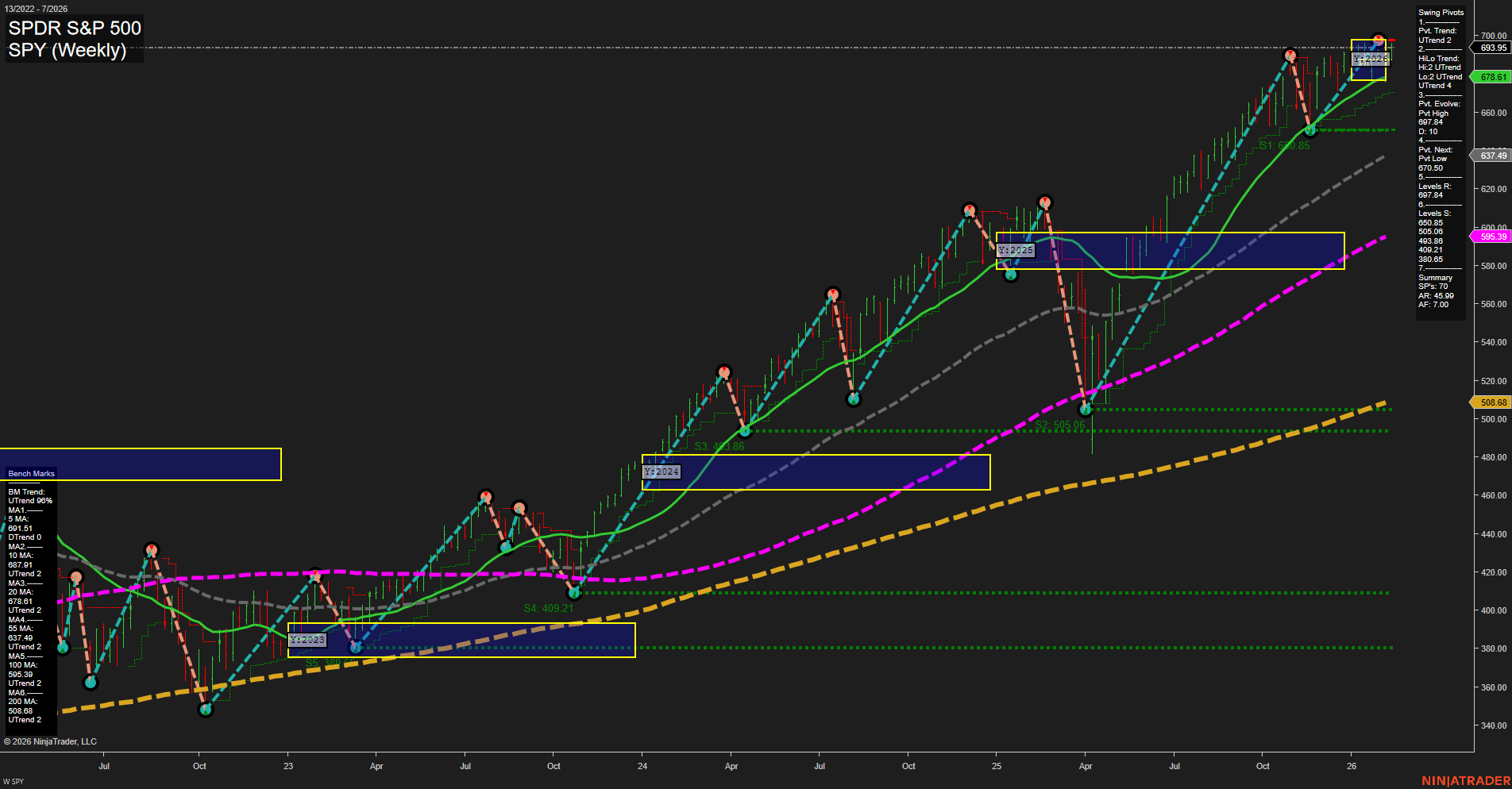

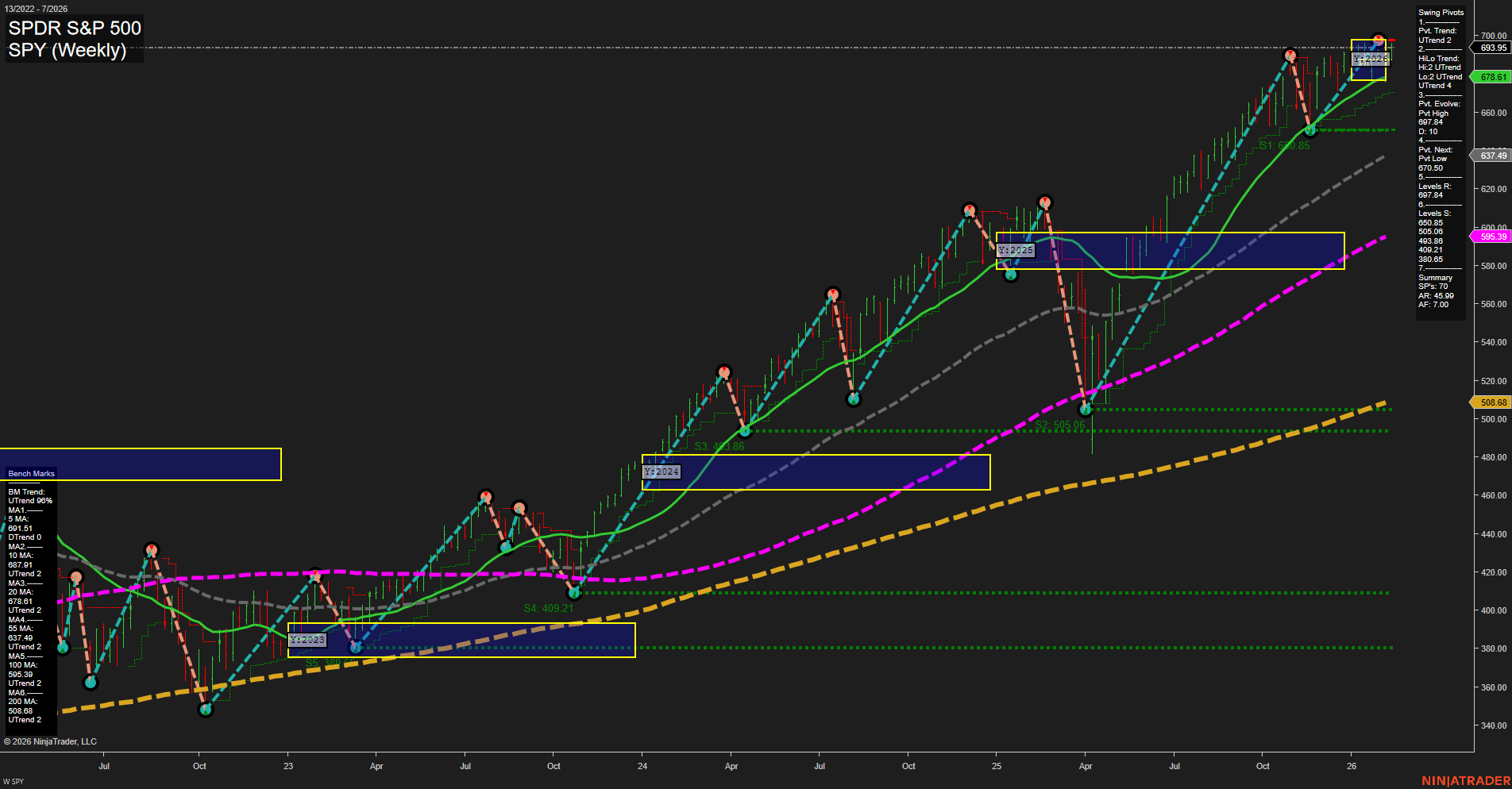

SPY SPDR S&P 500 Weekly Chart Analysis: 2026-Feb-10 07:21 CT

Price Action

- Last: 693.95,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 693.95,

- 4. Pvt. Next: Pvt low 678.61,

- 5. Levels R: 693.95, 678.61,

- 6. Levels S: 637.49, 595.39, 505.99, 409.21.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 661.61 Up Trend,

- (Intermediate-Term) 10 Week: 678.61 Up Trend,

- (Long-Term) 20 Week: 637.49 Up Trend,

- (Long-Term) 55 Week: 595.39 Up Trend,

- (Long-Term) 100 Week: 505.99 Up Trend,

- (Long-Term) 200 Week: 508.68 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY weekly chart continues to display a robust uptrend across all timeframes, with price action making new highs and momentum holding steady at an average pace. All benchmark moving averages are trending upward, confirming the strength of the underlying trend. Swing pivot analysis shows the most recent pivot high at 693.95, with the next significant support at 678.61, and further support levels well below current price, indicating a wide cushion for any potential retracement. The neutral bias in the session fib grids suggests a period of consolidation or digestion at these elevated levels, but the prevailing trend remains upward. No major reversal signals are present, and the structure is characterized by higher highs and higher lows, typical of a sustained bull market. The chart reflects a market that has absorbed previous pullbacks and continues to attract buyers on dips, with volatility contained and no signs of froth or exhaustion. This environment is favorable for trend-following swing strategies, with the primary risk being a break below the most recent swing low support.

Chart Analysis ATS AI Generated: 2026-02-10 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.