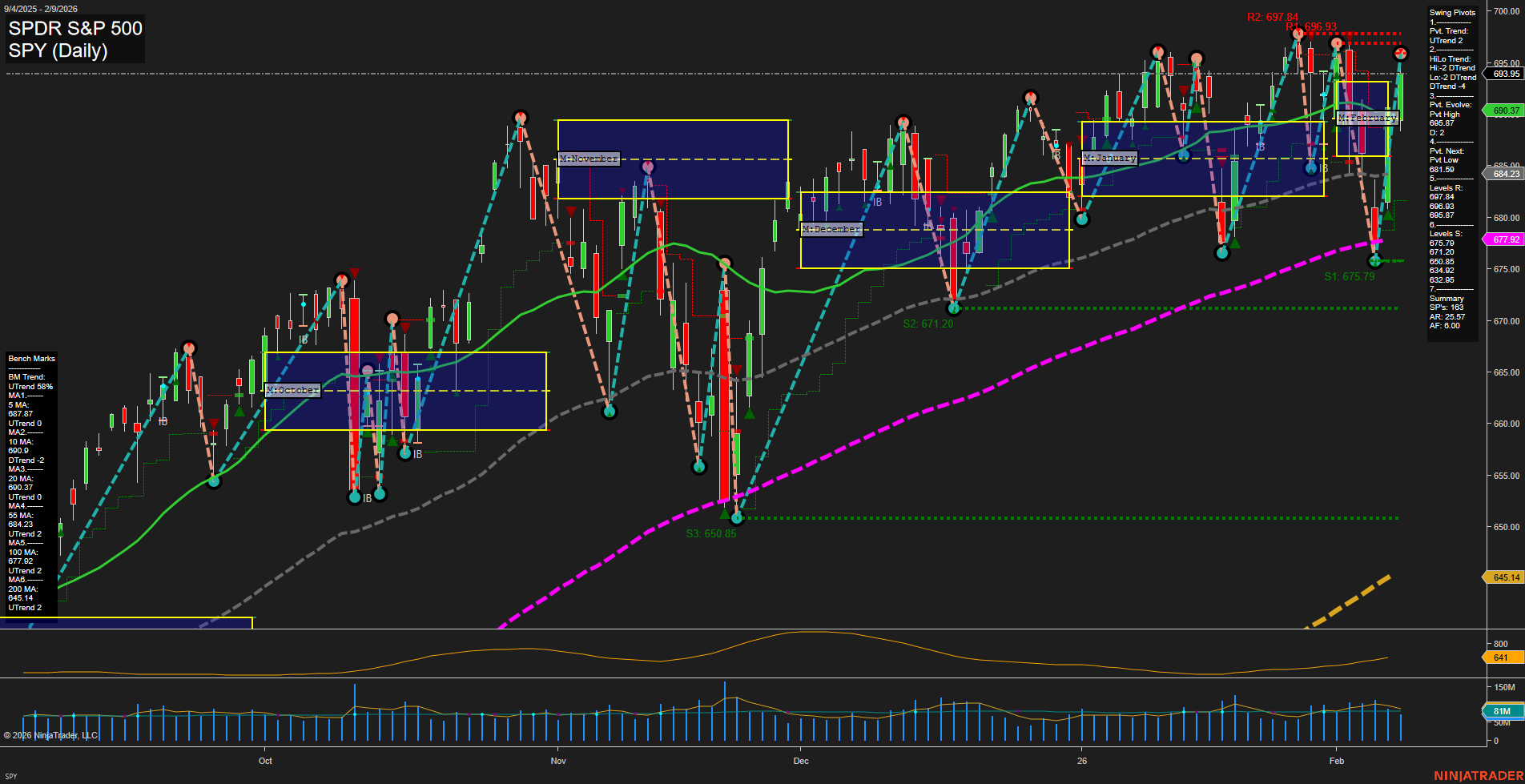

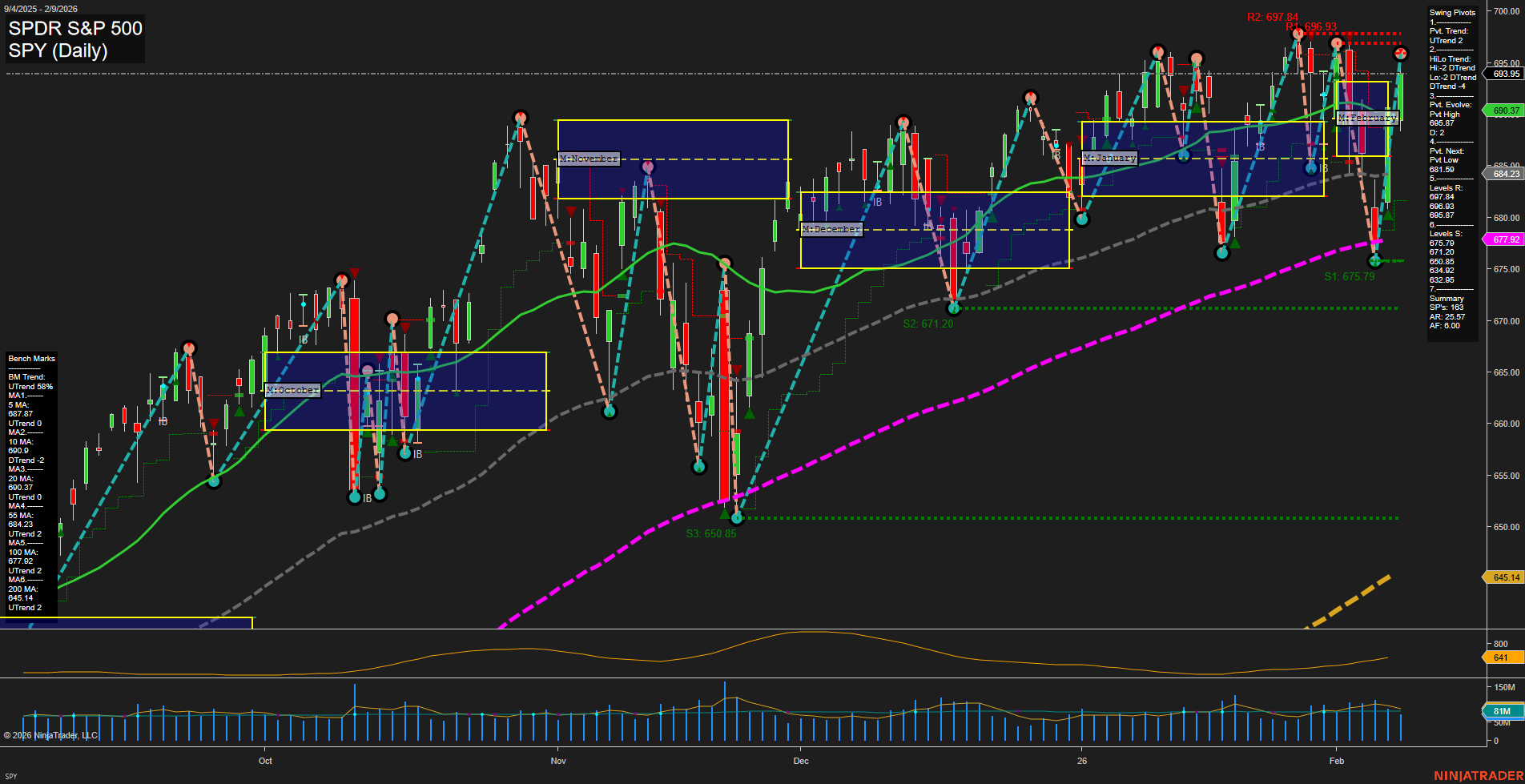

SPY SPDR S&P 500 Daily Chart Analysis: 2026-Feb-10 07:20 CT

Price Action

- Last: 680.37,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 696.93,

- 4. Pvt. Next: Pvt low 681.59,

- 5. Levels R: 697.84, 696.93, 693.95,

- 6. Levels S: 680.37, 675.79, 671.20, 650.85.

Daily Benchmarks

- (Short-Term) 5 Day: 687.87 Down Trend,

- (Short-Term) 10 Day: 684.23 Down Trend,

- (Intermediate-Term) 20 Day: 680.37 Down Trend,

- (Intermediate-Term) 55 Day: 677.92 Down Trend,

- (Long-Term) 100 Day: 646.14 Up Trend,

- (Long-Term) 200 Day: 645.14 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The SPY daily chart currently reflects a market in transition, with short- and intermediate-term momentum shifting to the downside. Price action has recently broken below key swing support levels, and the most recent pivots confirm a developing downtrend (DTrend) in both short- and intermediate-term swing structures. All short- and intermediate-term moving averages (5, 10, 20, 55-day) are trending down, reinforcing the bearish bias for swing traders. However, the long-term trend remains intact to the upside, as both the 100- and 200-day moving averages are still in uptrends, suggesting that the broader bull market structure is not yet broken. Volatility, as measured by ATR, is elevated, and volume remains robust, indicating active participation and potential for further price swings. The market is currently consolidating near a cluster of support levels, with the next key downside pivot at 681.59 and major support at 675.79. Resistance is layered above at 693.95 and 696.93. Overall, the environment is characterized by a corrective pullback within a larger uptrend, with the potential for further downside in the short term before any resumption of the primary bullish trend.

Chart Analysis ATS AI Generated: 2026-02-10 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.