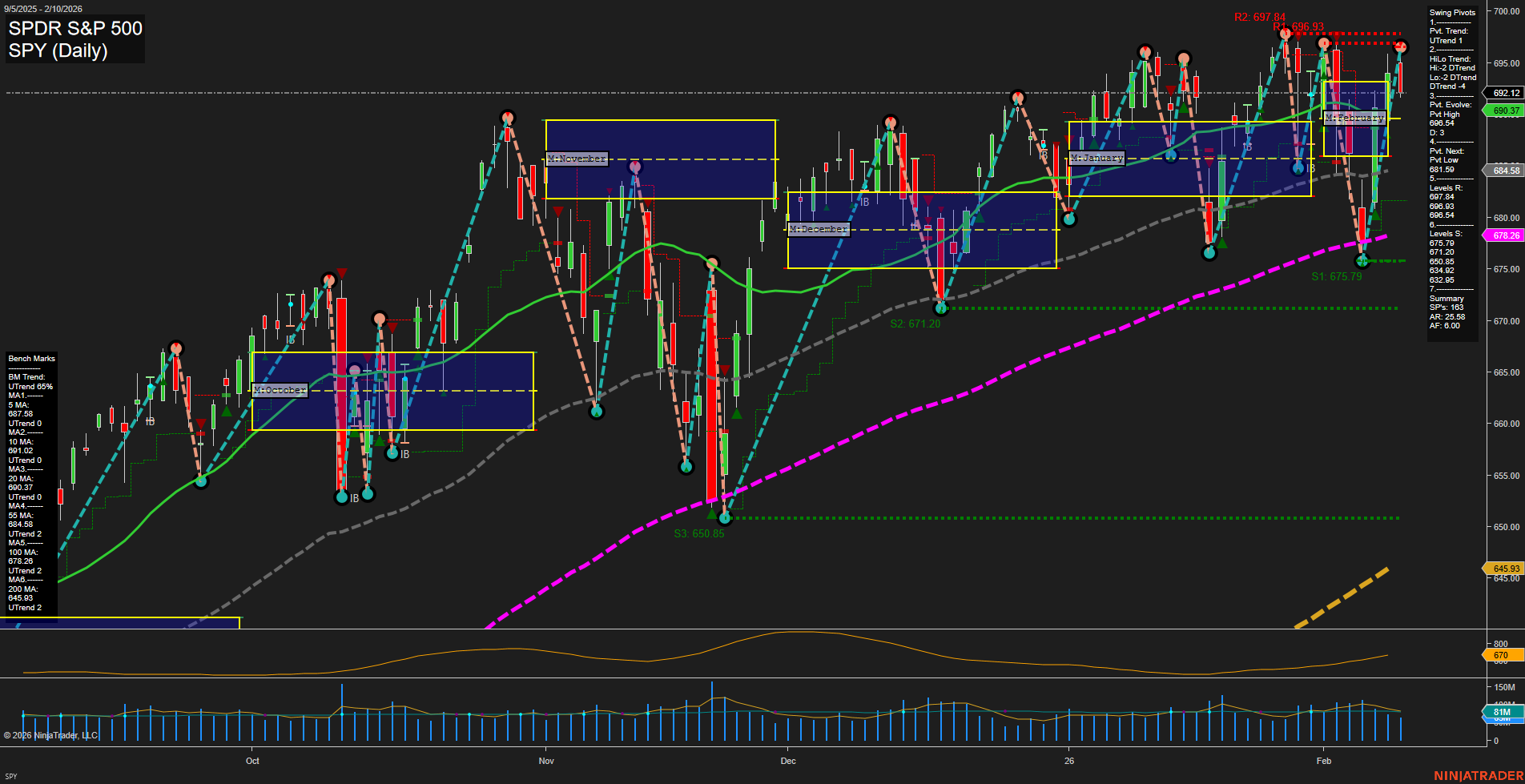

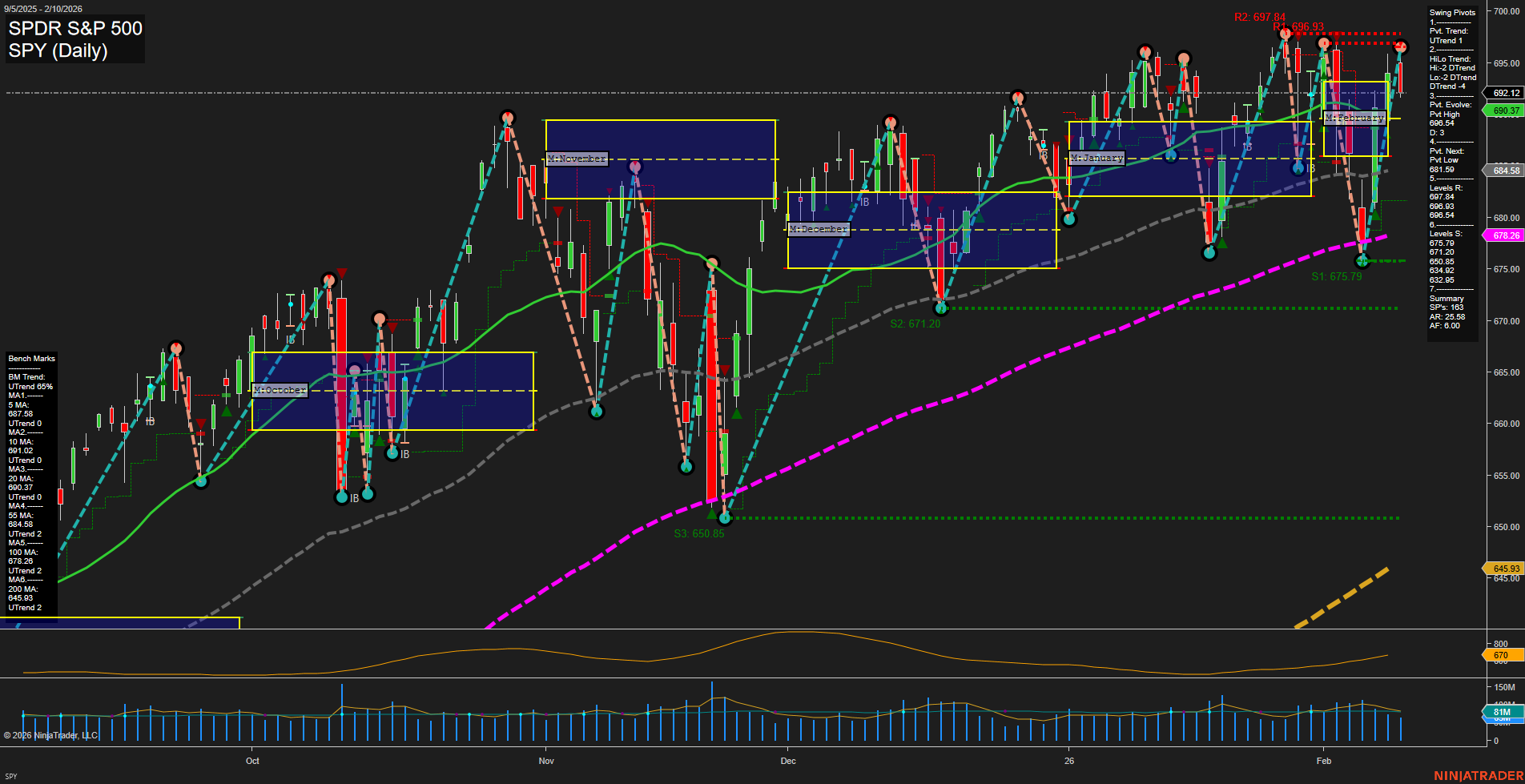

SPY SPDR S&P 500 Daily Chart Analysis: 2026-Feb-11 07:19 CT

Price Action

- Last: 690.37,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 696.93,

- 4. Pvt. Next: Pvt low 681.59,

- 5. Levels R: 697.84, 696.93, 692.12,

- 6. Levels S: 684.58, 678.26, 675.79.

Daily Benchmarks

- (Short-Term) 5 Day: 687.88 Up Trend,

- (Short-Term) 10 Day: 684.24 Up Trend,

- (Intermediate-Term) 20 Day: 679.26 Up Trend,

- (Intermediate-Term) 55 Day: 670.92 Up Trend,

- (Long-Term) 100 Day: 678.26 Up Trend,

- (Long-Term) 200 Day: 645.93 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The SPY daily chart reflects a market in a medium volatility environment, with average momentum and a recent pivot high at 696.93. Price is currently consolidating just below recent resistance levels (697.84, 696.93, 692.12), while support is layered at 684.58, 678.26, and 675.79. All benchmark moving averages (from 5-day to 200-day) are trending upward, confirming a strong underlying bullish structure on both short and long-term horizons. However, the intermediate-term HiLo trend has shifted to a downtrend, suggesting some caution as the market digests recent gains and tests support zones. The ATR indicates moderate daily range, and volume remains robust. The overall structure points to a bullish bias in the short and long term, with the intermediate-term trend in a neutral phase as the market consolidates after a strong rally. Swing traders should note the potential for range-bound action between the highlighted resistance and support levels, with the next directional move likely to be signaled by a breakout from this consolidation zone.

Chart Analysis ATS AI Generated: 2026-02-11 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.