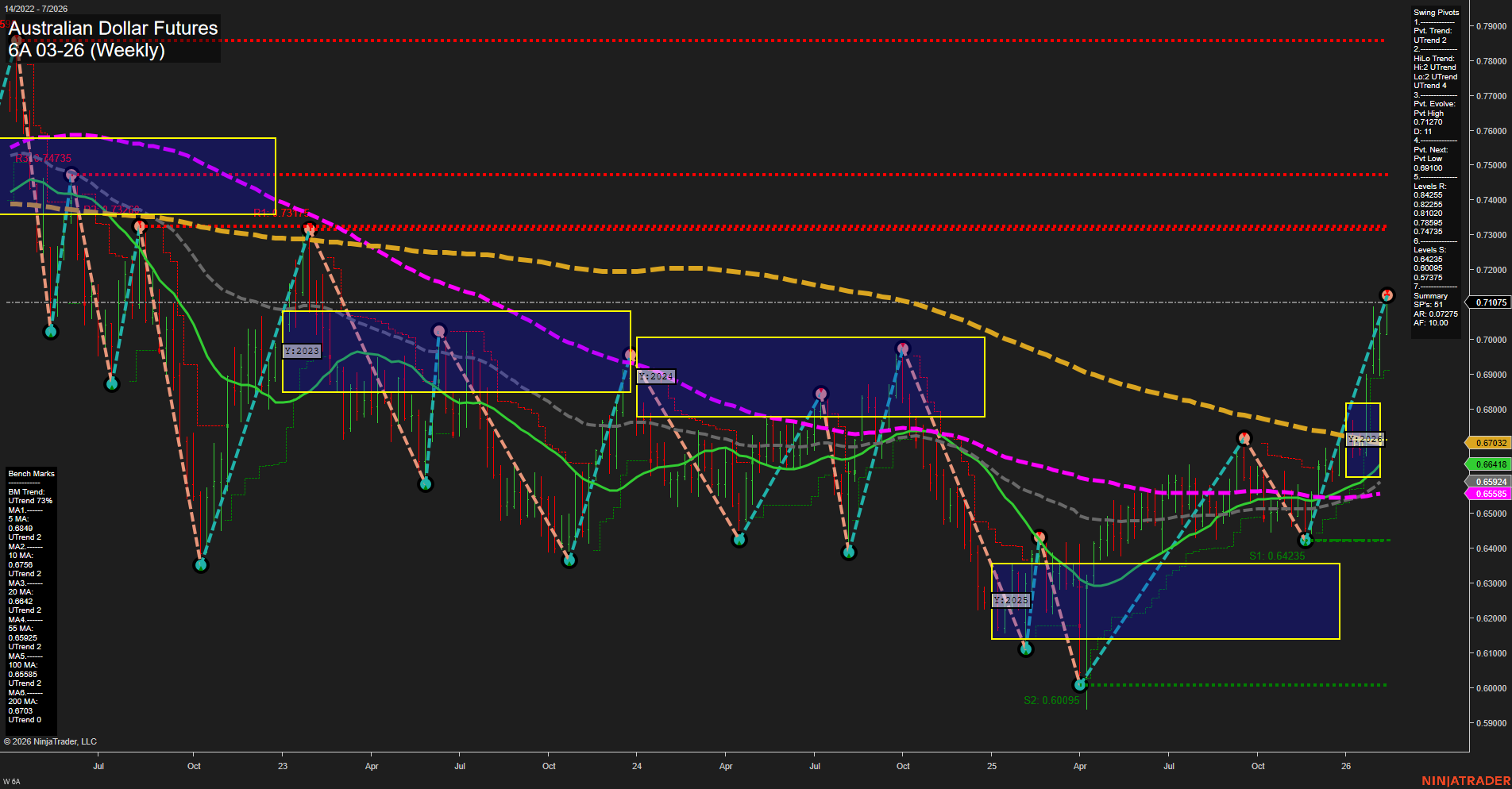

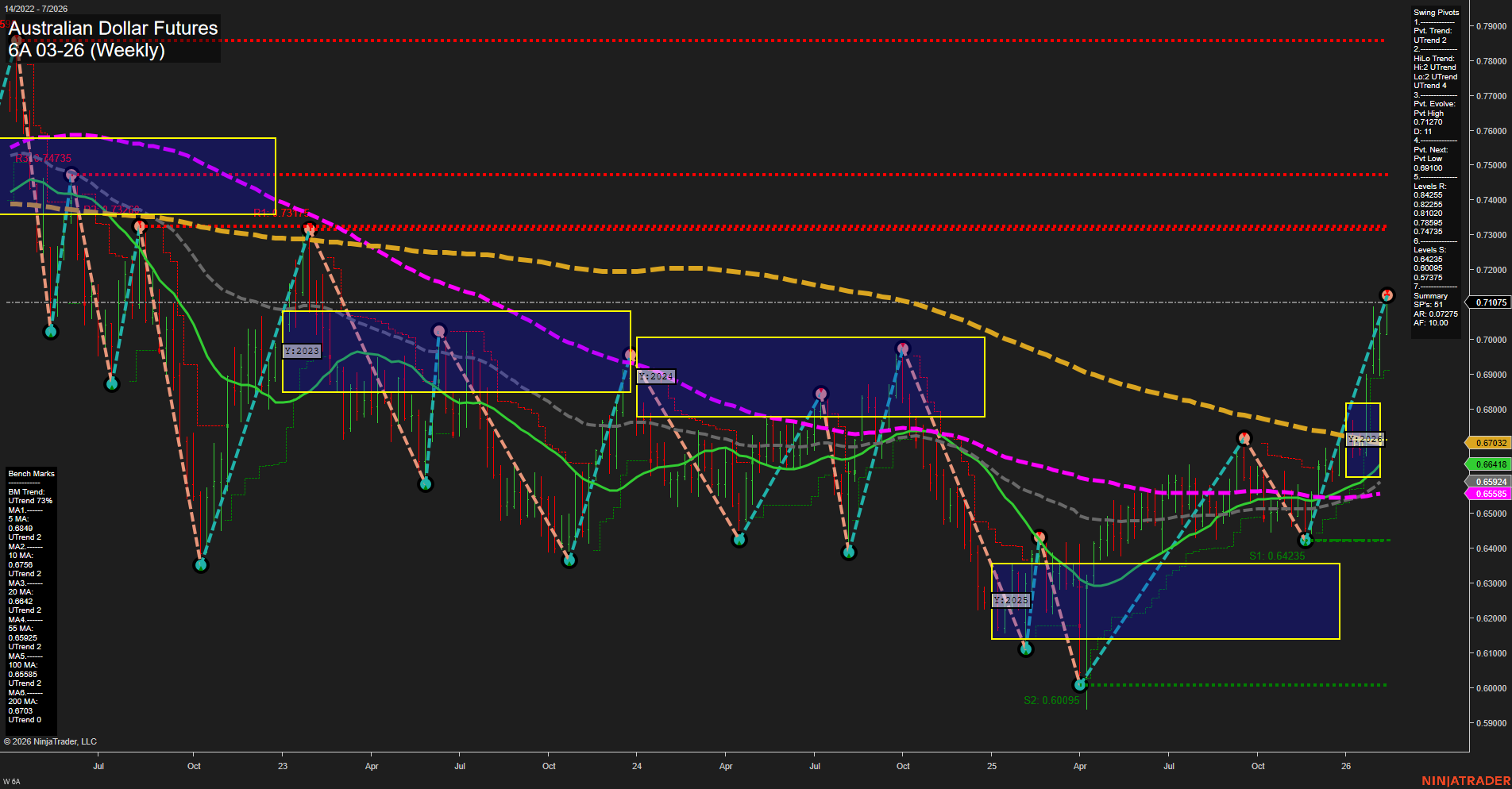

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Feb-11 07:00 CT

Price Action

- Last: 0.71075,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.71075,

- 4. Pvt. Next: Pvt low 0.64235,

- 5. Levels R: 0.79008, 0.77375, 0.74735, 0.69010, 0.68255, 0.68225, 0.67385, 0.67032, 0.65735,

- 6. Levels S: 0.64235, 0.60095.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65585 Up Trend,

- (Intermediate-Term) 10 Week: 0.65923 Up Trend,

- (Long-Term) 20 Week: 0.66148 Up Trend,

- (Long-Term) 55 Week: 0.67032 Down Trend,

- (Long-Term) 100 Week: 0.70603 Down Trend,

- (Long-Term) 200 Week: 0.73043 Down Trend.

Recent Trade Signals

- 09 Feb 2026: Long 6A 03-26 @ 0.70355 Signals.USAR-WSFG

- 06 Feb 2026: Long 6A 03-26 @ 0.7012 Signals.USAR.TR120

- 04 Feb 2026: Long 6A 03-26 @ 0.69955 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) have experienced a strong and rapid rally, with price surging to a new swing high at 0.71075. The recent weekly bars are large and momentum is fast, indicating aggressive buying pressure. Both short-term and intermediate-term swing pivot trends have shifted to uptrends, supported by a series of higher lows and higher highs. The 5, 10, and 20 week moving averages are all trending upward, confirming the bullish momentum in the short and intermediate timeframes. However, the longer-term 55, 100, and 200 week moving averages remain in a downtrend, suggesting that the broader trend is still neutral and that price is approaching significant overhead resistance zones. Multiple resistance levels are stacked above, with the nearest at 0.67385 and 0.69010, and major resistance at 0.79008. Support is well-defined at 0.64235 and 0.60095. Recent trade signals have all been to the long side, aligning with the current bullish swing. The overall structure suggests a strong short- and intermediate-term uptrend, but with caution warranted as price nears long-term resistance and the upper bounds of the yearly range. The market is in a potential breakout phase, but the long-term trend has yet to fully confirm a sustained reversal.

Chart Analysis ATS AI Generated: 2026-02-11 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.