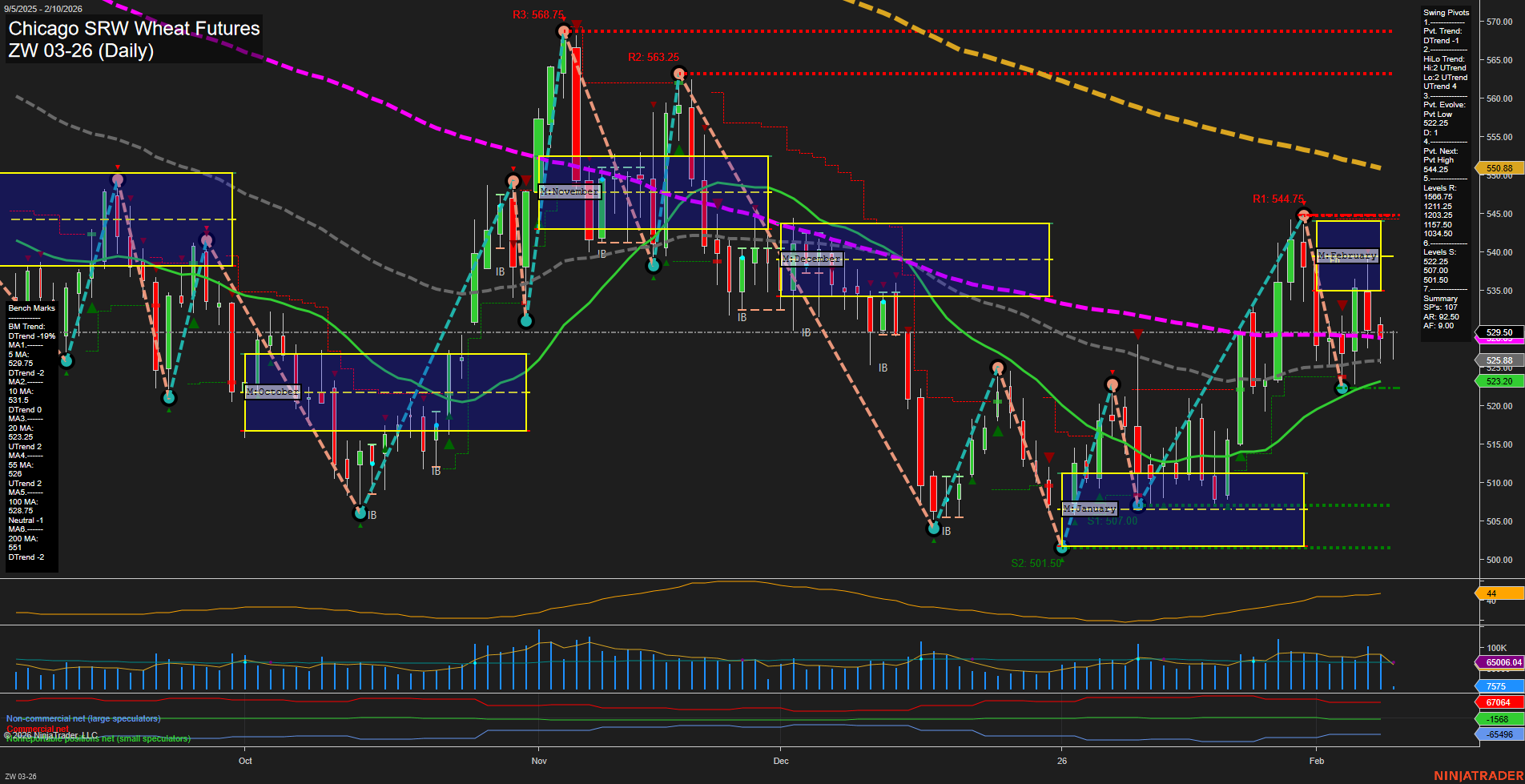

The ZW Chicago SRW Wheat Futures daily chart shows a market in transition. Short-term price action is bearish, with the last price at 529.50 and momentum at an average pace. The weekly and monthly session fib grids (WSFG and MSFG) both indicate a downward trend, with price trading below their respective NTZ/F0% levels, reinforcing short-term and intermediate-term weakness. The swing pivot structure confirms a short-term downtrend (DTrend), but the intermediate-term HiLo trend remains up, suggesting some underlying support or a possible basing process. Resistance is clustered at higher levels (568.75, 563.25, 544.75), while support is found at 523.20, 507.00, and 501.50, with the most recent pivot low at 522.00. Daily benchmarks show most moving averages trending down, except for the 20-day MA, which is slightly up, hinting at some stabilization or a potential pause in the decline. The long-term yearly fib grid remains up, but price is not decisively above key long-term averages. ATR and volume metrics indicate moderate volatility and participation. Recent trade signals have alternated between short and long, reflecting the choppy, range-bound nature of the market. Overall, the short-term outlook is bearish, but the intermediate and long-term trends are neutral, suggesting the market is searching for direction after a period of selling pressure. Swing traders should note the potential for further tests of support, with any sustained move above resistance levels possibly shifting the bias.