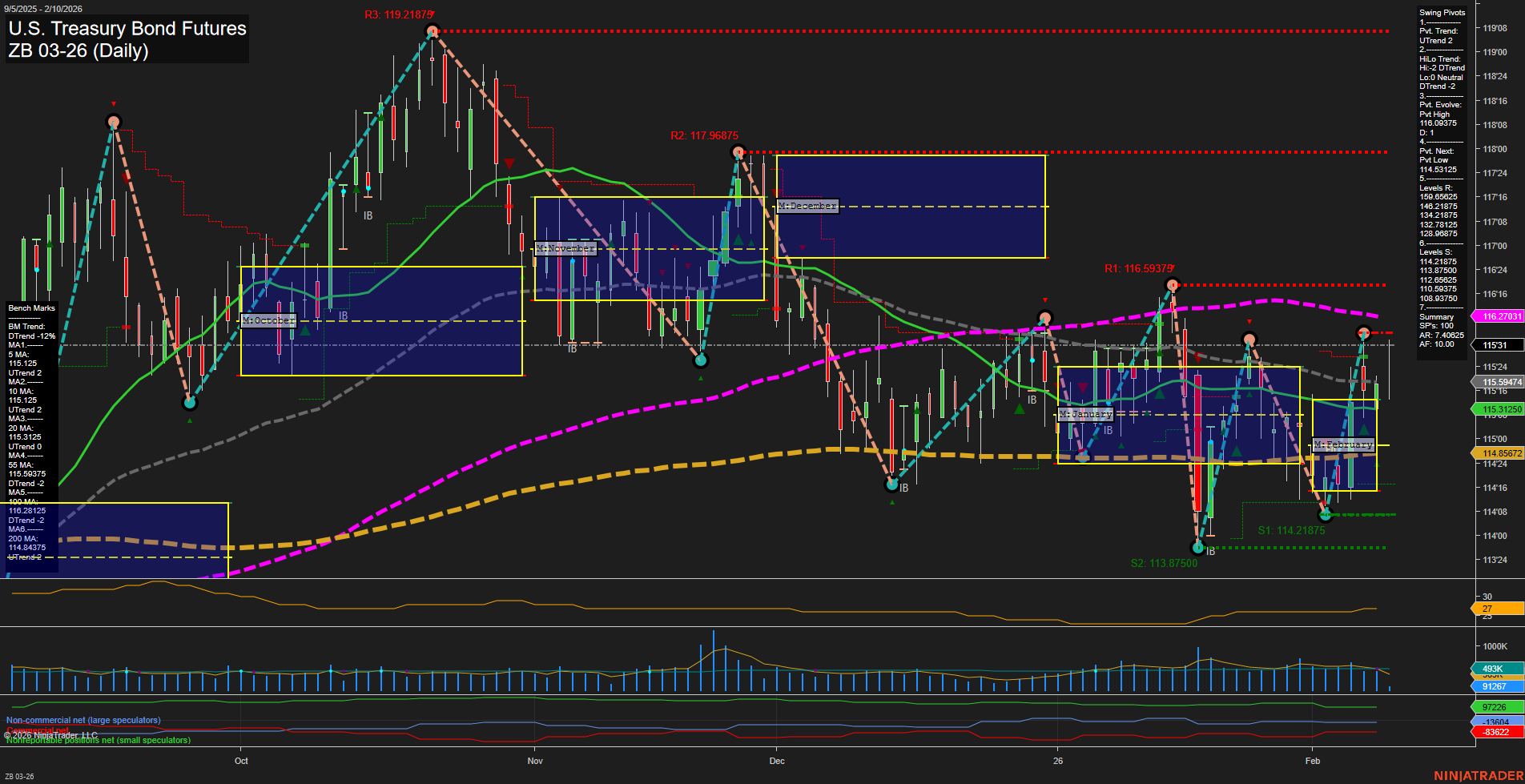

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in transition, with mixed signals across timeframes. Price action is showing medium-sized bars and average momentum, indicating neither strong conviction nor extreme volatility. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains down, suggesting that recent upward moves may be corrective within a broader bearish structure. Resistance is layered above at 116.59, 117.96, and 119.21, while support is found at 114.21, 113.87, and 113.50, highlighting a well-defined trading range. Benchmark moving averages are mixed: the 5-day MA is in a downtrend, while the 10- and 20-day MAs are up, but the 55- and 100-day MAs are still trending down, reflecting ongoing intermediate-term weakness. The 200-day MA is up, but price is currently below it, reinforcing a neutral to slightly bearish long-term outlook. ATR and volume metrics are moderate, indicating stable but not heightened volatility or participation. Overall, the market is consolidating after recent swings, with no clear breakout or breakdown. The short-term outlook is neutral as the market tests resistance and support within a choppy range. Intermediate-term signals remain bearish, while the long-term view is neutral, awaiting a decisive move. Swing traders should note the potential for continued range-bound action, with key levels likely to be tested in the coming sessions.