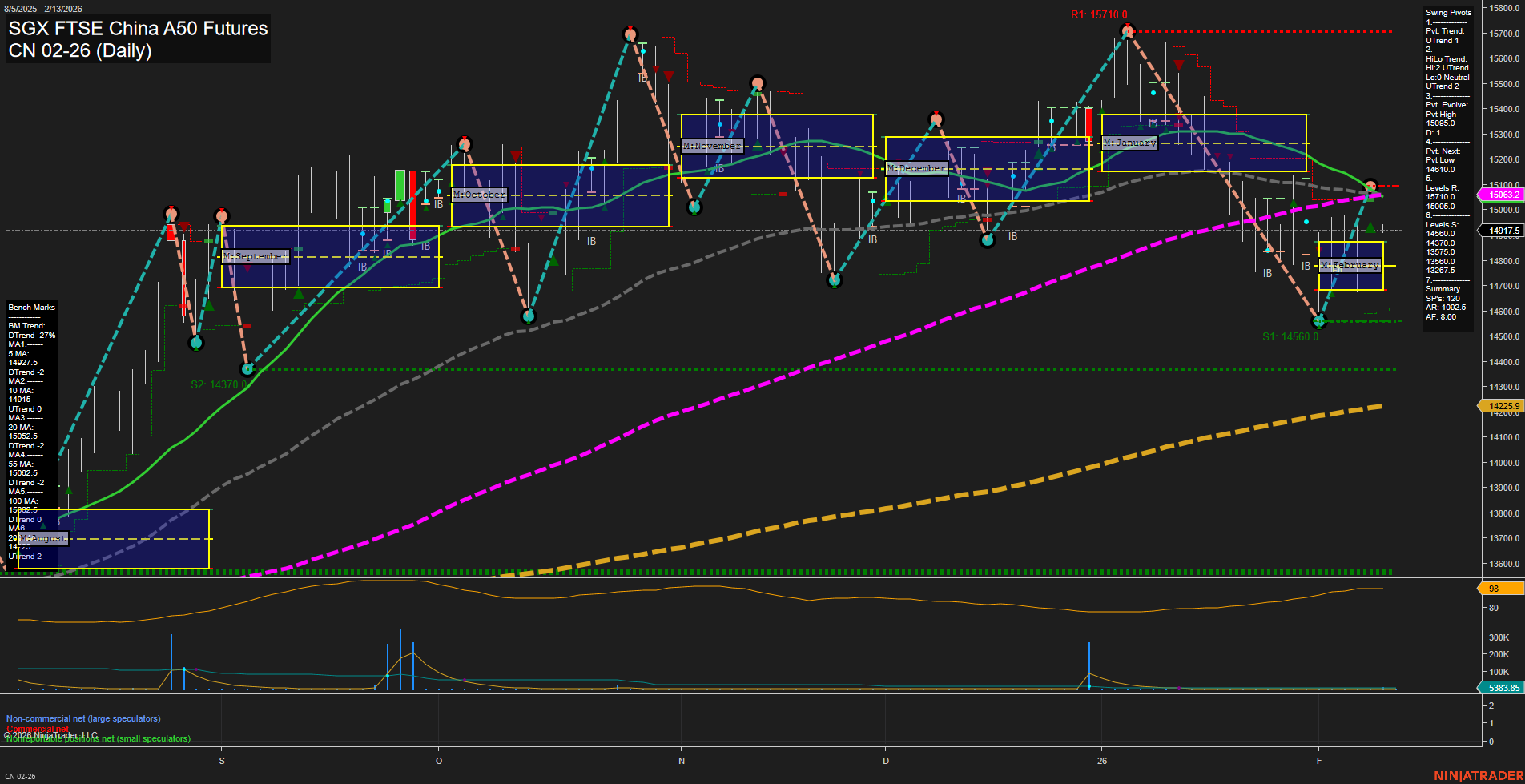

The CN SGX FTSE China A50 Futures daily chart shows a market in transition. Price action is currently at 14917.5, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains down, reflecting a recent bounce within a broader corrective phase. Resistance is layered above at 14917.5, 15380.0, and the major swing high at 15710.0, while support is found at 14560.0, 14370.0, and further below at 13257.5. Benchmark moving averages are mixed: the 5-day MA is in an uptrend, but the 10, 20, 55, and 100-day MAs are all trending down, suggesting that the recent upward move is counter-trend within a larger bearish structure. The 200-day MA remains in an uptrend, providing a longer-term base of support around 14295. Volatility, as measured by ATR, is moderate, and volume remains robust. Overall, the market is consolidating after a sharp sell-off, with a short-term bounce testing resistance but not yet reversing the intermediate-term downtrend. The technical landscape is neutral to bearish, with the potential for further choppy price action as the market digests recent volatility and tests key support and resistance levels.