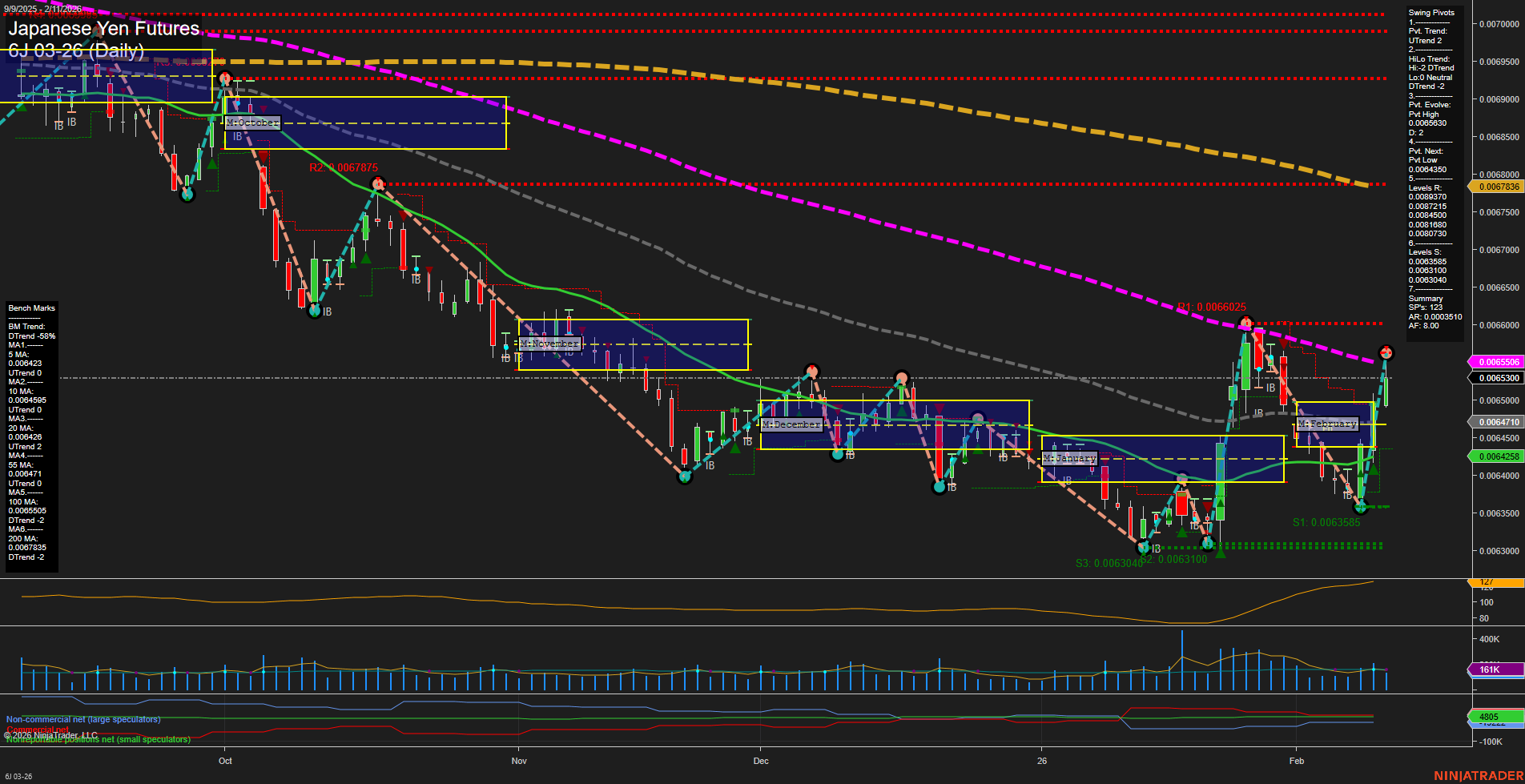

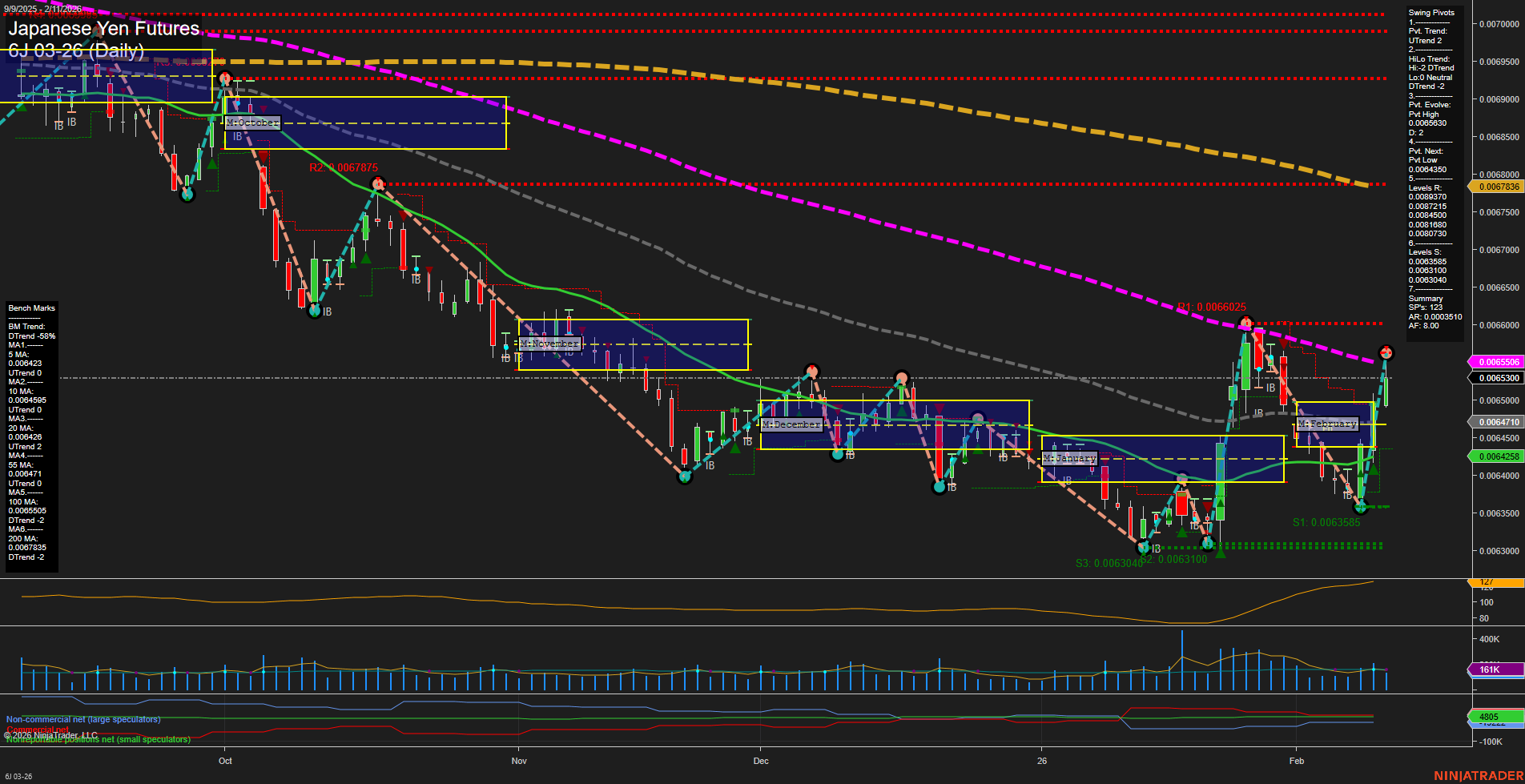

6J Japanese Yen Futures Daily Chart Analysis: 2026-Feb-11 07:02 CT

Price Action

- Last: 0.0065530,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 138%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.0066025,

- 4. Pvt. Next: Pvt low 0.0064350,

- 5. Levels R: 0.0068730, 0.0068180, 0.0067410, 0.0067336, 0.0066875, 0.0066025,

- 6. Levels S: 0.0063585, 0.0063100, 0.0063040, 0.0062850, 0.0062455.

Daily Benchmarks

- (Short-Term) 5 Day: 0.006423 Up Trend,

- (Short-Term) 10 Day: 0.006445 Up Trend,

- (Intermediate-Term) 20 Day: 0.006428 Up Trend,

- (Intermediate-Term) 55 Day: 0.006471 Up Trend,

- (Long-Term) 100 Day: 0.006565 Down Trend,

- (Long-Term) 200 Day: 0.006783 Down Trend.

Additional Metrics

Recent Trade Signals

- 10 Feb 2026: Long 6J 03-26 @ 0.0064995 Signals.USAR-MSFG

- 10 Feb 2026: Long 6J 03-26 @ 0.0064995 Signals.USAR.TR720

- 09 Feb 2026: Long 6J 03-26 @ 0.0064455 Signals.USAR.TR120

- 03 Feb 2026: Short 6J 03-26 @ 0.006444 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6J Japanese Yen Futures have shifted decisively into a bullish phase on both short- and intermediate-term timeframes, as evidenced by strong upward momentum, large bullish bars, and price action well above the key NTZ/F0% levels on the weekly and monthly session fib grids. The swing pivot structure confirms an uptrend, with the most recent pivot high at 0.0066025 and the next potential pivot low at 0.0064350, while resistance levels are stacked above current price, suggesting room for further upside if momentum persists. All short- and intermediate-term moving averages are trending up, supporting the recent rally, though the 100- and 200-day long-term averages remain in a downtrend, indicating that the broader trend has not fully reversed. Volatility (ATR) and volume (VOLMA) are elevated, consistent with a strong move and increased market participation. Recent trade signals have flipped to the long side across all major timeframes, reinforcing the current bullish sentiment. However, with price approaching significant resistance clusters and long-term averages overhead, the market may encounter consolidation or retracement as it tests these levels. Overall, the technical landscape favors continued bullish momentum in the near term, with the potential for further gains if resistance is overcome, but the long-term trend remains in transition.

Chart Analysis ATS AI Generated: 2026-02-11 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.