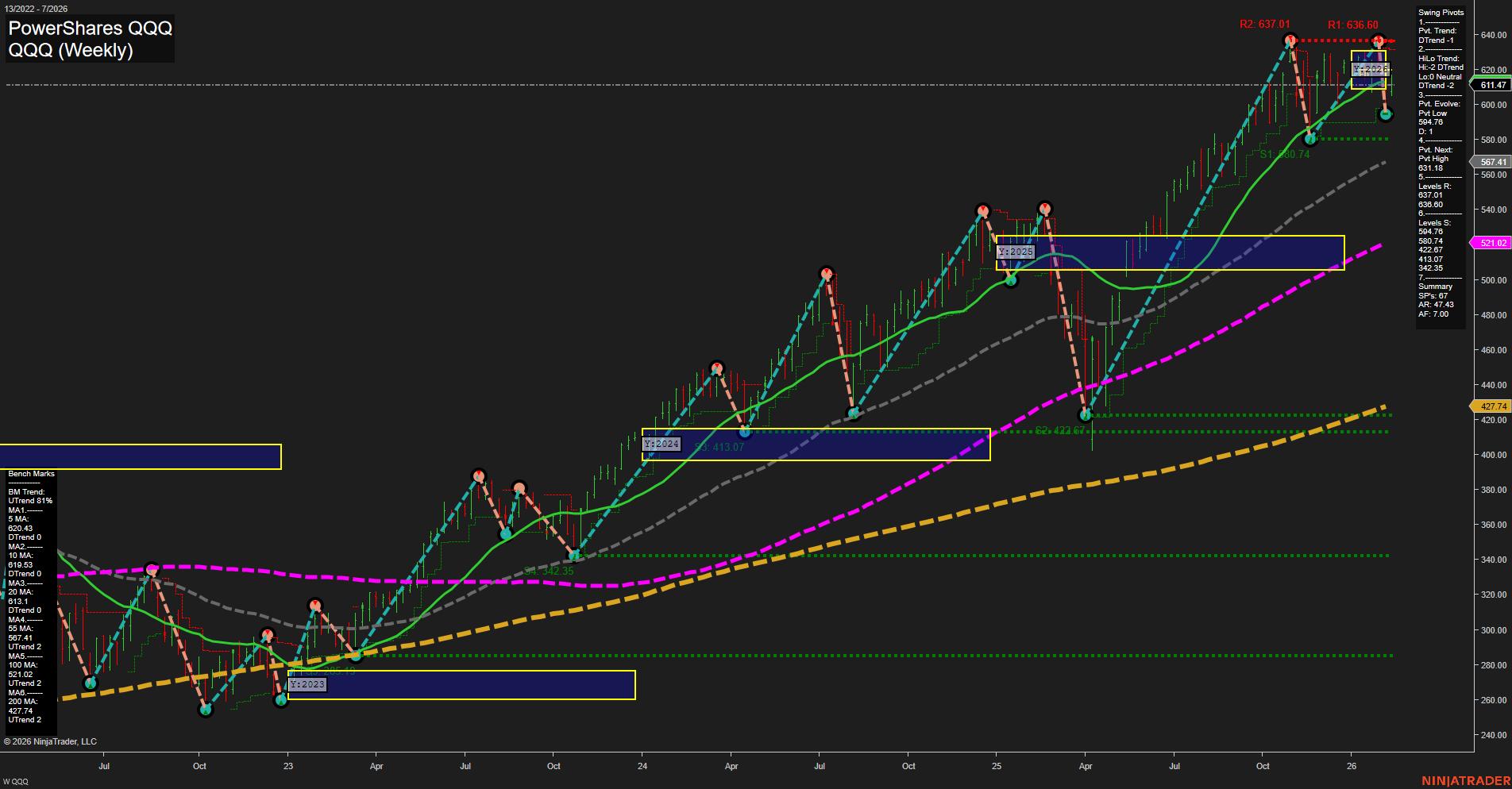

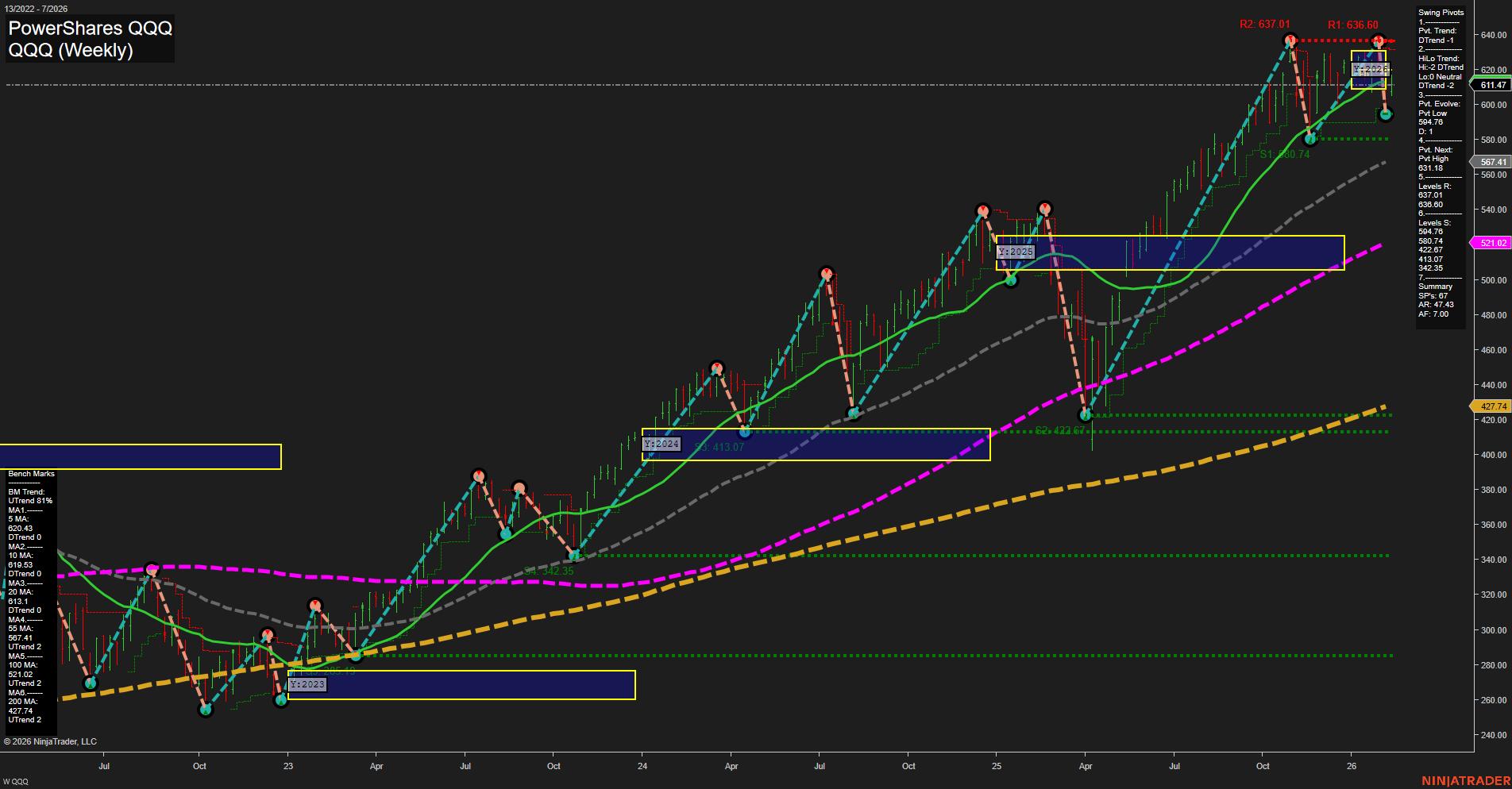

QQQ PowerShares QQQ Weekly Chart Analysis: 2026-Feb-11 07:15 CT

Price Action

- Last: 611.47,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 637.01,

- 4. Pvt. Next: Pvt low 567.41,

- 5. Levels R: 637.01, 636.60,

- 6. Levels S: 567.41, 540.74, 472.67.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 611.44 Down Trend,

- (Intermediate-Term) 10 Week: 630.43 Down Trend,

- (Long-Term) 20 Week: 621.02 Up Trend,

- (Long-Term) 55 Week: 567.41 Up Trend,

- (Long-Term) 100 Week: 519.03 Up Trend,

- (Long-Term) 200 Week: 427.74 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The QQQ weekly chart shows a market in transition. Price action has recently pulled back from a swing high at 637.01, with the last price at 611.47, and momentum is average. The short-term trend has shifted to a downtrend, as confirmed by the swing pivot and both the 5- and 10-week moving averages turning down. However, the intermediate- and long-term trends remain bullish, supported by higher swing lows and all long-term moving averages trending upward. Key resistance is at the recent highs (637.01, 636.60), while support is layered at 567.41, 540.74, and 472.67. The market is currently consolidating within the NTZ (neutral zone) of the yearly session fib grid, suggesting indecision after a strong rally. This setup often precedes either a deeper retracement or a resumption of the prevailing uptrend. The overall structure favors bulls on longer timeframes, but short-term traders should note the current corrective phase and watch for signs of stabilization or reversal at support levels.

Chart Analysis ATS AI Generated: 2026-02-11 07:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.