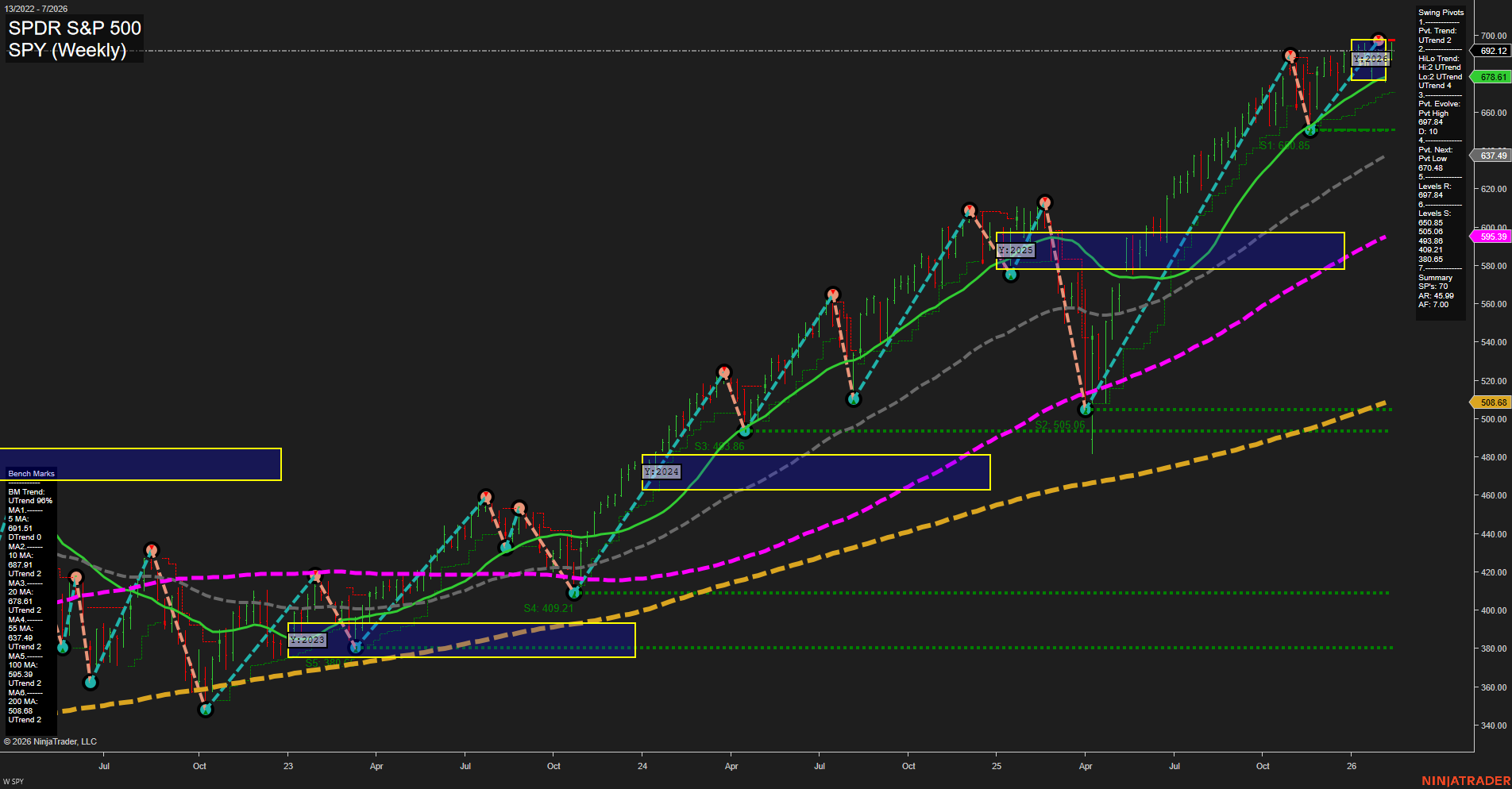

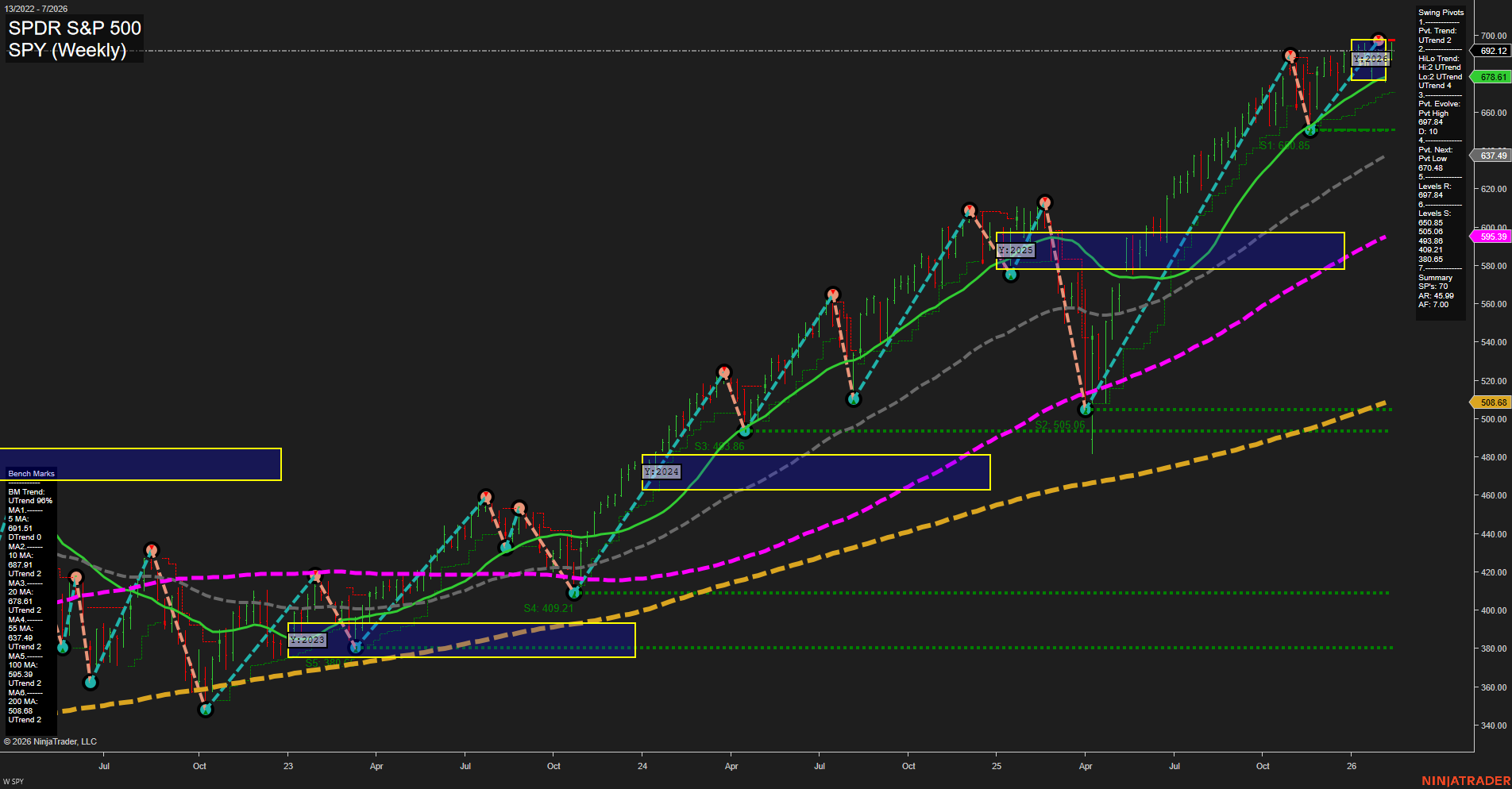

SPY SPDR S&P 500 Weekly Chart Analysis: 2026-Feb-11 07:19 CT

Price Action

- Last: 692.12,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 692.12,

- 4. Pvt. Next: Pvt low 678.61,

- 5. Levels R: 692.12,

- 6. Levels S: 678.61, 637.49, 570.48, 505.99, 409.21.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 661.16 Up Trend,

- (Intermediate-Term) 10 Week: 678.61 Up Trend,

- (Long-Term) 20 Week: 637.49 Up Trend,

- (Long-Term) 55 Week: 595.39 Up Trend,

- (Long-Term) 100 Week: 570.48 Up Trend,

- (Long-Term) 200 Week: 508.68 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY weekly chart continues to show a strong bullish structure across all timeframes, with price action making new highs and momentum holding steady at an average pace. The most recent swing pivot marks a new high at 692.12, with the next key support at 678.61, indicating a healthy uptrend with higher lows and higher highs. All benchmark moving averages from short to long term are trending upward, reinforcing the prevailing bullish sentiment. The neutral bias in the session fib grids suggests the market is not currently overextended, and there is no immediate sign of exhaustion or reversal. The market has shown resilience through previous pullbacks, with each correction finding support at higher levels, and the absence of significant resistance above the current price leaves room for further upside. Volatility appears contained, and the trend remains intact, with no major reversal signals present. This environment is favorable for trend-following swing strategies, as the market continues to reward buying on dips within the established uptrend.

Chart Analysis ATS AI Generated: 2026-02-11 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.