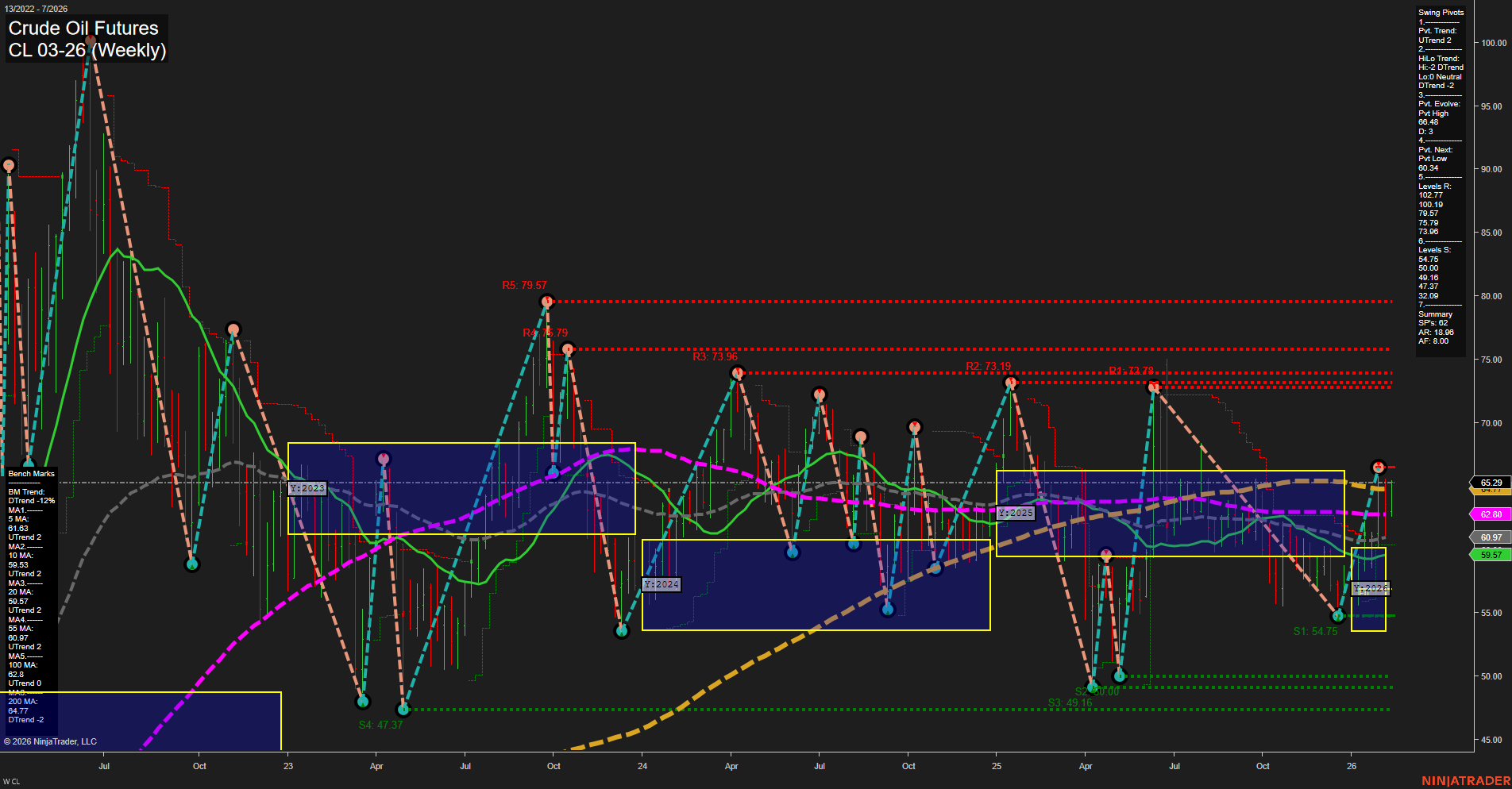

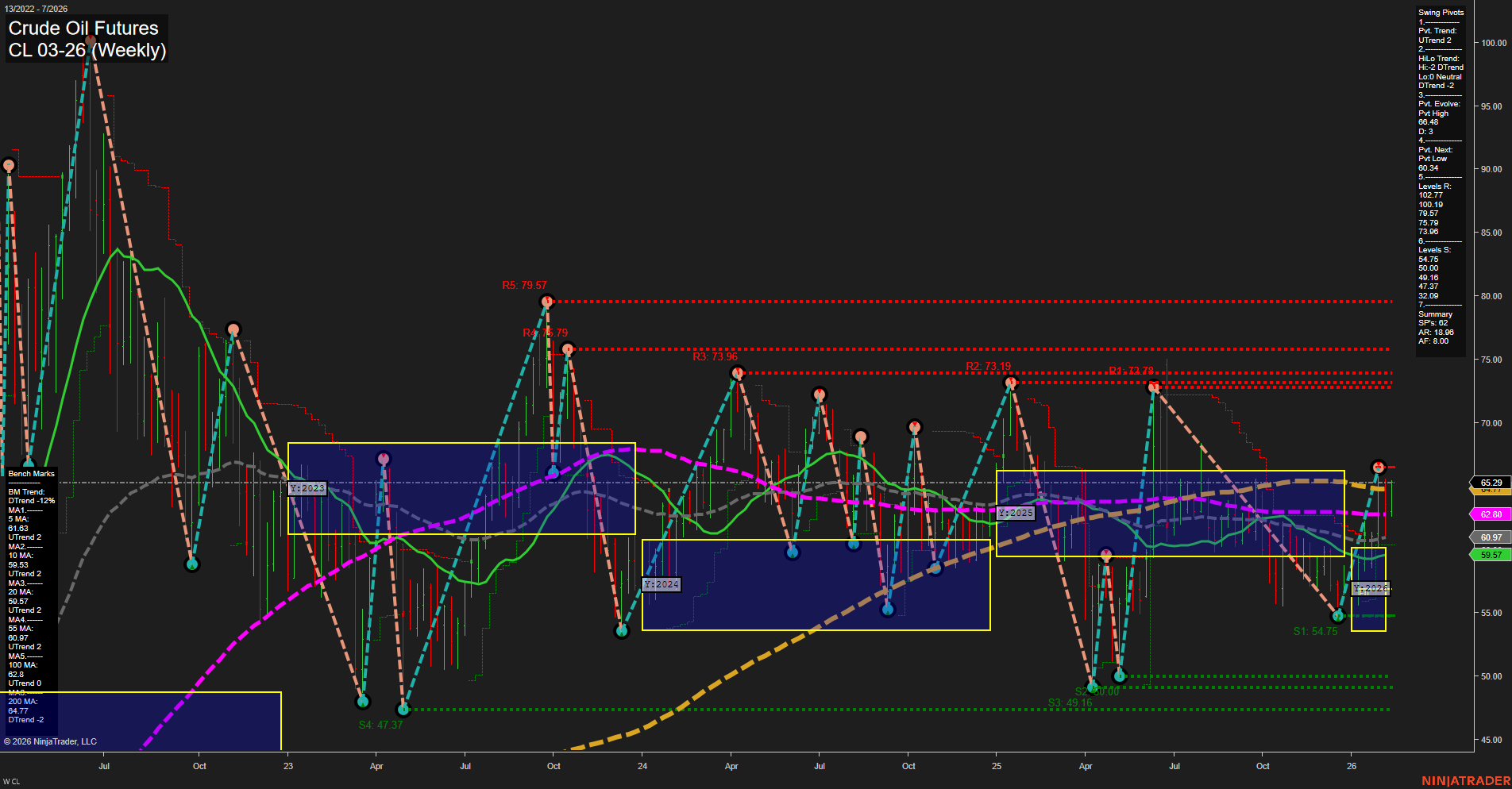

CL Crude Oil Futures Weekly Chart Analysis: 2026-Feb-11 07:04 CT

Price Action

- Last: 65.29,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 56%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 65.29,

- 4. Pvt. Next: Pvt low 54.75,

- 5. Levels R: 100.17, 79.57, 76.79, 73.96, 73.19, 72.78,

- 6. Levels S: 54.75, 50.10, 49.16, 47.37, 37.02.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 61.83 Up Trend,

- (Intermediate-Term) 10 Week: 59.57 Up Trend,

- (Long-Term) 20 Week: 60.97 Up Trend,

- (Long-Term) 55 Week: 62.90 Up Trend,

- (Long-Term) 100 Week: 65.29 Up Trend,

- (Long-Term) 200 Week: 64.77 Up Trend.

Recent Trade Signals

- 06 Feb 2026: Short CL 03-26 @ 64.08 Signals.USAR-WSFG

- 03 Feb 2026: Long CL 03-26 @ 63.8 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

Crude oil futures have recently shown a strong upward move, with price breaking above key NTZ (neutral trading zone) levels on all major session fib grids (weekly, monthly, yearly), and momentum is fast with large bars indicating heightened volatility. The short-term swing pivot trend is up, supported by a cluster of moving averages all trending higher, suggesting a robust bullish environment in the short and long term. However, the intermediate-term HiLo trend remains down, reflecting that the market is still digesting a prior downtrend and may be in a transition or consolidation phase. Resistance levels are stacked well above current price, while support is clustered in the mid-50s and upper-40s, highlighting a wide trading range. Recent trade signals show both long and short entries, reflecting tactical swings within the broader uptrend. Overall, the technical structure points to a bullish bias in the short and long term, with the intermediate-term trend still neutral as the market works through previous volatility and potential consolidation.

Chart Analysis ATS AI Generated: 2026-02-11 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.