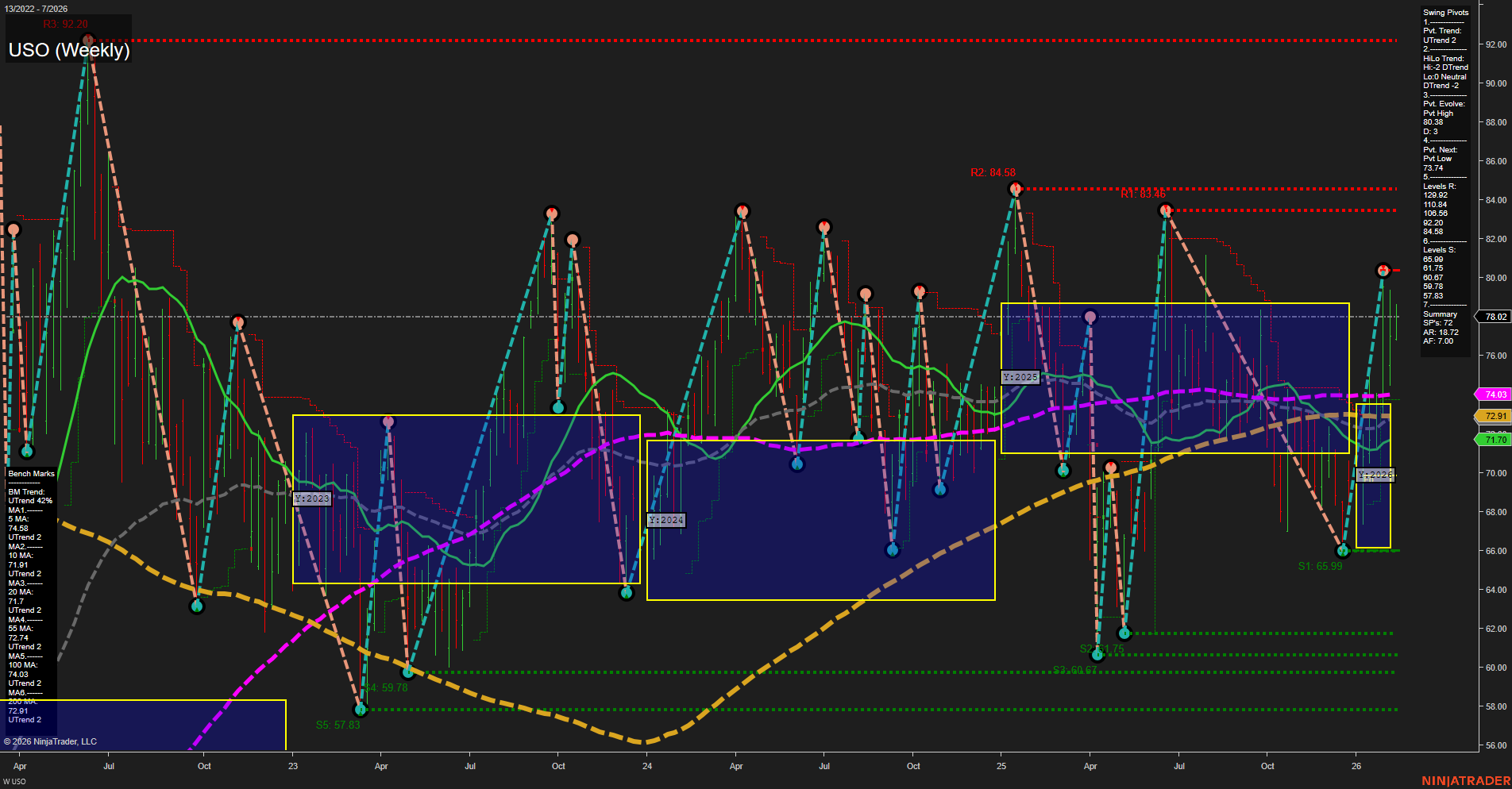

USO is currently trading at 78.02, with medium-sized weekly bars and average momentum, indicating a steady but not aggressive move. The short-term swing pivot trend is up, while the intermediate-term HiLo trend remains down, suggesting some divergence between immediate price action and broader swing structure. The most recent pivot high is at 83.36, with the next significant pivot low at 65.99, highlighting a wide trading range and potential for volatility. All benchmark moving averages from 5-week to 200-week are in uptrends, reinforcing a bullish bias on a longer-term basis. However, the price is currently within a neutral zone on the session fib grids, and both short- and intermediate-term grid trends are neutral, pointing to consolidation or a pause in directional conviction. Resistance levels cluster above at 83.36 and 84.58, while support is layered below at 65.99 and 59.78. The overall structure suggests a market in transition, with bullish undertones from the moving averages but a need for a breakout above resistance to confirm a sustained trend. Futures swing traders may note the potential for range-bound action until a decisive move occurs, with the current environment favoring tactical positioning around key support and resistance levels.