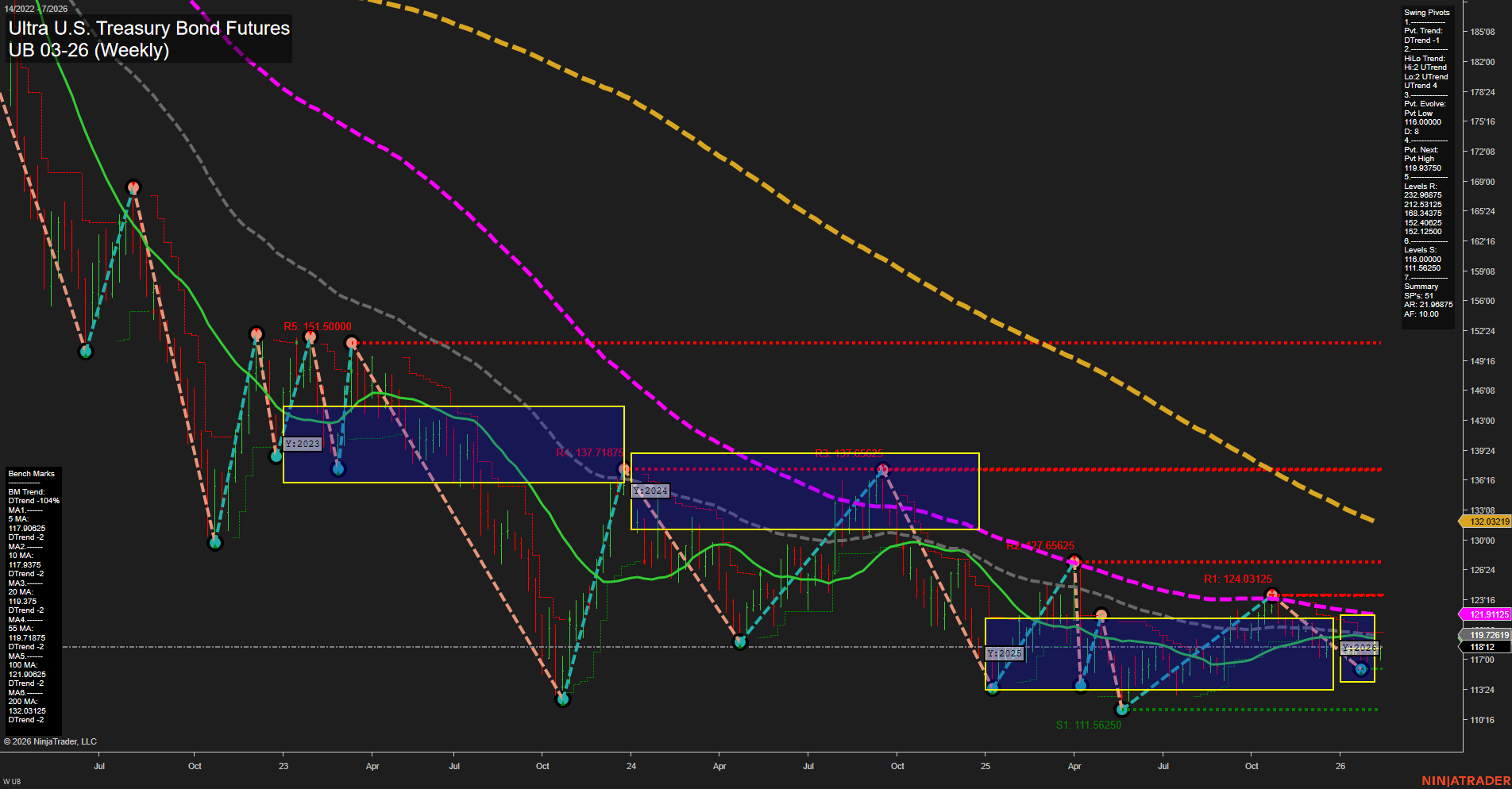

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently consolidating with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term Weekly Session Fib Grid (WSFG) and intermediate-term Monthly Session Fib Grid (MSFG) both show price above their respective NTZ center lines, with uptrends in place, suggesting a recent shift toward bullishness in the shorter timeframes. However, the swing pivot summary reveals a short-term downtrend (DTrend) while the intermediate-term HiLo trend remains up (UTrend), highlighting a possible pullback or pause within a broader recovery attempt. Key resistance levels are clustered at 119'09.375, 121'09.125, and 124'03.125, while support is found at 116'00 and 111'16.625. The most recent pivots suggest the market is evolving from a low at 116'00, with the next significant test at the 119'09.375 high. All major moving averages (from 5-week to 200-week) are trending down, reflecting persistent long-term bearish pressure despite the recent bounce. Recent trade signals have triggered long entries, aligning with the short- and intermediate-term bullish grid trends, but the overall structure remains challenged by overhead resistance and a dominant long-term downtrend. The market appears to be in a corrective phase within a larger bearish cycle, with potential for further upside retracement if short-term resistance levels are overcome, but the long-term trend remains a headwind. Swing traders may observe a choppy, range-bound environment with the potential for trend continuation or reversal depending on how price reacts to the key resistance and support levels.